As a real estate agent, you’re in business for yourself. Naturally, this leads many agents wondering if an LLC for real estate agents is the right business structure for them.

Or perhaps, you weren’t even thinking about business entities and real estate business structures until you went into your real estate CPA’s office the last time you had your taxes done. Your real estate accountant mentioned setting up a limited-liability company or LLC.

Unsure about the right business structure for your real estate business, you started to do some research and stumbled across this article.

In this post, we’re sharing the aspects you need to consider when setting up a real estate LLC, the pros and cons of a real estate agent LLC, if you should consider other legal structures, and more.

Disclaimer: Before we dive in, we need to make a disclaimer. Dolinski Group and this article should not be taken as legal or tax advice. The information here is provided for entertainment. For your situation, we recommend consulting with your local attorney or certified public accountant.

Why An LLC For Real Estate Agents?

There are two main reasons a real estate agent may wish to set up a limited liability company or LLC. The first is for legal protection. And, the second is for tax advantages.

Home buyers and sellers bring suits against real estate agents for various reasons, such as:

- Breach of Contract: This happens when a client believes a real estate agent and broker did not perform according to the provisions in their contract. For example, a client might seek legal action if an agent failed to comply with presenting offers stated in the agreement.

- Misrepresentation: A lawsuit happens when a client feels a property was misrepresented. Examples include when an agent claims a property is worth more than it is, in better condition than it is, or failure to disclose information.

- Breach of Duty: As an agent, you have a fiduciary responsibility. Meaning, you must act in our client’s best interest. If a client feels you acted otherwise, they could bring a lawsuit.

There are other reasons for setting up an LLC, but they rarely apply to real estate agents and how most real estate agents operate their business.

Let’s explore each of the main reasons in greater detail to help you determine if an LLC is the right business structure for your real estate business.

LLC Could Offer Protection For Agents

With large financial transactions and a heavily regulated industry, real estate is a common industry where lawsuits occur. In addition to a lawsuit from buyers and sellers, you could be subject to a lawsuit from creditors or employees.

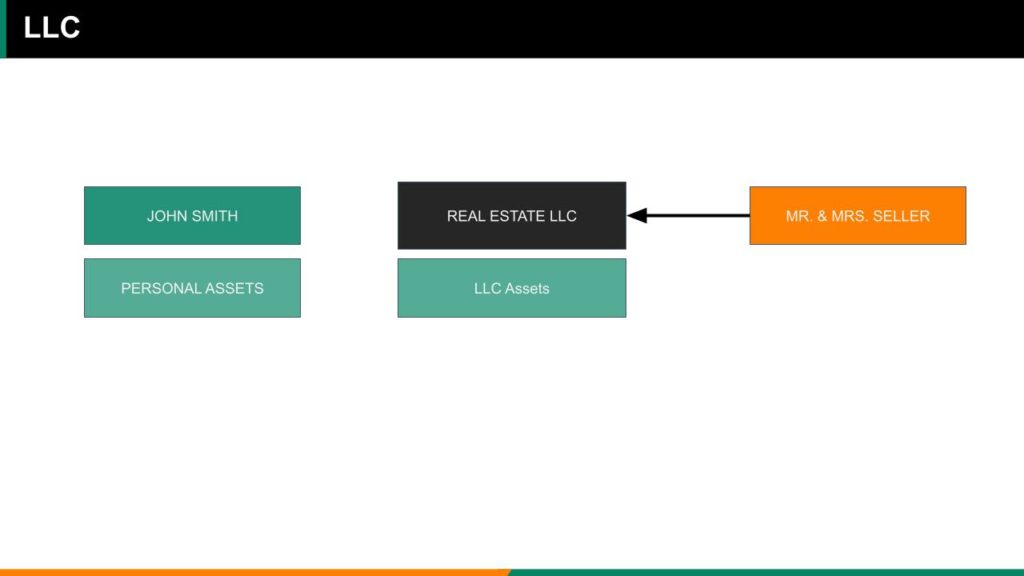

As an independent contractor and real estate agent, you’re at risk for being the subject of a lawsuit. Without a formal legal entity, like an LLC, your personal assets could be at risk during a lawsuit.

For example, agent Jon has $20,000 in his personal bank account and another $30,000 in his real estate bank account.

Jon is sued by Mr. Seller and without an LLC, Jon’s $20,000 in his personal bank account and $30,000 in his business is at risk. He may be required to pay $50,000 for loss or damages incurred by his client.

If Jon set up an LLC for real estate agents and followed a set of rules, it is possible that Jon’s personal assets — $20,000 in this example — are protected from the lawsuit. In this case, Jon’s liability is limited to $30,000 or the assets in his business.

Did you notice the wording in that last sentence…?

… Jon’s liability is limited.

Hence the name, Limited Liability Company or LLC. The idea is that your liability is limited to the company. In theory, a real estate agent’s business assets are the only items at risk.

Therefore, a real estate agent will set up an LLC for peace of mind and in an effort to create protection for their personal assets, such as, personal bank accounts, house, car, and other property.

Real Estate Agent LLCs Get Tricky

Here’s the thing… Real estate agent LLCs get tricky when we look at different laws and regulations.

When it comes to transacting real estate, ONLY brokers are licensed to broker real estate. Real estate agents, or licensed salespersons, are allowed to broker real estate under a broker’s license.

As a result, many contracts that real estate agents and clients enter into are on behalf of the real estate broker. This creates some unique features.

