Michigan has a program to help first-time homebuyers and certain, qualifying seasoned home buyers purchase a home. You may hear them referred to as:

- Michigan First time home buyer grant

- MSHDA Loan

- MI Home Loan (rare)

- First time home buyer programs in Michigan

- MSHDA first time home buyers

- Michigan down payment assistance program

All of these names refer to a program in place through the Michigan State Housing Development Authority, or, colloquially referred to as, MSHDA.

Let’s be real for a sec. Saving enough cash for a down payment can be hard. Between all of the bills, it’s tough to set aside money for a down payment.

People that once had savings had it wiped out from the pandemic. With the increasing cost of goods, it’s making it harder to save.

Who can get ahead when it’s hard to catch up?

We’ve created this comprehensive MSHDA loan guide to help you:

- Understand what a MSHDA Loan is

- The Pros and Cons of a MSHA Loan

- How to Get A MSHDA Loan

- Know When You Have To Pay a MSHA Loan Back

What Is A MSHDA Loan?

MSHDA offers a series of loans to home buyers, both first time and repeat buyers, as well as current homeowners. There are three loan products that are offered through MSHDA.

- MI Home Loan

- MI Home Loan Flex

- Property Improvement Program

The last one, the Property Improvement Program, is built towards homeowners with equity in their home who are looking for cash to make improvements to their home. For that reason, we’re not going to talk about it any further.

Instead, we want to focus on the MSHDA loans that help people buy a home.

When you hear agents or lenders refer to a MSHDA loan, they’re often referring to the MI Home Loan program. That’s going to be the focus of our article.

However, it’s possible for buyers to look at the MI Home Loan Flex program. So, let’s briefly discuss the difference.

MI Home Loan Vs. Flex Program

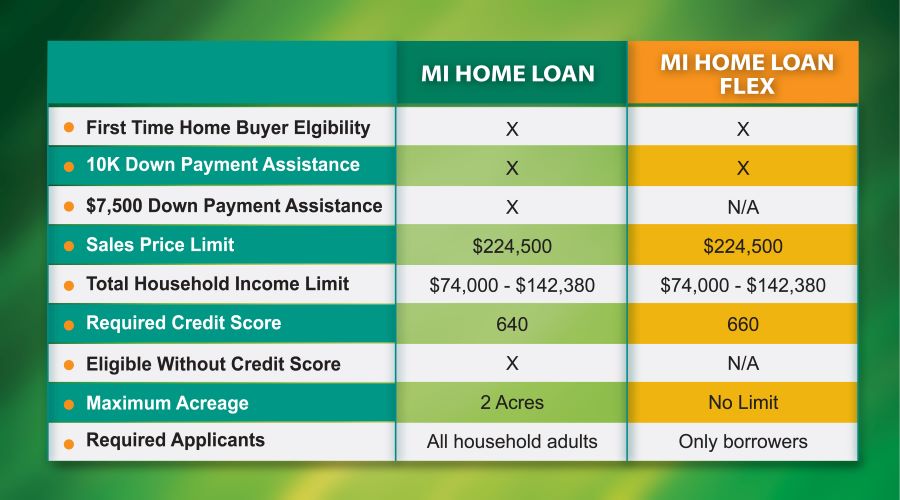

The MI Home Loan is the most common and has better terms. However, the Flex program does offer more flexibility for a home buyer.

For reference, here is a brief comparison between the two MSHDA loan programs:

The major difference between the two loan programs is their qualifying requirements and eligible down payment assistance.

You only need a 640 credit score to qualify for the MI Home Loan. The Flex program requires a 660 credit score.

All applicants in the household are required to meet the eligibility requirements of a MI Home Loan.

For example, if a husband and wife are looking to purchase a home, then both will require a minimum 640 credit score. If one partner has a 640 credit score, but the other has a 540 credit score, then they wouldn’t be eligible for the MI Home Loan.

The fewer household adults that plan to purchase a home together, the easier it is to qualify for the MI Home Loan. A MI Home Loan can be a great mortgage option for single mothers, college students, and more. That’s why some refer to a MSHDA loan as a single mom grant for home buying.

At the end of the day, it’s a great loan option for anyone.

