In this guide, we’re covering how to buy a condo for the first time. Whether you’re a first-time home buyer or looking to downsize into a condominium, this guide will cover what you need to know and the process for buying a condo.

When it comes to condos, there are some unique qualities and features that make it different from your usual single-family home purchase.

At a high level, buying a condo follows the same principles as buying a single-family home. Start with a search on platforms like Zillow, work with a qualified real estate agent, tour homes, make an offer, close on the condo, and move in.

Pretty straight forward on the surface…

The differences are in the details. For example, condos often have different financing rules and options than a single-family home. We cover those details more below.

When buying a condo, it’s important to know that every condo community is different. Each has their own rules, management company, amenities, and costs.

We’ll cover what differences you should be looking at when evaluating the different condo communities in your city or region.

What You Need To Know Before Buying Your First Condo

1. Know The Difference Between Single Family Home And Condo

A condo is an alternative option to buying a single-family home or renting an apartment. Really, buying a condo is sort of an in-between option.

Depending on the community, it will have features and benefits of apartment living, like snow shoveling or lawn mowing, while having the benefits of real estate ownership.

When you buy a condo, you own a single unit inside a larger condo community and share certain amenities, like fitness centers, tennis courts, and pools.

Reasons people buy condos rather than single family homes differ, but some of the reasons include:

- Less maintenance than a single-family home

- Home ownership without the headaches of single family homes

- Convenience and lifestyle

- Access to various community amenities

As a condo owner, you’re part of a community that shares expenses in amenities and benefits. As a single family home owner, you’re responsible for your own amenities and maintenance.

It’s important to understand that each condo can look very different. Some will seem closer to apartment living while others will look closer to single-family living.

2. Know The Association Fees

In most condo communities, you will pay a monthly, quarterly, bi-annual, or annual fee. Each resident is required to pay the association fee.

The fees cover common expenses such as insurance, maintenance, the upkeep of amenities, and long-term capital expenditure projects, like a roof.

A reserve account is often the name for the long-term capital expenditure account.

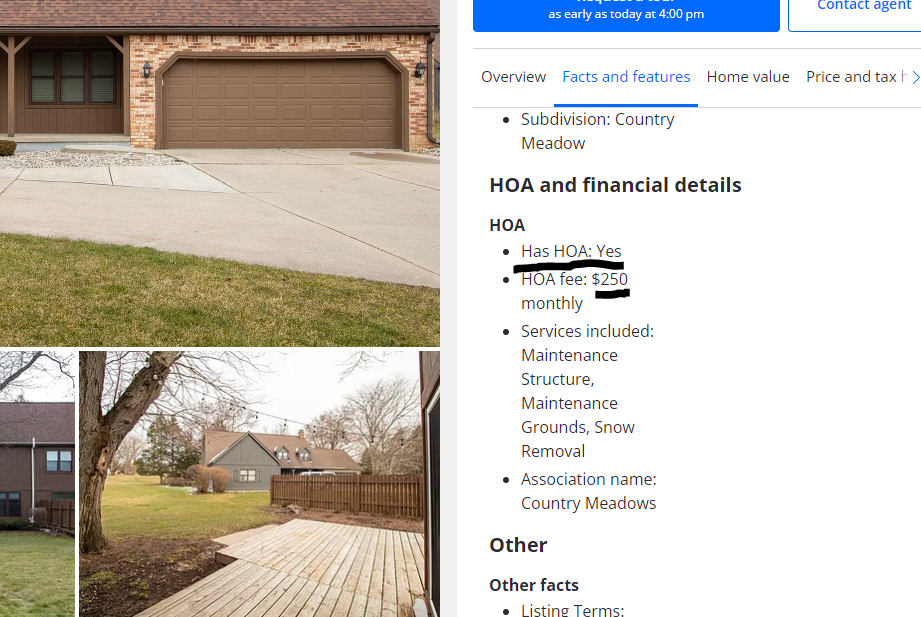

Association fees vary from condo community to community. The average condo association fee ranges from $200 to $300 per month. That translates to roughly $2,400 to $3,600 per year for condo association fees.

However, certain communities are as high as $1,000 or as low as $100 per month.

When reviewing condos for sale, most search platforms post the condo fees on the listing. If you’re uncertain, ask a real estate agent prior to seeing a condo for sale.

Take this into account when trying to determine how much you can afford and how much you want to pay for a condo.

3. Know What Condo Fees Include

Now that you have an idea of the condo association fees, the next step is to learn what is included in your fees. This helps you decide if the value is worth it.

As mentioned, fees generally include maintenance, insurance, amenities and upkeep. However, the specifics are based on the community.

Some items that your association fees can pay for are:

- Lawn maintenance, snow removal, landscaping

- Water and sewer service

- Road maintenance

- Trash Pickup

- Pools, fitness centers, and clubhouses

- And more

You may or may not value certain amenities or features. It’s important to find a community that aligns with your values. This way you’re paying only for the amenities you care about.

