The eXp Revenue Share program is a major value proposition agents use to recruit and sponsor other real estate agents and teams into the brokerage.

Browse the web and you’ll find no shortage of articles touting the amazing earning potential that the eXp Realty revenue share program offers.

But… is it really as good as they say it is?

Maybe. It depends.

Most articles talk about the upside potential of eXp’s revenue sharing program. I couldn’t find any articles on the downsides and the risks.

Since I have no interest in eXp, as I’m not an eXp agent, I thought it would be good to write a post about the downside risks and point out some of the flaws in the revenue sharing program.

This way, real estate agents who are considering joining eXp have a perspective from both sides — one that is selling the revenue sharing program and another one that points out the flaws. I’m also going to compare this revenue sharing program to the one offered by Exit Realty.

Why Read This?

If you’re reading this, you’re likely considering joining eXp realty or, at the very least, you’re interested in learning more about the eXp revenue share plan.

You should read this post to avoid confirmation and survivorship bias in your decision making. These two biases can lead to poor decisions if they aren’t properly checked.

Confirmation bias is our tendency to search and interpret information in a way that supports our own ideas. So, for example, if you believe eXp revenue share is amazing, you’re going to look and search for information that supports your bias.

You will also interpret the results to your ideas. My goal of this post is to raise evidence that contradicts the power and benefits of eXp’s revenue sharing plan.

Even if you’re not doing this intentionally, Google is doing it for you by serving results they think you want.

For example, during my research for this article, only results supporting the eXp revenue sharing plan were generated. There weren’t any valid, but opposing articles on the topic of eXp revenue share.

This leads that average person to conclude that eXp’s revenue share plan must be awesome.

I am hoping when I publish this post, that Google will rank it, so it gives agents a more well-rounded perspective and helps them to avoid confirmation bias.

Survivorship Bias

A second fatal bias we make as humans is the survivorship bias, or a tendency to view only the performance of those that succeeded without regard to those that failed.

Let’s look at a simple example and relate this to the eXp revenue sharing plan.

Take Steve Jobs, the founder of Apple. He dropped out of college and was able to build a successful company. Survivorship bias would cause us to conclude that you don’t need a college degree in order to succeed in life and business.

However, this would be neglecting all of the other people who dropped out of college to be the next Steve Jobs and failed.

When you look at Steve Jobs or the story of similar CEOs, you might believe college is useless. Imagine if 100,000 people dropped out of college to be the next Steve Jobs, but the only one successful was Steve Jobs.

Do you like those odds? You have a one in one-hundred thousand chance of being the next Steve Jobs.

Same goes with eXp’s revenue sharing program. What can happen is an agent will hear the success stories of 20 different real estate agents earning $200,000 or more from the program and conclude that must be the average performance of the program.

However, it doesn’t look at all of those who failed or left eXp. What if the company had 20,000 real estate agents and an additional 10,000 agents had quit or left eXp. In this case, only 20 out of 30,000 agents were able to earn more than $200,000 or more.

Survivorship bias will lead to a conclusion that the revenue share program is better than it actually is. Performance will be over-reported.

What Is Revenue Share?

The concept of revenue sharing isn’t new to the real estate industry. Companies like Exit Realty have been offering revenue share plans before eXp Realty was even founded. eXp Realty didn’t invent the concept.

At a high-level, all revenue share plans work like this: an agent sponsors and recruits another agent into the company and then receives a percentage bonus on the gross commission generated by the sponsored real estate.

Example: Agent Kyle sponsors Sally into eXp Realty. Kyle will receive a bonus of 3.5 percent on all gross commission produced by Sally, up to $2,800 per year. When Sally closes on a $300,000 home, Kyle will receive a revenue share of $315.

There are different revenue share plans out there. Exit Realty, for example, pays 10 percent on gross commission for direct sponsors. Instead of getting $315, Kyle would earn $900 if he sponsored Sally into Exit Realty.

While there are different plans, they all have the same basic idea: sponsor agents into the company and be rewarded for bringing agents into the company.

Now, let’s dive into the specifics of eXp’s revenue sharing plan.

How eXp Revenue Share Works

The eXp revenue share is a seven-level deep sponsorship plan with various revenue share percentages and eligibility requirements. Here we’ll cover some of the important aspects of the revenue share plan.

A Seven-Tiered System

The eXp revenue sharing plan allows you to earn a percentage of revenue off recruits that are seven levels deep.

Meaning, you can earn a percentage of revenue off your direct sponsors and the agents that they sponsor. All the way down to seven levels. Each level is called a tier.

