As real estate agents, our cash flow is a little bit erratic and like being on a roller coaster. To help smooth out the ups and downs of cash flow, real estate commission advance companies were born.

Real estate commission advance companies promise same-day cash distribution on a portion of your potential commission earnings. It’s an opportunity to get paid BEFORE your closing. Rather than wait, you can get paid today.

That’s the promise, anyways.

These services go by various names. Some common terms you’re likely to see:

- Realtor Commission Advance

- Real Estate Agent Advance

- Commission Loans

- Real Estate Commission Factoring

In this post, I’m giving you an unbiased review of realtor commission advances, if they’re a good idea, how much they cost, and alternative options for managing your cash flow.

Most articles around the web are written by commission advance companies, so I wanted to give real estate agents an unbiased resource from the perspective of a real estate agent.

What Is A Commission Advance?

A commission advance is a cash advance solution that offers immediate payment — before closing — of a portion of your commission for a fee.

Commission advances are simply a specific cash advance vehicle. Cash advances are nothing new and exist in almost every industry — from probate cash advances to employment check cash advances, to tax return cash advances.

These commission advance solutions are like any cash advance product on the market. They offer a convenient way to fast cash, but come at a high cost. There are often cheaper alternatives to a cash advance.

Real estate agent commission advances are different from a loan. With a loan, you borrow money and pay interest. Qualifying for a loan often involves a credit check and income verification.

On the other hand, a real estate commission advance requires no income check or credit check. And generally has no upfront costs.

Here’s how it works: fill out an application with information about yourself, your broker, and the deal under contract. A commission advance company will review your application, and if approved, will send funds immediately. At the time of closing, the real estate commission advance company receives the full amount of your commission.

Let’s say you are entitled to a $3,500 commission check. You don’t want to wait until closing, so you get a commission advance. The company gives you $3,150 and at closing, the commission advance company receives the full $3,500 commission you were entitled to.

In other words, the fee was $350, or 10 percent in this case. This fee is paid at the time of closing and a commission advance doesn’t have any upfront fees.

What’s A Commission Advance Cost?

Commission advances cost a lot. At least when you compare them to other alternatives, which we will talk about in a bit.

Exact costs and fees for a real estate commission advance are going to vary by company. eCommission, a commission advance company, advertises themselves as the lowest fee company.

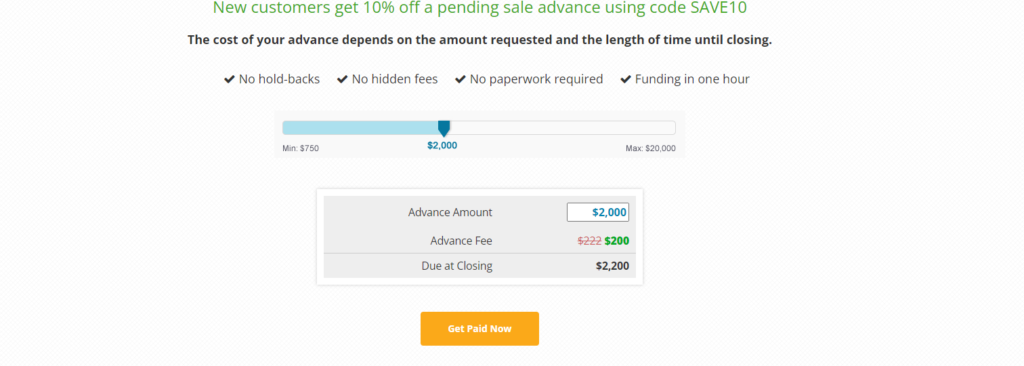

From reviewing their website, they have an offering for first-time clients. You can get your first commission advance at 10 percent off their regular commission fee.

So, if you are entitled to a $2,200 commission. The commission advance company charges a $200 fee, giving you $2,000 of instant cash. The commission advance company collects $2,200 at closing.

This special offer works out to roughly a 9 percent fee. Doing the math, their normal fee is about 10.1 percent of the commission.

On the surface, this sounds fairly reasonable when you think credit cards charge 20 percent interest or more. A loan might charge seven percent, but that requires a credit check.

Unfortunately, this mode of thought is faulty.

We’re comparing apples to oranges when we do this. Instead, we need to convert everything to an annual percentage rate to compare apples to apples.

When we just look at interest rates or fee rates, we’re using two different timelines. We need to put them in the same timeframe. You can do that by calculating annual percentage rate, or APR.

Calculate Commission Advance APR

To put cash advance and loan products on the same timeline, we have to calculate the annual percentage rate, or APR.

The APR represents the total cost of a financial product over a given year. It includes both interest and any fees that you have to pay. Examples of fees are closing costs or credit card member fees.

Generally, loan products, like credit cards or lines of credit, are required to publish this information. For example, credit cards will range from 16.99% to 26.99% APR.

A business line of credit can have an APR between 2% and 10%, on average.

