Today, I’m sharing the power of profit first for real estate agents and brokers.

Few money books will change the way you think about money, cash flow, and your real estate business.

Profit First is a book and a method developed by Mike Michalowicz to help entrepreneurs overcome the challenges of cash flow and a lack of profitability in their small-business.

His book was developed from his personal experience as an entrepreneur and his conversations with fellow entrepreneurs.

The profit first method was put through the fire and tested with business owners across various industries — from real estate, to construction, to dental practices. You name it.

There are hundreds of case studies of business owners that found success with the profit first method and who have successfully changed the trajectory of their business.

It works for business owners and it will work for real estate agents. The profit first method will work for you.

I implemented the profit first method after the first year in real estate. Today, I want to share the case for profit first, how the profit first method works for real estate agents, and how it can work regardless of the real estate business model you run.

It works for:

- Solo agents

- Real Estate Teams

- Teamerages (the hybrid team and brokerage)

- Brokers

Before we dive into the principles of the profit first method for real estate agents, I want to make a case for it.

It’s not enough for me to share with you what to do, but why you need to do it. What is it that the profit method solves?

The Case For Profit First For Real Estate Agents

The real estate industry has its ups and downs — both in the long-term and short-term. That has a direct impact on our paychecks and cash flow as real estate agents.

One minute we’re getting $10,000 worth of commission checks, and in the next minute, we haven’t closed a deal in months.

It’s hard to ride that emotional roller coaster. There is a lot of anxiety and concern about our livelihood.

Managing cash flow from one month to the next is difficult. Sometimes it means we rely on our lines of credit or dip into our emergency savings.

On top of that, a career in real estate often requires us to spend money, time and resources before we make any money.

It’s common for new real estate agents to invest time, money, and resources for up to six months before they make their first closing.

Even as an experienced agent, you still have to spend time and money to show clients homes, write up purchase agreements, and take listing photos. You’re expected to do all of this without getting paid until a home closes.

Living on commission and being responsible for expenses can be HARD.

To make matters worse, we often face a dreaded tax bill at the end of the year. It’s easy for real estate agents to find themselves in a tax mess because they failed to set aside taxes that come with being a contractor and business.

The profit first method is a promise to alleviate or avoid these problems.

It seeks to help real estate agents stabilize their personal cash flow, generate an income they can support themselves and family on, and not be ramrodded when the tax bill comes at the end of the year.

Guarantee Your Real Estate Salary

Profit first for real estate agents is a method and system that will guarantee you make a salary and avoid overspending.

No more being left up to chance.

Instead, you’re going to take disciplined and deliberate actions to pay yourself first and take care of your tax obligations before you spend your money on operating expenses, like marketing, software, technology, and other expenditures.

If you’re familiar with the Millionaire Real Estate Agent by Gary Keller, you might remember the “Lead With Revenue” concept.

Keller advocates that agents must control their spending and only increase spending as revenue grows.

We agree that spending needs to be monitored, but Keller’s “Lead With Revenue” still encourages too much spending.

Here’s what typically happens: an agent gets a $3,000 commission check and immediately spends all of it. Sometimes on past due expenses or new expenses for projects they are working on.

At the end of the year, these real estate agents are surprised to learn they didn’t actually keep any of that money. Some money came in and a lot went out.

This concept of spending what we make is Parkinson’s Law. We spend all of the money we believe we have available to spend.

This shows up in our personal lives, too. Look at how people who make a significant amount of money still seem to live paycheck to paycheck.

The profit first method reframes what money is actually available to spend by removing that money, earmarking it for other purposes, and putting that money in different bank accounts.

The goal is to designate funds to specific accounts FIRST. Then, you proceed to pay your expenses.

Learn to grow your real estate business using the "Profit First Method" as laid out by Mike Michalowicz. Navigate complex cash flow cycles, avoid running out of money and going into debt, and never get surprised by a tax bill you can't cover.