Any agent you personally recruit into eXp is part of your Tier One. When an agent in your Tier One personally recruits an agent into eXp, the new recruit becomes part of your Tier Two. It can go on like this all the way to Tier Seven.

Example: You recruit agent Kyle into eXp. Agent Kyle becomes a direct sponsor and part of your Tier 1. Kyle then goes out and recruits Sally into eXp. Sally now becomes part of your Tier Two. If Sally went out and recruited Jennifer, then Jennifer would be part of your Tier Three. Jennifer goes out to recruit Kathleen; she becomes part of your Tier Four.

It goes on and on like that until you reach Tier Seven. At that point, any agents recruited beyond Tier Seven won’t have any revenue share benefit. You won’t earn any percentage off them.

Max Payouts and Percentages

Each tier has their own percentage of revenue share and maximum payout, which is based on how many agents you directly recruit into eXp. So, you will earn a different percentage for recruits in your Tier One than agents in your Tier Two.

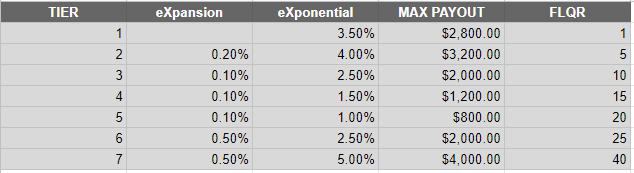

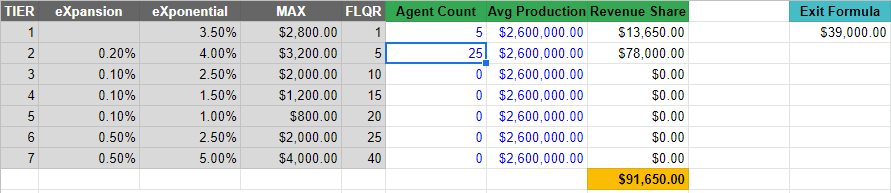

Here is an example chart of qualifications, payout percentages, and max payout for each of the seven tiers.

So, looking at the chart, agents will get a 3.5 percent payout, up to a maximum of $2,800 per year, for all agents inside their Tier One.

Example: Agent Shawn recruits three agents into eXp. They each have a gross commission income of $70,000. Shawn will get $7,875 as a revenue share bonus. It would like this in a formula:

$70,000 x 3 Agents x 3.5% Revenue Share

If Shawn’s direct recruits happen to produce $100,000 in GCI, Shawn would get the maximum payout of $2,800 rather than the full 3.5 percent. His total revenue share earnings is $8,400 in this case.

Pretty simple so far. Now, let’s look at percentages and payouts from other tiers.

You will receive a 0.2% or 4.0% percent, up to $3,200 per year, revenue share bonus — depending on whether you meet eligibility requirements — for all agents that are in your Tier Two.

The revenue share bonus you earn from your Tier Two agents are in addition to the revenue bonus of agents in your Tier One.

Floor Qualifying Required Agents

In the chart above, you see a column labeled FLQR, or Floor Qualifying Required Agents. This column represents the number of real estate agents you need to sponsor into eXp Realty in order to unlock that tier’s highest revenue sharing percentage, called the “eXponential Share”.

Failure to hit the required direct recruits will only qualify you for the “eXpansion Share” percentage.

Take Tier Two. You need five direct recruits in order to qualify for the 4.0 percent bonus on agents in your Tier Two. Otherwise, you will only get a 0.2 percent bonus.

Example: Agent Shawn has three direct recruits in his Tier One. He only qualifies for a 0.2% bonus on GCI produced by his Tier Two Agents. If Shawn has an agent in Tier Two who sells a home for $300,000, he will get a whopping $18.

If he manages to recruit the minimum required agents, five, then he will get four percent or $360.

That’s a big difference. We will bring up this point again as we go through the post.

Reading the chart, you can see you need ten direct recruits to qualify for Tier Three and 40 recruits to qualify for Tier Seven.

Let’s look at some examples to crystallize how the eXp revenue share program works.

eXp Revenue Share Examples

To keep things simple, I’m going to hold some variables constant. This will allow us to see how the eXp revenue sharing plan works without creating distortions in the results.

I’m going to hold agent production constant at $2.6-Million. This is based on the reports published by the National Association of Realtors, which puts the average number of sides sold by an agent at 10, and Zillow’s average home value at $260,000.