The MI Home Loan Flex requires only borrowers to meet the requirements. This creates potential options for home buyers to qualify for a MSHDA program, even if one member of the household has too low of a credit score, for example.

What Are MSHDA Loan Requirements?

There are four requirements to qualify for a MSHDA loan.

- First-time Home Buyer

- Credit Score

- Income Limits

- Asset Limits

To be considered a first time home buyer by MSHDA, you can’t have owned a home in the previous three years.

So, someone who owned a home five years ago will qualify for the program. Someone who lost their home during the Great Recession and has been renting since will also qualify.

The minimum credit score, as discussed, is 640 for all household members. Income limits fluctuate based on household size and geographic location.

For example, the income limit is very different for a single male in Wayne County than it is for a married couple in Ingham County. To get exact income limits, it’s best to talk with a MSHDA lender.

Asset limit is $20,000. You can’t have more than $20,000 in savings and checking accounts. This excludes retirement accounts like 401(k)s.

Myth: You Can Only Buy In Certain Areas

There’s a myth that gets pushed around. I think it’s because of a misunderstanding of the program. Every so often, I will hear home buyers or other agents say that they can only buy a home in a specific area if they’re using a MSHDA loan.

That’s not true. You can buy a home anywhere in Michigan with the MSHDA loan. Whether you want to buy a home in Wayne County, the U.P. or somewhere else in Michigan, you can do so with a MSHDA loan.

The confusion, I believe, comes from the different down payment assistance programs, which will vary by zip code.

What Is Michigan Down Payment Assistance?

The primary benefit to a MSHDA loan is the down payment assistance program (DPA), which gives people an opportunity to purchase a home without all of the typical upfront cash.

A DPA is a non-amortized, no monthly payment loan given to home buyers to help offset closing costs and the down payment.

Meaning, home buyers can purchase a home with very little money down. The MSHDA program only requires you to provide at least one percent of the total loan amount.

So, for example, if you’re purchasing a home for $150,000, then you need to be able to bring $1,500 to the closing table as down payment.

The rest can be covered with the down payment assistance program.

Michigan has two down payment assistance programs:

- $7,500 DPA

- $10K DPA

The MI Home Loan, the most common loan, is eligible for a $7,500 or $10,000 Michigan down payment assistance. On the other hand, the Flex program only qualifies for the $7,500 down payment assistance.

So, you can get the $7,500 down payment assistance with either loan programs and for purchasing a home anywhere in the entire state of Michigan.

The $10,000 down payment assistance is only available with the MI Home Loan in 236 qualifying zip codes.

To repeat that, you need to get a MSHDA home loan and purchase in one of the 236 qualifying zip codes to get the $10,000 down payment assistance.

Here is a map published by the state with the qualifying 236 zip codes.

For a large part, most zip codes inside of Wayne County qualify for the 10K DPA program. That includes cities like Trenton, Southgate, Wyandotte, Dearborn, and Detroit.

Special Note: MSHDA is always changing their program. In early 2023, MSHDA set out with the objective of making home affordability possible. As a result, they have since expanded their $10,000 DPA program to all zip codes.

The $7,500 program is no longer offered through MSHDA.

Pros of MSHDA Loan

We’ve already highlighted some of the pros, or advantages, of a MSHDA loan, but let’s dive a little deeper.

The biggest benefit to a MSHDA loan is that it provides opportunity for homeownership where it might not otherwise be possible, due to the large barrier of saving up enough money for a down payment.

In my career, I have seen the joy of dozens of homeowners, who thought homeownership was never going to be possible for them, as they got the keys to a house. Tears often fill the eyes of these home buyers as they’re at the closing table.

I will never forget a client who was a McDonald’s manager and single mother. She was living in an apartment with unsafe conditions. Homeownership seemed impossible to her, but it was something she wished for.

To be able to buy a home with the MSHDA program and provide a safe, stable environment for her daughter brought her to tears. Without this program, it’s unlikely she would have ever been able to purchase her own home.

The down payment assistance program helps cover many of the upfront costs of homeownership.

In addition, the DPA is a loan only due when you sell the home or refinance. It doesn’t add extra payments to your monthly mortgage. So, not only does it cover upfront costs, it helps to keep your monthly mortgage payment lower.