We Have It Backwards

Michalowicz, in his book, says that traditional accounting has led us to think about money in a backwards way. They have tricked us into adopting the idea that:

Sales – Expenses = Profit.

In other words, profit is what you get after you generate some income and pay your expenses. It’s a magical line on the profit and loss statement that we have no control over.

The profit first method alters this formula to help you think about cash flow in your business in a new way.

Sale – Profit = Expenses.

A subtle difference, but a big one.

We can have a profit margin and take our compensation first.

In the traditional model, we pay expenses first. Under a profit first model, you take your compensation and profit first.

Once we have paid ourselves and taken our profit, we align our business to fit within our expenses.

Let’s look at some more technical aspects to the profit first method.

Simple Explanation of Profit First Method

The profit first method can be thought of as a bucket system. Revenue generated from the company will be allocated to specific buckets: profit, compensation, operating expenses, and taxes.

Example: you received a commission check for $4,000. You pay yourself 50 percent, allocate 5 percent to profit, and set aside another 15 percent to pay taxes at the end of the year. Doing the math, that leaves you with 30 percent for expenses, or $1,200.

Your goal is to align your expenses within that target limit. And, you should never dip into any of the buckets.

The book recommends that you set up separate business accounts for each of these buckets. It’s not a bad idea. For more details on how to set it up with different bank accounts, I recommend that you read the book.

But, what are the target percentages you should be using? Should you try to pay yourself more? What about not taking a profit for a start up business?

Great questions and one the book answers.

Target Profit First Percentages

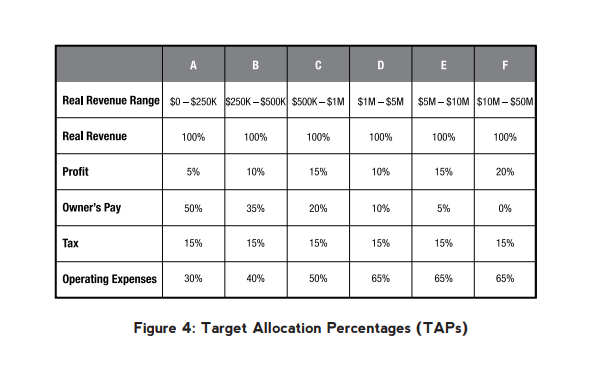

In the Profit First method, it’s recommended that you create target allocation percentages for each of the four buckets: profit, owner’s pay, tax, and operating expenses.

You can see a chart below for the recommendations based on real revenue ranges.

There is a key definition that I have to cover: real revenue.

Real revenue is defined as the total of revenue less any material and subcontractor costs. If you run a business where materials and subcontractors add up to more than 20 percent of the revenue, then you want to focus on your real revenue numbers.

This is a critical concept that took me a long time to learn. Greg Crabtree, in his book, Simple Numbers. Straight Talk. Big Profits has a similar concept called the contribution margin.

It’s from the contribution margin or real revenue that we set our target metrics. For example, your profit margin should be based on the contribution margin or real revenue rather than total revenue.

Failure to do so in the real estate industry will cause you to set targets that may be unrealistic.

If you’re a solo real real estate agent, you won’t have much to worry about when it comes to real revenue. Just make sure that you count your revenue as the gross commission income less the broker commissions paid.

With that said, let’s look at how to determine the real revenue amount for different real estate business models so that they can set the appropriate profit first percentages to target.

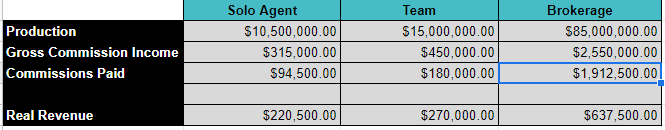

Solo Real Estate Agent

For a solo real estate agent, your real revenue will be the money you make after your brokerage split. It is NOT going to be the gross commission income.

When I say solo real estate agent, this can include agents who have an assistant or transaction coordinator.

It encompasses agents that may have a transaction coordinator or administrator on staff, but don’t generate revenue from other agents.