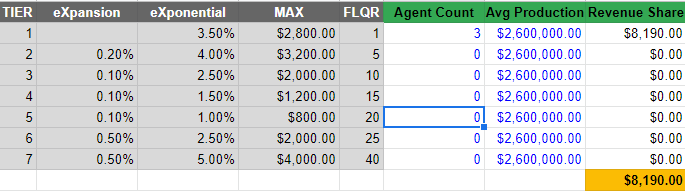

Example #1 – Tier One Only

Assume you recruit agents directly and don’t have any other agents in your other tiers. You manage to recruit three agents and each of them produce the average $2.6-Million, or $78,000 in GCI.

Your revenue share earnings will be $8,190, or 3.5 percent on all GCI. That’s an average bonus of $2,730 per agent — just below the maximum payout.

If we boosted the production to $3-Million per agent, then you would hit the maximum payout per agent ($2,800), and therefore, get a revenue share bonus of $8,400.

That’s not bad money. It can get better, though. Both at eXp and other places. Let’s add in some agents into our other tiers.

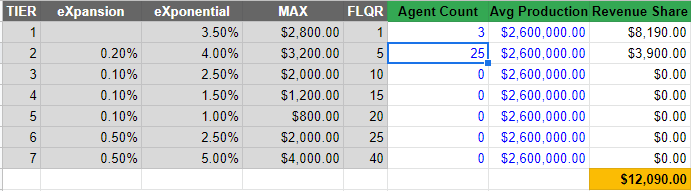

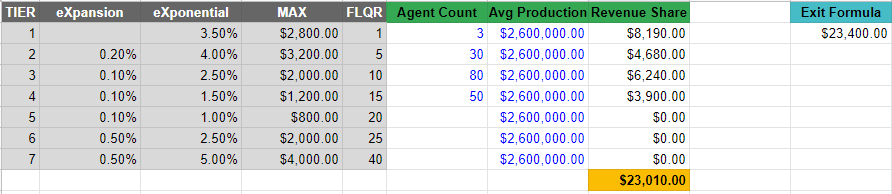

Example #2 – Tier Two With eXponential Share

Let’s say you go out and directly recruit five agents into eXp, unlocking the eXponential percentage share for all agents in Tier Two.

In your Tier Two, you have 25 real estate agents since each of your direct recruits went out and recruited five other real estate agents.

Again, all agents will have an average production of $2.6-Million.

In this example, you would earn $91,650 per year. NOW, we’re talking. That’s a good bonus.

Want this calculator? You can access it and download your own copy.

All sounds good, right?

…Hang on, because this assumes a best-case scenario. Examples like these are how eXp sells their revenue share plan.

But, what happens to your earnings when you don’t hit the minimum required direct recruits? Let’s take a look.

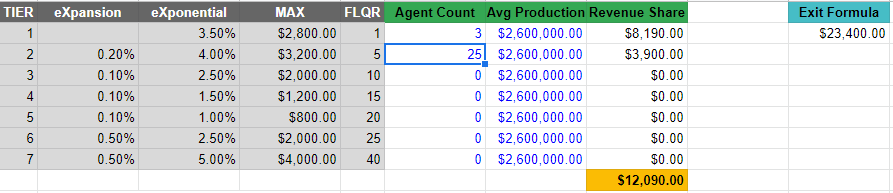

Example 3 – Not Enough FLQRs

Example two sounds pretty good. And, it is. But, not if you don’t hit the minimum required direct agents to unlock maximum percentage in Tier Two.

Imagine instead of five agents, you’re only able to recruit three real estate agents into your Tier One. You still have 25 agents in your Tier Two and all agents produce $2.6-Million.

Since you’re only eligible for the 0.2 percent eXpansion Share percentage, your revenue share earnings drop all the way to $12,090.

Ouch, that’s a huge difference. Sure, there is a lot of upside potential for earnings when you hit the minimum FLQRs, but the earnings are dismal when you don’t.

Does this example seem far-fetched? It’s not.

Imagine you recruit a high producing real estate team. The team lead might be made your direct sponsor, but all of the team leader’s agents will be put in your Tier Two.

This is how you could easily have one direct recruit, but 25 agents in your Tier Two.

I don’t know about you, but $12,090 doesn’t seem like a good bonus for bringing over a real estate team that would produce $67.6-Million, or $2,028,000 in gross commission income.

That’s only a 0.6% share in the revenue.

Hm… why don’t more eXp agents share these examples?