For example, many single first time condo buyers are looking for a community where they don’t have to worry about lawn maintenance, snow removal, and landscaping.

These buyers may be busy professionals so they don’t have time to enjoy amenities like pools and fitness centers. In this case, these buyers are best suited for condo communities that offer maintenance, but are low on amenities.

On the other hand, a couple that is looking to downsize as part of their retirement strategy is likely most interested in buying a condo with a ton of amenities that will allow them to stay active.

Buyers like this should look for communities that offer amenities such as pickle ball courts and fitness centers.

Many condo listings will include the amenities in the listing description, however, be sure to ask about the amenities upfront. You want to get a clear picture of everything you’re paying for when you buy a condo.

When in doubt, be sure to review the association documents. Each condo has a set of documents that you can review to get a solid understanding of everything that is included.

4. Know How Association Fees Change Your Purchase Limit

When getting a mortgage, lenders take association fees into consideration when trying to calculate debt-to-income ratios and whether a buyer can afford the monthly mortgage payment.

Association fees will have a direct influence on the maximum purchase price you can afford.

The higher the association fees, the higher the higher the monthly debt obligation, and therefore, the lower the purchase price you can afford.

For example, you may look at a condo community that has a $500 monthly association fee. In this case, you may only be able to afford a $175,000 condo.

On the other hand, a condo with a $100 monthly association fee may allow you to purchase a condo for $225,000.

The exact numbers depend on your specific situation. To get an idea of how association fees affect your purchase price, consult with your lender.

In some cases, it is possible for condo community association fees to prevent a buyer from affording a condo.

5. Know The Rules and Regulations

Unlike single family homes, most condo communities have a set of rules and regulations that outline what residents are able to do and how they must maintain their properties.

In a condo community, you’re unable to do whatever you want whenever you want. For example, some condo communities limit gatherings and parties.

Perhaps they limit the times you can have a party or they limit the size of the party. For example, you might only be permitted to have a party between 11AM and 7PM and gatherings must not exceed 30 people.

Other communities restrict the type of pets you’re allowed to have. For example, it’s common to see certain breeds, like pit bulls, banned from the list. This is often due to insurance issues.

Either review these documents yourself or have an attorney review them on your behalf. You don’t want to move into a community and then find out a certain activity or plan isn’t permissible.

6. Know The Management And Maintenance Company

To protect your investment and enjoy condo life, you need to know how well the condo community is being managed and maintained. Knowing this information starts with understanding the management and maintenance company.

You can get a good sense of the maintenance by looking around the community. Are common areas clean? How does the landscape and exterior look if a maintenance company is responsible for it?

Are there a lot of deferred maintenance like old roofs? This could be a sign of a poorly managed condo community.

A condo community that is not well maintained is frustrating and can hurt your investment when it comes time to sell your condo in the future.

At a deeper level, you can talk to residents of the condo community and gather feedback. Residents will raise additional red flags and give you a complete picture of the community.

In addition to the maintenance, you want to understand how well the community is being managed. Management companies are responsible for day-to-day operations and responsibilities include, enforcing association rules, handling resident questions, and handling the finances of the condo.

How well the finances are run are critical. Poorly managed finances can quickly cause frustration for condo owners.

Poorly run condos either result in regular special assessments, increased monthly association fees, or a condo community where repairs are rarely completed and maintenance is deferred.

A well-run condo community is happy to share their financial information. You should never buy a condo for the first time without reviewing and understanding the financial performance of the condo.

You want to see healthy reserves, no special assessments, and no deferred maintenance in the community.

7. Know The Cost Of Special Assessments

Special assessments are additional monthly association costs that residents pay in certain circumstances. These fees can raise monthly association fees by $400 per month or only $30 per month.

It depends on the cost, project, and timeline.

Even the best run condo communities can make special assessments due to unforeseen events. For example, an unexpected roof collapse, pipe’s bursting, or structural issues are reasons a special assessment might exist.

Ideally, a well-run condo community accounts for these expenses and adds them into the regular monthly fees. Money from monthly association fees build a reserve account. From the reserve account, the association pays for these long-term capital expenditure projects

Ask about any special assessment before you buy a condo. Any planned special assessments should be provided to potential buyers with full disclosure.

Few things are worse than moving into a condo community expecting a certain monthly payment only to get hit with a special assessment you weren’t budget for.

It could turn your dream condo into a nightmare.

8. Know If Your Condo Is A Good Investment

Condos, in general, are good investments. The best investment is the community that is well-run and well-managed.

Condos don’t typically appreciate in value as fast as single-family residences. Some condos may not appreciate much at all if they are poorly run.

This is why it’s critical to understand how well your potential condo community is run.