Example: A credit card with a balance of $1,000 for an entire year at a 24.99% APR will cost $249.99. APR doesn’t take into account the compounding effect of debt.

To find the APR of a commission advance, you need to know a few numbers. You need the amount you will get in commission advance (A), the amount of commission you’re entitled to (B), and the number of days between when you get the money and when you close on the home (C).

You can now calculate an effective annual percentage rate. The formula is as follows:

[(B-A)/A] x (365/C) x 100

Commission Advance APR Example

Let’s pull from the example above where eCommission is offering you $2,000 in a cash advance in exchange for a $200 fee.

The amount of commission you get (A) is $2,000 and you’re entitled to $2,200 (B). Their special offer assumes you will close within 60 days (C).

If your closing is more than 60 days out, the fees are higher, according to eCommission’s website and fine details.

With this information, we can calculate an APR. The formula is as follows:

[(2,200 – 2,000)/2,000] x (365/60) x 100

Solving: we get a 60.8% annual percentage rate (APR).

Wow! Framed in terms of APR, real estate commission advances seem quite expensive. Especially, when we provide context around the cost of other financial products.

Commission Advance Alternatives

There are several alternatives to a cash advance if you’re tight on money. The best options are going to be a credit card or a line of credit.

Credit Cards As A Cash Advance

Aside from the lower APR, credit cards are an excellent cash advance option. Instead of getting a commission advance and then paying a fee, you can use a credit card to pay for your expenses. When you get your commission check, simply pay off the credit card.

But, the number one reason I love a credit card over a commission advance is because you can borrow money for free if you pay it off within 30 days.

Let’s say instead of getting a commission advance of $2,000, you make a $2,000 expense on your credit card. The first month you pay $40 in interest (a 24% APR). In the second month, you get your commission check and pay off the credit card before the month’s interest is calculated.

Instead of paying a total of $80.80, you only pay $40.

Even if you paid the interest for two months, $80.80 in interest is far better than $200.

Business Line Of Credit

Credit cards are generally easier to get approved for, but business lines of credit tend to have better terms and rates.

A business line of credit works like a loan that you can borrow against at any time. So, you have a $10,000 line of credit. You can request $2,000 out of your line of credit.

Interest rates are lower than credit cards unless you’re going with a company like OnDeck. Certain business lines of credit are just as expensive as a commission advance.

For real estate businesses with sufficient revenue and credit, you can get a line of credit around 10 percent APR.

How to use a line of credit for a commission advance: let’s say you take out $2,000 to pay for expenses. In the first month, you pay $16.67 in interest. The second month, you pay $16.80.

Your total commission advance cost is $33.47.

To me, it makes a lot more financial sense to use a business line of credit or a credit card over a real estate agent commission advance company.

Why Agents Use Commission Advance Companies

There are two reasons, as I see it, that cause real estate agents to use commission advance companies.

- They are misinformed about the costs and using faulty math to compare the costs

- They are in dire financial circumstances and can’t use a credit card or line of credit

This post sought to fix problem number one. Hopefully every real estate agent is now more informed about real estate commission advances and how they work.

In our examples provided, the cost of a commission advance cost roughly 60% APR. Far more expensive than some of the alternative options.

If an agent needs to rely on a commission advance, then there is likely a big financial problem going on.

A realtor advance will put a bandaid on your financial situation, but it’s not a long-term solution. Lines of credit are hard for new real estate agents and solo agents to qualify for. But, a credit card should be a possibility.

If you’ve maxed out your credit, then you have a serious financial issue that needs more than a commission advance. You need to explore bankruptcy and your other options.

It could mean closing up shop and quitting real estate.

Since 60 days is such a short period, I don’t believe that commission advances make a lot of sense. You can wait 60 days for a commission check.

Make An Informed Decision

At the end of the day, you have to do what you believe is right. A commission advance is okay as long as you’re making an informed decision. That the benefit you get from an advance far outweighs the high cost.

Don’t make this decision lightly. There are risks if you take a commission advance and the deal falls through. While a majority of deals successfully close, there is one that falls apart every once in a while.

Should this happen, your cost goes up and the commission advance becomes more expensive.

Explore your alternative. Even if you can’t get a credit card or line of credit, can you borrow from someone else and pay them back? Is your real estate broker willing to advance the money?

Final Words On Commission Advances

TL;DR – Too Long; Didn’t Read.

For a fee, real estate agent commission advance companies give you instant cash for your entitled commissions.

However, the APR of these advances are 60% or higher. You will pay a significant cost for a commission advance when compared to alternative financial products like a credit card or a business line of credit.

Your circumstances will depend on whether a commission advance is a reasonable choice.

I don’t recommend getting a commission advance. Rely on alternative options. These financial services are just too expensive. It will eat away at the commissions you worked hard to earn.

Want to learn to track your money and create better cash flow in your business? Then check out our Cash Crash course for real estate agents.