I think the answer is obvious. It doesn’t make the eXp revenue share program as attractive, especially if you put in comparison to the revenue share plan Exit Realty offers, called their Exit Formula.

Exit Realty Revenue Share

Since both companies offer a revenue share plan and they are similar in names, it’s not hard to confuse eXp Realty with Exit Realty. However, the companies have very different revenue share plans.

At Exit Realty, their is called their Exit Formula.

Under the Exit Formula, a real estate agent gets a 10 percent bonus, up to $10,000 per year, on all first-level real estate agents directly sponsored into the company.

Since it’s a single-level, meaning you only share in the revenue of direct sponsors, some argue that it’s a weak and disadvantaged revenue share plan.

While it doesn’t leverage a seven-tier system, it pays out nearly three times more on direct sponsored real estate agents than eXp does.

On top of that, an agent at eXp has a maximum bonus of $2,800. At Exit, it’s $10,000.

I’m going to share some examples where the Exit Realty Formula actually outperforms the eXp model.

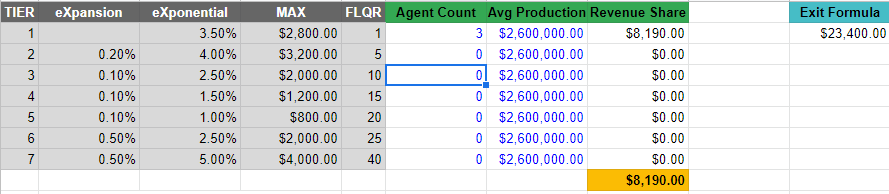

Example #1 – Direct Sponsors

For these examples, we’re going to assume a $2.6-Million production just like the eXp examples. This will give us a better apples-to-apples comparison on potential earnings.

In eXp example one above, an agent managed to recruit three agents into eXp. Under this model, a real estate agent’s earnings totaled $8,190.

At Exit Realty, by sponsoring three real estate agents, each with a GCI of $78,000, the total earnings are $23,400.

That’s a huge difference if you’re just looking at directly sponsored real estate agents.

It makes sense. Directly recruited agents at eXp have a maximum earnings of $2,800 per year at a 3.5 percent bonus. At Exit, it’s $10,000 per year at 10 percent bonus.

In this example, I would say Exit has a better revenue share plan than eXp.

Example #2 – eXponential Share Vs Exit Formula

Let’s compare example two at eXp with Exit Realty. In example two above, an agent that manages to directly recruit five agents and has 25 agents in their tier two will earn $91,650 — assuming the average $2.6-Million in production.

At Exit Realty, there are no earnings on the second level. The only revenue sharing earnings an agent will get are based on the five directly sponsored agents.

In this example, the Exit Formula only produces $39,000 in revenue share earnings. Hands down, eXp Realty wins in this scenario.

But, what happens when we don’t hit the minimum required direct agents to unlock the maximum percentage in Tier Two?

Example #3 – Exit Vs Fewer FLQRs

Under the eXp revenue plan, if an agent had 25 agents in their Tier Two, but only had three agents in their Tier One, then their earnings were a whooping $12,090.

A far cry from the $91,650 in example two.

Since Exit Realty doesn’t have recruiting requirements to hit certain revenue bonuses, an agent at Exit with three sponsored agents at an average production will earn $23,400

Nearly double what the agent at eXp would earn.

With these examples, let’s draw a few insights and conclusions from these models.

Insights On eXp Revenue Share

When comparing the eXp revenue share plan to the Exit Realty formula, there is a major insight we can draw. To get the most out of eXp, you MUST directly sponsor enough agents to unlock the different tiers AND you must have enough agents in other tiers.

Failure to have enough directly sponsored agents will result in better revenue share earnings at Exit Realty. Example three above is a perfect case where we could have a ton of agents in our other tiers, but underperform compared to the Exit Formula.

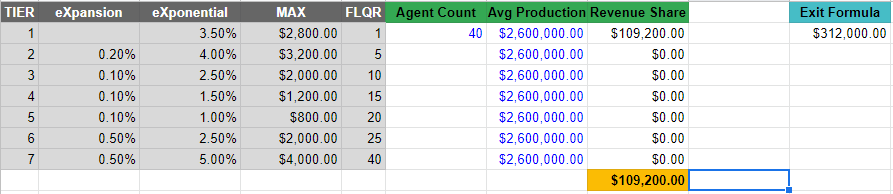

Heck, here’s an example with 163 real estate agents in various tiers of your system.