Second, how long you live in a condo community affects the results of your investment. If you sell your condo after a short time, it may not have appreciated enough to cover the selling costs you will incur, such as realtor fees, transfer taxes, and seller’s concessions (if applicable).

The longer you stay in a well-managed condo community, the better your investment return.

Find Your Dream Condo

Okay, we covered exhaustively what you need to know before you buy your first condo. Now, we want to look at the nuts and bolts on how to buy your dream condo.

Let’s look at the specific process for buying a condo from start to finish by discussing how to find your dream condo.

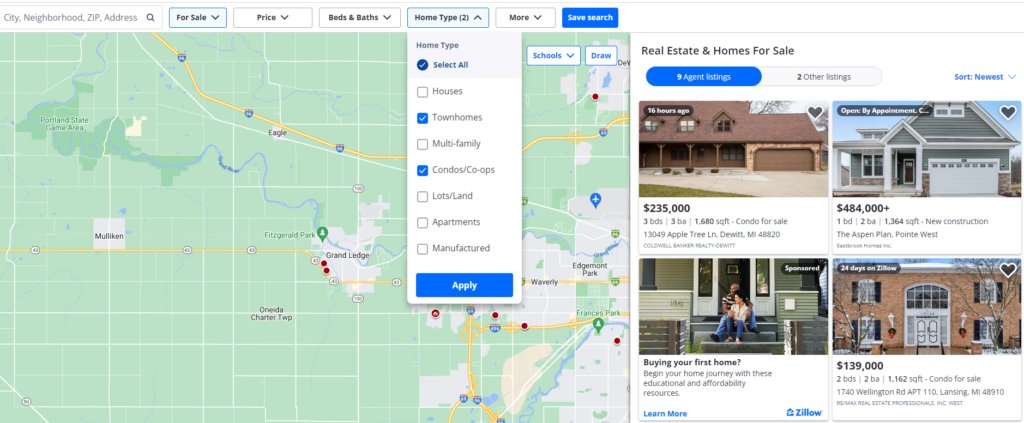

First, you can use popular house hunting websites like Zillow or Realtor to find condos. Many of these websites have features that allow you to select only condos or townhomes.

Alternatively, you can type into Google your city plus “condo communities”. For example, if you’re looking for condos in Lansing, Michigan, you might search “Lansing condos for sale” or “Lansing condo communities”.

Some common condo communities in Lansing include:

- Aspen Lakes Condos and Apartments

- River Park Estates

- Thomas Farms

- College Fields

When you have a list of condo communities, you can often search their community websites or use the community location to search for condos with the map feature on house hunting websites.

Work With A Condo Realtor

Buying a condo is different than buying a single family home. The purchase contract for a condo is typically not the same for single family homes.

It’s a good idea to find a real estate agent with experience in buying or selling condos. This way you avoid hurdles and problems along the way.

For example, qualified condo realtors know that most condo communities will require their own separate contract to be signed. Buyers typically need to sign a purchase agreement and a contract with the condo that states they understand and agree to association rules.

In large urban cities, it’s easier to find realtors that specialize in selling condos. In more rural or suburban housing markets, you may not find a real estate agent that only sells condos.

That’s okay. Look for a real estate agent that has some experience selling condos.

Secure Condo Financing

Financing a condo is different than financing a single family residence. You will still have access to the same basic mortgage types: FHA, VA, and conventional loans.

However, there are different rules. For example, if you plan to buy a condo with an FHA loan, then you will need to make sure the condo community is on the Federal Housing Administration’s list of approved communities. Typically, an FHA loan requires that 80 percent of the units are owner-occupied.

When buying a condo for the first time, make sure to get pre-approved and ask your lender if there are any rules to financing.

You don’t want to fall in love with a condo, write an offer, then learn the condo isn’t approved.

Work with a qualified lender. If you’re able to connect with a condo realtor, they can often refer you to a lender that has experience in condo financing.

Make An Offer

Your next step is to write an offer on a potential condo. There is a lot to writing an offer and your real estate agent will guide you. They will help you craft the best offer that gives you a chance at getting your offer accepted.

We wrote an excellent guide on how to determine how much to offer. It covers how to balance close date, seller’s concessions, contingencies, and the offer price. There is more to an offer than the price.

With a condo purchase, you want to make sure that every offer includes a series of contingencies. Specifically, you want to make sure your offer gives you adequate time to conduct due diligence, complete a property inspection, review financial information, and review the association fees.

The biggest mistake I see is often creating too short of a due diligence period. This provides little time for buyers to review all of the documents in time. If needed, you can create different timelines for the different phases of due diligence.

Conclusion

Buying a condo for the first time can be exciting. In this guide, we covered 8 different things you must know before buying a condo. Make sure to focus on association fees, what they cover, the management company, and the kind of lifestyle you want.

We also outlined the process for buying a condo. Armed with this information, your condo buying experience can be smooth.

Follow these steps for a great experience and a buying decision you love. Happy house hunting!