It’s possible for the real estate agent to have liability, but it’s also likely the real estate broker has liability. In other words, lawsuits may be leveled at the broker than the real estate agent.

All of this is to say that determining your liability in real estate is difficult. For that reason, we recommend consulting with a local attorney to determine your liability risks and if a limited liability company, or LLC, is right for you.

Can A Real Estate Commission Be Paid To An LLC?

In most states, like Michigan, a real estate commission cannot be paid to an unlicensed LLC. Most states don’t allow an LLC to hold a real estate license. Only a real estate agent or person can hold a salesperson license, and therefore, commissions can only be paid to a real estate agent.

Of course, this rule changes if you have a broker’s license. A license can be issued to an individual or to an entity. An associate broker with a real estate company could set up a corporation, obtain a broker’s license and ask to be paid to the LLC.

Since an LLC cannot hold a real estate license, it is the real estate agent that is doing the deal and paid by the broker. This creates some questions on whether this actually creates a separate entity or not.

As a result, it’s possible the “corporate veil” is torn down. Even if you have an LLC, your personal assets could be at risk.

LLCs Offer Tax Advantages

The second reason real estate agents will set up an LLC is to save money on taxes. A limited liability company for real estate agents offers tax flexibility and savings.

In general, real estate agents are considered pass-through entities unless they establish an LLC and elect a different tax classification.

As a result, a real estate agent’s profit or loss is “passed through” to their personal tax return. Their earnings are then taxed at the individual’s city, state, and federal income tax rates — as applicable — and are subject to the employer and employee share of Social Security and Medicare taxes.

On the other hand, an LLC can elect to be taxed as an S Corporation. There are certain requirements a real estate agent must meet in order to make this election.

However, when a real estate agent is able to elect S-corp status, a real estate agent pays income taxes and Social Security and Medicare on wages paid to the real estate agent.

Profits paid out as distributions are subject only to income tax and thus avoid the Social Security and Medicare taxes. Potentially saving roughly 15 percent in taxes.

Note: the strategy is on the IRS’s radar because business owners will pay themselves a below market wage and take out all of the money as a profit distribution.

Specific rules must be followed. Failure to do so could result in an audit and BIG Ol’ bill full of penalties and interest courtesy of the IRS.

The reality is that few real estate agents qualify to take advantage of the tax benefits.

Do Real Estate Agents Need An LLC?

Okay, so we’ve talked about the reasons to set up an LLC and let me give you a few scenarios where it typically makes the most amount of sense to establish an LLC in real estate.

- You earn enough to pay yourself a fair-market wage plus produce a profit;

- You have employees on staff that you pay (generally excludes other real estate members if they are paid by the broker);

- You also are a real estate investor;

- You have a lot of personal assets you want protected;

Even though there is some confusion about the protection an LLC could offer in the event of a lawsuit from a buyer or seller, you will want protection in the event of a lawsuit from an employee.

Sole Proprietor For Real Estate Agents: The Alternative

Perhaps, you’ve decided you don’t want to establish an LLC as a real estate agent, but you’re not sure what else to do.

By default, real estate agents are considered to be a sole-proprietor, which is essentially a single operator. You don’t need to do anything to establish yourself as a sole-proprietor.

If you wish to market yourself to the public using a different name, such as a “Jon Real Estate Group”, then you may need to file a doing-business-as (D.B.A.).

Many real estate agents elect to go this route because of the simplicity and costs. Real estate agent LLCs must file an Articles of Organization and an annual filing every year. The costs are fairly marginal, but can add up if you’re a new real estate agent looking to control your start up costs.

Check Insurance Options To Limit Liability

An LLC may or may not be right for you. Maybe you decide you don’t want to file an LLC, how do you limit your liability and protect your assets?

Even then, LLCs do not guarantee protection, especially if you’re not separating your finances and you’re commingling funds in your bank accounts. So what can you do?

The best way to add some protection is to consider your insurance options as a real estate agent.

There are three types of insurance that you should look into for your real estate business:

- Errors and Omissions Insurance

- Personal Liability or Umbrella Policy

- Business Liability Insurance

Errors and Omissions Insurance (E&O) is probably the most common insurance in the real estate industry.

This protects against some of the most common lawsuits real estate agents see, such as errors in paperwork, omission or failure to disclose information, and more.

Most real estate agents will receive some projection under their broker’s insurance policy.

Your exact coverage will depend on your broker’s policy. Be sure to ask them. I’ve seen agents pay a fee per transaction for E&O and other places where there was no charge, but the agent was required to pay a $1,000 deductible for any lawsuits.

Personal liability insurance and umbrella policies are purchased to protect your personal assets. In the event, you’re found liable for damages or injury, the insurance could pay out the liability rather than putting your home or other personal assets at risk.

Best Business Structure For Real Estate Agents

The best business structure for real estate agents is going to be individualized. A real estate agent just starting out likely doesn’t need the same business structure as a real estate agent running a mega-team.

In general, we tend to see most new real estate agents or solo-agents operate as a sole-proprietor. Does this make that the right option for you? Maybe. Maybe not. You need to consult with an attorney and accountant.

Real estate teams are more likely to set up LLCs and operate as an LLC.

Want To Learn How To Set Up Your Real Estate Business?

Setting up your business involves several steps. You need to consider your legal structure, tax classification, how to set up a bank account, and more.

We’ve created a course “Agent Crash Course” that walks you through how to set up your business, track your money, and create a team of advisors to help you along the way.