But failure to leverage the various tiers will also underperform Exit Realty. You could have 40 directly sponsored agents but that won’t be Exit Realty if you don’t have a bunch of agents in other tiers. eXp would earn $109,200 at 40 directly sponsored agents to Exit’s $312,000.

To reiterate the insight, you need both a high level of directly sponsored agents and other agents in other tiers in order to earn the most from eXp’s revenue sharing plan.

Which Is Better: Exit Formula or eXp Revenue Share?

At this point, you might be wondering which revenue share plan is better. I’m biased to Exit, but that’s not to say the eXp revenue sharing plan doesn’t have its advantages.

Let’s look at some different factors to help you determine which one is better for you.

What’s More Probabilistic?

Part of deciding which revenue sharing plan is better for you comes down to finding the probability of various outcomes. We ran through various scenarios where Exit Realty earns more and where eXp earns more.

It’s about which scenario you believe is most likely to happen for you.

To get the most from eXp, you need to recruit several agents directly and have those agents sponsor their own agents. Those agents must sponsor other agents and so on so you can fully leverage the power of seven-levels.

But, what are the odds you can recruit that deep? High if you could get into eXp early on. Might not be as good now in 2022.

For eXp to work with the highest chance, it’s kind of like a multi-level marketing company,or MLM. You have to get in early.

I encourage you to use my calculator and run through different scenarios. Then, assign percentages to those outcomes based on your assumptions, skills, resources, etc.

When I did this for myself, I felt like it was more likely that I could directly sponsor ten real estate agents and get them to a $100,000 gross commission income, resulting in a $100,000 per year revenue share bonus.

At eXp, an equivalent earning would be 10 agents in Tier One, Two, and Three. But, I can’t control if an agent goes out and recruits.

I felt like I was less likely to have 10 agents in Tier Two and Three. Therefore, my earnings would be lower than at Exit Realty.

But, you should also consider more than potential earnings when looking at these two plans.

Exit Formula Is Better For New Agents

If you’re a new agent within your first three years, I would pick Exit Realty every day of the week. That’s because the Exit Formula is better incentivized to mentor new real estate agents to higher production numbers — allowing these agents to earn more.

When I was looking at eXp and Exit, part of my decision was based on what I felt was best for real estate agents. Not just myself. Maybe I could earn more at eXp, but the Exit Formula is better for new real estate agents.

Here’s why: at eXp, a mentor is financially incentivized to get an agent to $80,000 in production. After that, a mentor stops receiving any financial benefit from a recruited agent.

So, why would a mentor at eXp care if you produce more than $80,000 in production?

They wouldn’t. At the 80-20 eXp commission split, your earnings are $64,000.

On the other hand, Exit Realty offers 10 percent up to $10,000 per year. Sponsors and mentors at Exit Realty are financially incentivized to get you to $100,000 in GCI.

Even at a 70-30 split at Exit Realty, your take home pay is $70,000. That’s nearly 10 percent more than at eXp.

What kind of difference would $6,000 make to you? That’s a nice vacation. Money for a home remodel. Anything.

Plus, eXp mentors want their direct recruits to also recruit. It’s the only way to maximize the system. For that reason, it becomes a numbers game.

It’s about getting in as many agents as possible. There is a “throw-agents-at-the-wall-and-see-who-sticks” mentality at eXp.

That philosophy didn’t sit well with me. I wanted to focus on quality over quantity. I wanted to do right by the real estate agents I was sponsoring.

Greater Downside Risk At eXp

I’m a personal finance nerd, so to me, I equate eXp and Exit Realty to stocks and bonds, respectively. The eXp revenue plan has the qualities of a stock: high upside potential with high risk and large downside risks. Whereas Exit Realty is like a bond, it might yield lower returns, but is generally a safer investment and protected more from downside risk.

It comes down to those pesky FLQRs requirements at eXp. Imagine you have ten recruits in your Tier One, 30 in Tier Two, and 90 in Tier Three.

Your total revenue share earnings are $319,000. That’s awesome. In contrast, you would only earn $78,000 at Exit Realty.

But, what happens when a direct recruit at eXp decides to leave for another brokerage and you’re left with only nine agents in Tier One?

The revenue share earnings drop to $129,000. That’s roughly a 60 percent decrease in earnings.

Ouch. That’s a HUGE hit. This is what I mean by greater upside potential accompanied with greater downside.

Worse yet, imagine if you relied on that $319,000 for operating your business. What would a near-$200,000 drop in revenue do to your personal life or business?