Cons of MSHDA Loan

However, there can be some real cons to the MSHDA loan program. For starters, it’s money that you have to pay back.

Since people often refer to a MSHDA loan as a first time home buyer grant, it’s often mistaken as free money with no pay back requirement.

That’s not true. You will have to pay it back. For example, if you sell your home or refinance your mortgage, the down payment assistance will need to be paid back.

You might be saying… “whoa, whoa. My friend or family member bought a home a few years ago and their down payment assistance is forgivable. The amount they owe is reduced every year they live in the home.”

It’s possible. They may have taken advantage of a special program MSHDA was offering. In 2018, MSHDA rolled out a program where they gave buyers $15,000 in down payment assistance and every year they owned the home 20 percent of the DPA would be forgiven.

It was called the Step Forward Down Payment Assistance Program. But, all of those funds ran out in early 2019.

It’s no longer available to home buyers. Instead, the $7,500 DPA and 10K DPA are the programs available to home buyers and they MUST be paid back.

Lack of Equity With MSHDA Loans

The second disadvantage to a MSHDA loan is potentially the lack of equity for the first few years. A lack of equity can make it hard to sell the home later. Or, you could find yourself in a negative equity position if home values drop.

A negative equity position is often referred to as being underwater on your mortgage. It’s when you owe more money than your home is currently worth.

That creates a problem if you want to sell your home. The full mortgage amount needs to be paid off, but when you’re underwater, you don’t have enough money.

To pay off the mortgage and pay for closing costs, you have to bring additional money to the closing or risk going through foreclosure or a short-sale.

None of those situations are ideal.

Over the last few years, MSHDA buyers haven’t had to worry about negative equity since home values grew so much. In 2021 alone, for example, home values increased by 18 percent.

However, past growth isn’t indicative of future growth. Meaning, just because home values have grown, doesn’t mean they will continue to grow.

Be aware that a low equity position can be a problem if home values drop and you don’t plan to stay in a home for a long time.

Of course, this is problematic to any loan option. Not just MSHDA. Home buyers with FHA loans or USDA loans can be at just as much risk.

That’s the insight to take away. MSHDA works best for a buyer who plans to stay in the home for a decent number of years. I recommend at least two to five years given current pricing trends in 2022, but maybe more time depending on the way home values move.

How Do I Get A MSHDA Loan?

Despite the name MSHDA loan, you can’t actually get this loan directly through MSHDA. Instead, you need to contact one of MSHDA’s lending partners.

The State of Michigan publishes a list of MSHDA approved lender partners on their site.

They also produce a list of their top lenders in specific areas. You can work with a lender anywhere in the State of Michigan. For example, you could be in Muskegon and work with a MSHDA lender in Wayne County (near Detroit).

Our partnership with one of Michigan’s top MSHDA lenders allows us to help home buyers get connected and qualified for MSHDA loans.

Can I Get A MSHDA Loan With Bad Credit?

Well, that depends on what you define as bad credit. We may have different opinions on what bad credit is.

To qualify for the MSHDA loan, you need to have a 640 credit score. Do you have at least a 640 credit score?

If so, then you’re eligible for a MSHDA loan — even if you think that’s a bad credit score.

A score lower than 640 will make you ineligible.

But, that’s okay. Don’t give up hope because there are still options.

Just because you don’t qualify today, doesn’t mean you won’t qualify in the future.

We recommend you work on improving your credit score. That might mean paying off debt, moving debt into different formats, opening up a credit card, and more.

Your exact situation will determine the steps you need to take. If you’re new to your credit score, take the time to do some research or reach out to a credit repair company.

You can find a free credit score on sites like CreditKarma or Credit Sesame. These sites will often have recommendations for you on how to improve your credit score.

Homeownership Education Class

To qualify for the loan, you need to take a Michigan homebuyer education class. This is required for all MI Home Loan programs, regardless of whether you plan to use down payment assistance.

You will need to register, attend and get a certificate of completion for a homebuyer education class. The certificate will need to be submitted to your lender. Your lender will then submit your certificate to MSHDA along with the entire lending package.

In some cases, there may be a small fee to attend a homebuyer education class. With Covid, you can find these classes in multiple formats — online and in-person.

The certificate of completion is valid for 12 months. If you fail to buy a home within 12 months, you will be required to take the education class again in order to maintain eligibility for a MSHDA loan.