If you have any agents under you, that would be a real estate team. Read the next section if you’re curious about your percentages.

Most real estate agents fall in “Category A” and have a real revenue between zero and $250,000.

Since a lot of real estate agents I have coached prefer to talk about production volume, I want to translate this into potential production ranges.

The exact production amount will vary based on the structure of a brokerage split, but we can get some rough ideas.

Rule of thumb: the less you pay to the broker, the less production needed per category.

For example, a real estate agent that fits in “Category A” at a brokerage with a cap of around $20,000 will have a production range of zero and $9-million.

On the other hand, a real estate agent working at a traditional brokerage with a 70/30 split will have a production range of zero to $11.9-million.

Since these situations describe most solo real estate agents, the target allocation percentages should be as follows: 5 percent for profit, 50 percent for compensation, 15 percent for taxes, and 30 percent for your expenses.

A Real Estate Team

As a real estate team, you might be led to believe that you easily fit into “Category B” or “C”.

But, hang on. Let’s do some math. The common mistake many real estate agent teams make is counting too much revenue.

To find the real revenue of a real estate team, you need to subtract your broker’s commissions and your team members’ commissions from your gross commission income.

The industry standard paid to team members is an average of 30 percent. Of course, it will vary by lead source and the type of client.

For our example, we’re going to stick with 30 percent to calculate real revenue. In addition, real estate teams tend to be built at brokerages with cap-models, so we’re going to make that assumption in our example.

Based on a 70/30 team split and an additional $20,000 paid to the brokerage, a team with a production volume between zero and $12.6-million will fall into “Category A”

To be in “Category B”, you would need to do between $12.6-million and $25.1-million. “Category C” would be between $25.1-million and $50.2-million in production.

Remember, the more you pay out to team members and your broker, the higher production needs to be in order to move into the other categories and change your target allocation percentages.

Most real estate agent teams fall into “Category A” and a few will reach “Category B”. If you fall into “Category A”, then you should have the same target allocation percentages as an individual real estate agent.

Otherwise, follow the ones in your perspective category.

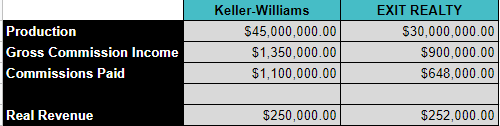

A Real Estate Broker

Real estate brokers are notorious for violating real revenue and contribution margin guidelines.

Instead, they like to compare themselves to each other through production volume and agent count.

If you’re comparing yourself on production and agent count, you have to stop. You’re comparing apples to oranges.

You need to find the real revenue of your company and the other companies if you’re going to try to make comparisons. Although, some may argue that you should avoid any kind of comparison.

Let me show you a perfect (and fictitious) example of why you need to find the real revenue.

Take a real estate broker operating with a cap-model, like Keller-Williams. Their market center has determined that the cap is $23,000. Their production volume is $45-million and they have a GCI of $1.35-million.

Due to caps, their real revenue is only $250,000.

Across town there is a traditional broker, like EXIT Realty, offering a 70/30 split for agents until they reach $100,000 GCI, at which point, the split will change to 90/10.

The company has only a few agents capping, so they are able to achieve an average 72/28 split.

EXIT does only $30-million in production so a lot of brokers dismiss EXIT and think they are the “small guy”. Based on the company’s average 72/28 split, EXIT generates $252,000 in real revenue.

These companies, on the surface, don’t seem to be close to each other. I mean, EXIT does 33 percent less production than Keller-Williams.

When you dive deeper, you find companies that generate nearly identical revenue. This fictitious example is ONLY illustrative in nature and meant to help you see the problem in comparing production rather than real revenue amongst brokers.

For simplicity, we will say that both brokers fall into “Category A” of the profit first method and run the same target allocation percentages.

Both companies should seek to set aside a 5 percent profit. But, if you are trying to determine the profit percentage in relation to the gross commission income, you will find these targets to be extremely low.