In contrast, at Exit Realty if a sponsored agent left, you would go from $78,000 to $70,200. That’s a much smaller drop in revenue. It’s only a ten percent drop in earnings.

This is what I mean by volatility and risks. At Exit, a single agent leaving — all things being equal — is likely to produce less negative effects on your revenue share earnings.

Yes, I will point out that earnings are still greater at eXp in this example, but where this matters is if you become reliant on the money produced from your revenue share plan.

Say Goodbye When You Die At eXp

As far as I know, if an agent in eXp dies, their beneficiaries aren’t eligible for the revenue share plan. A big difference between these two revenue sharing plans because Exit Realty pays out a death benefit.

Imagine if you built a lifestyle that relied on income from your revenue share plan and suddenly it’s gone. What would life look like for your beneficiaries?

All your hard work at eXp is gone.

Just gone…

And your beneficiaries pay the price. You might end up putting financial strain on them and cause them a lot of suffering in years to come.

Now, I get it. Nobody plans to die early. We all think we’re invincible.

At Exit Realty, your beneficiaries can receive five percent, up to $5,000 per year, of gross commission income from your direct sponsors.

Imagine you built a team of 10 directly sponsored agents at Exit Realty all who produce $100,000 in gross commission income. Your beneficiaries would get $50,000 every single year, as long as those sponsored agents remain with the company.

It doesn’t matter if it’s 5 years or 20 years or more. Your beneficiaries will continue to get this money.

If you want to provide that income to your beneficiaries in perpetuity, you need to purchase a 1,250,000 annuity that provides a 4.0 percent return.

So yes, I might be able to earn more at eXp, but the downside risk if I die is more significant. All that money I bring in would be gone.

I want to make sure my family is taken care of if I die and the Exit Formula provides a way to do just that. I’d rather give up short-term earnings for long-term protection.

What About Retirement?

The eXp revenue plan is often sold as a retirement plan, but as far as I understand it you can never fully retire. To continue to be eligible for the revenue sharing plan, you must maintain your real estate license and be employed by the company.

At Exit Realty, you can fully retire and enjoy seven percent of the gross commission produced by your direct sponsors.

Plus, let’s bring up the fact that eXp is like a stock and Exit Realty is a bond. Most financial advice recommends that as you retire, you want your money in less volatile and stable investments, like bonds.

In other words, trying to retire off the eXp revenue share plan is like trying to retire with a predominant stock portfolio. It goes against conventional wisdom and is a bad idea.

Your earnings at eXp are volatile. You could be earning over $300,000 one year and then $120,000 all because a directly sponsored agent left eXp.

With the Exit Realty Formula, you’re insulated more from the downside risks. That’s how it should be in retirement. Safe, stable investments.

Relying on eXp for a long-term retirement strategy is risky. Nobody wants to have an entire portfolio of stocks at retirement.

What About Agent Production?

In all of the examples in this post, we assumed constant agent production to keep things simple. Of course, this isn’t going to happen.

Part of determining which revenue share plan is better is figuring out which system will lead to higher agent production.

To me, I believe Exit Realty does a better job at training and supporting real estate agents. From the mentorship training to the technology to a physical office, Exit is better.

To learn more about why Exit is better, read our eXp vs Exit article.

Further differences are expanded or minimized when you assume higher production at Exit Realty. Best case scenarios at eXp aren’t as attractive when you assume higher production at Exit Realty. And Exit Realty performs even better than downside scenarios at eXp Realty.

Agent production is another variable that will create greater volatility in the eXp revenue share model. It’s going to create giant swings in your results in comparison to Exit Realty.

Final Word on eXp Revenue Share

The eXp revenue sharing plan has some strong upside potential. There is definitely a chance for you to earn some serious money by being part of eXp. When you look at the downside risks though, they underperform compared to Exit Realty.

Ultimately, which one you believe is better boils down to the importance of risk, death benefits, and your assumptions.

For me, I ended up aligning with the Exit Formula because I felt it was better for agents and myself. It was important for me to protect my long-term interests in retirement and hedge against the risk of an early death.

If I died today, knowing my family would get five percent of all sponsored agent GCI for nearly 40 years makes me feel better. I have a long life still to live.

Plus, I feel better about my retirement. I could retire and leave real estate at 40 and enjoy the fruits of my labor. At eXp, I would still need to maintain my license and pay their monthly fees. No thanks. When I retire, I want to be done.

If you’re interested in learning more about the Exit Formula or joining Exit, I encourage you to reach out to me and schedule time for a chat. Shoot me an email at realtor@dolinskigroup.com