You can find these classes through your lender or by looking on MSHDA’s website. I don’t recommend trying to Google things like First time home buyer education class.

The education class must be provided by a HUD-approved housing counseling agency. There are a lot of scams out there offering a home buyer education class. Many of these aren’t MSHDA approved.

So, ask your lender before taking a class and prior to paying any money for the education class.

When Do You Have To Pay Back A MSHDA First Time Buyer Loan?

While the down payment assistance loan doesn’t require monthly payments, it does have to be paid back. There are only three cases where the DPA has to be paid back.

First, and most common, is if you sell the home. In addition to the mortgage loan, you will need to repay the MSHDA loan back. It will be the amount of down payment assistance that you accepted.

For example, if you bought a home and received $7,500 in down payment assistance, you would need to pay the full amount of $7,500, along with your mortgage balance, at the time of selling your home.

Second, you will need to pay back the down payment assistance if you choose to refinance your MSHDA loan.

A refinance is when you get a new mortgage on your home. Often homeowners do it to pull equity out of the home or get a lower interest rate.

Lastly, and not common, is you will need to pay back the MSHDA down payment loan when you go to pay your home off in full.

So, as long as you live in the home and don’t refinance, you don’t have to pay off the MSHDA down payment loan until you pay off the entire mortgage in 30 years, assuming a 30-year mortgage.

Can You Refinance a MSHDA Loan?

Yes, you can refinance a MSHDA loan. Keep in mind that if you choose to refinance a MSHDA loan, you will owe the down payment assistance amount before closing on the new loan.

Given the bond program through MSHDA, there is a good chance that most mortgage products won’t be able to compare, in terms of rates, with a MSHDA loan. You’re likely to have a lower interest rate unless interest rates dropped dramatically since the time you closed on your MSHDA loan.

Refinancing a MSHDA loan can make financial sense in some cases, but be sure to compare interest rates and potential increases in your monthly mortgage payment.

Of course, there are cases where you need to refinance due to things like divorce. Given the 50 percent divorce rate, you may need to refinance your MSHDA loan.

To be eligible for a refinance on the mortgage, you need to pay the down payment assistance back. A lender will not allow you to refinance the down payment assistance.

So, what that means for you will depend on your equity position in your home. Let me go over a few examples.

MSHDA Refinance Examples

Example: you have a mortgage balance of $100,000 and a down payment assistance loan of $7,500. You need to refinance your MSHDA loan to a FHA loan with a loan-to-value requirement of 95%. Meaning, you can refinance up to 95 percent of the home’s value.

In the first example, assume the home’s value is $130,000. So, we can refinance up to $123,500. That is enough to pay the $100,000 mortgage balance, the $7,500 down payment assistance MSHDA loan and closing costs.

It’s possible we might even have some cash left over to consolidate debt, for example.

In another example, let’s say the home value is $110,000. Your refinance limit would be $104,500. In this case, you could pay off the $100,000 mortgage balance and $4,500 towards the down payment assistance loan.

In this case, you would be $3,000 short. It needs to be paid back. So, you would have to come up with the cash to pay off the down payment loan before you can refinance. Failure to come up with the difference will hold you back from refinancing a MSHDA loan.

Find A MSHDA Lender

Now that you’ve learned A TON about the MSHDA Loan, you might wonder how you can find a MSHDA lender and get started in the home buying process.

That’s a great question. Since MSHDA loans are a specialty product, not every single lender or mortgage broker offers the MSHDA loan.

It’s important to understand that MSHDA lenders are not endorsed by the Michigan State Housing Development Authority. They are lenders that partner with MSHDA to provide down payment assistance.

I would break up mortgage lenders into three categories during your search process. They are as follows:

Lenders that do not offer MSHDA loans,

Lenders that offer MSHDA loans, but do very few transactions per year,

And MSHDA lenders that do multiple transactions per year and are ranked top in the state.

If you contact random lenders, you will find a lot of type one and type two lenders. To give yourself the best chance to find a MSHDA lender, it’s a good idea to browse MSHDA’s website for lenders in the state or your area.

The next step is to contact a MSHDA lender to learn if a MSHDA loan is right for you and if you qualify for the program.