Keller-Williams would need to have a 1% profit margin. EXIT’s will be 1.4%.

A lot of business advice advocates for profit margins in the 10 to 15 percent range. That would seem like an impossible target if you’re staring at your one percent profit margin that is based on gross commission income.

Current Allocation Percentages (CAPs)

I encourage you to do an instant assessment on your company and establish your current allocation percentages. All you need is some data from your quickbooks or other accounting platform.

Find the real revenue, your compensation, profit, expenses and taxes. The formula to calculate each bucket is as follows:

(Bucket / Real Revenue) x 100; where bucket is defined as one of the five buckets

Running through this exercise will reveal some great insights. Real estate agents that first hear of the profit first method and run an instant assessment often learn that their expenses are too high.

And these expenses are being paid for through:

- Their compensation, so they aren’t being paid

- Profit

- Or worse, they’re financing it with debt.

If this is you, then you will need to work toward the target allocation percentages. It’s recommended that you set target allocation percentages that are better than your current allocation percentages, but not so drastic they are unrealistic.

A 1 to 2 percent increase or decrease is recommended.

For example, if you learn that your expense bucket is currently at 45%, you will set a goal to hit 43% over the next 60 days.

You implement plans to cut expenses to bring them within 43% of your real revenue.

Missing The Target

Setting goals is all fine and great, but what’s important is the implementation of the strategy. It’s possible for targets to be set and missed for various reasons.

One example is poor execution. If you’re setting these percentages, but still unable to hit them, you need to examine your expenses in an honest manner.

Ask yourself, can I really not cut any more expenses or am I executing these strategies poorly?

Proper execution will get most people 80% of the way to their profit first percentages.

The other 20% is the cause of the business model that you built.

Look back at the formula for calculating your target allocation percentages. It’s controlled by the money in the bucket and the real revenue.

If you can increase real revenue without driving more expenses, you will be closer to your target allocation percentages.

As a real estate agent or team, this often means renegotiating commission splits or increasing commissions with clients. For example, you may get a better split with your brokerage or try to lower the split you pay to agents on your team.

After implementing both of these strategies, you should get close to your target allocation percentages. If you’re still having issues, then you have an unsustainable business model.

You will need to change your business model entirely or close up shop. No amount of trying to control expenses is going to help.

Sell Your Real Estate Brokerage

For a moment, I want to talk to real estate brokers. There is an opportunity to sell your company.

Unfortunately, too many brokerages struggle to sell it for anything of real value. It’s mostly due to a profit issue.

Here’s the deal: to sell your company for more than asset-value, you need to generate free cash flow into the business.

Free cash flow is an accounting term for finding the cash being generated in a business and is left after making working capital and capital expenditure adjustments.

The takeaway is to realize that free cash flow is directly tied to net profit.

Meaning, the more net profit, the more free cash flow you’re going to generate. The more free cash flow, the more value in your company.

If you’re a broker and hoping to exit the industry through selling your brokerage, you need to take profit first very seriously. It’s only through profits and eradicating your debt that your company will sell for something of real value.

Takeaway

The profit first method has helped thousands of entrepreneurs with their business and it can help every real estate agent and brokerage. It’s possible to be profitable and pay yourself a salary in this industry.

I covered the basics to profit first, but if you’re considering implementing the method, I recommend that you grab a copy of the book from Amazon (affiliate link). The book will go over, in much greater detail, a plan for how you can start implementing this method, such as, the best bank accounts, if you should do something different if you’re just getting started, and what to do when things go wrong.

Imagine having a real estate business where you don’t have to worry about being paid from week to week. You can confidently walk into your office knowing that you’re going to give yourself a bi-weekly paycheck you can live off because you set up systems and the profit first method.

Learn to grow your real estate business using the "Profit First Method" as laid out by Mike Michalowicz. Navigate complex cash flow cycles, avoid running out of money and going into debt, and never get surprised by a tax bill you can't cover.