Updated: January, 2026

Determining the value of a home during an estate transition is rarely as simple as looking up a number.

A home may need to be valued for many different reasons:

- probate filings,

- tax basis,

- estate planning,

- buyouts between heirs,

- or preparing for a future sale.

In each case, the question is not just what is the home worth, but why the value is needed and how it will be used.

That distinction matters.

A value used for court filings is not the same as a value used for pricing a sale. A value used to establish a tax basis is not the same as a value used for early planning.

Confusion often arises when valuation methods are applied outside the context they were designed for.

This guide explains how home valuation works during an estate transition — before death, during probate, and after inheritance — with particular focus on situations where accuracy, fairness, and defensibility matter.

Rather than promoting a single method or professional, it outlines how different valuation tools are used, when each is appropriate, and how to align the approach with the decision being made.

The goal is not to find the number, but to choose a valuation method that fits the purpose it needs to serve.

That perspective is what turns valuation from a source of uncertainty into a practical decision-making tool.

Why Home Valuation Matters During Estate Transitions

There are times when a home’s value is simply a reference point.

And there are times when that number informs taxes, planning decisions, court filings, and how an estate is ultimately settled.

Estate transitions fall into the second category.

A home may need to be valued while an owner is still living and planning ahead, during estate settlement, such as probate or estate administration, or years later when heirs decide to sell or transfer the property.

In each case, the property itself is the same, but the purpose of the valuation is different.

During an estate transition, a home’s value may be used to:

- Establish tax basis and future capital gains

- Support estate or Medicaid planning decisions

- Calculate probate inventories and filing requirements

- Guide pricing, buyouts, or long-term holding strategies

- Provide a shared reference point for heirs and fiduciaries

For many families, this is the first time a home requires a formal opinion of value, rather than an informal estimate.

Different parties may rely on that number for different reasons — tax authorities, probate courts, advisors, or family members. Each context places different expectations on how the value is determined.

This guide explains the most common valuation methods used during estate transitions, when each is appropriate, and how to choose an approach that aligns with the decision being made — whether for planning, administration, inheritance, or eventual sale.

When You Need a Home Valuation During an Estate Transition

Most people don’t seek a home valuation on its own. They need one because something else requires a number.

- A filing.

- A decision.

- A transfer.

During an estate transition, a home valuation is commonly needed in situations such as:

- Probate administration, where the home’s value is listed in estate inventories and used for court filings and fee calculations

- Trust inheritance, to document asset transfers and establish future tax basis

- Quitclaim or deed transfers, even when no sale occurs, to support tax reporting or ownership records

- Date-of-death valuation, to establish stepped-up basis for inherited property

- Equity buyouts between heirs, when one party keeps the home and others receive their share

- Estate planning and long-term decisions, where value helps guide liquidity and timing choices

In each case, the property is the same, but the purpose of the valuation is not.

A value used for probate filings serves a different role than one used to price a sale. A value used to establish a tax basis serves a different role than one used for a buyout.

Methods Used to Value Property

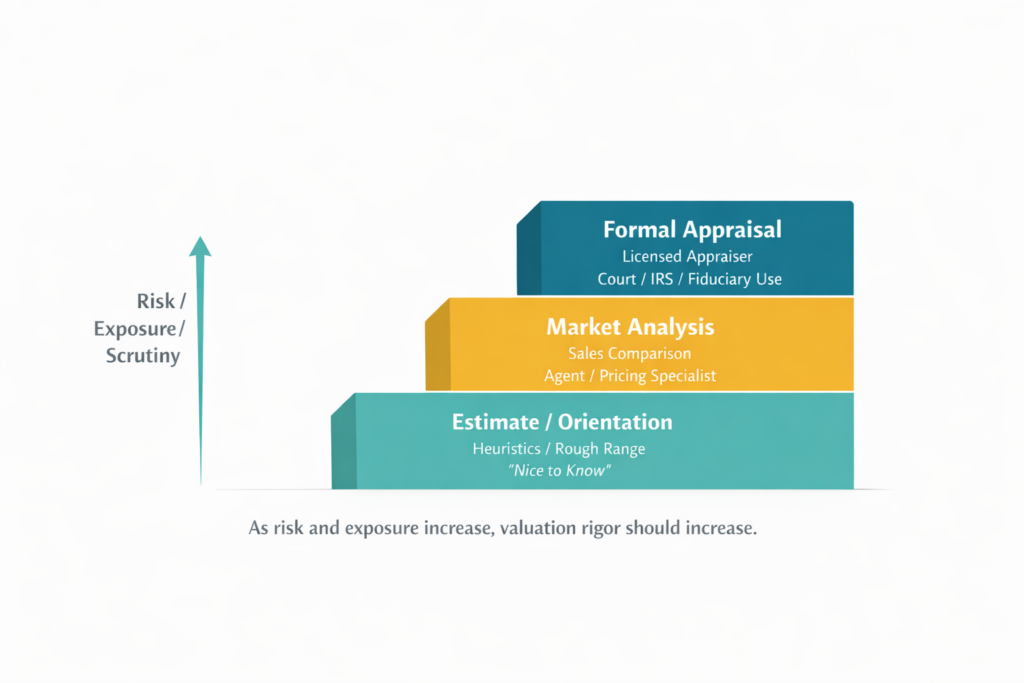

Not all valuation methods are designed to carry the same weight.

- Some are meant for approximation.

- Some are meant for planning.

- Some are meant to withstand review by courts, tax authorities, or other parties.

Understanding the differences — and the limitations — is more important than memorizing formulas.

Below, valuation methods are presented from least reliable to most reliable, based on how much exposure they can reasonably support. Followed by valuation methods for unique properties or situations.

Heuristics and Administrative Values (Lowest Reliability)

Heuristics are simplified shortcuts used to estimate value quickly. They are the kind of “quick-and-dirty” valuations you can use to get very, very rough estimates.

Common examples include:

- State Equalized Value (SEV)

- Tax assessed values

- Rule-of-thumb multipliers

- Informal percentage estimates

These figures are typically designed for administrative or reporting purposes, not market accuracy.

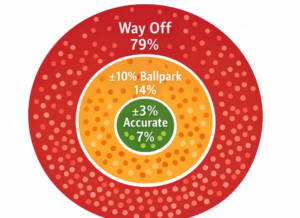

Our Michigan SEV research found that SEV can diverge widely from market value for individual properties, with many outcomes falling outside a ±10% range. In practice, that level of variance limits SEV’s usefulness to administrative context and early, high-level estimation.

Heuristics are most useful for:

- High-level planning

- Early-stage discussions

- Non-decisional estimates

The issue is not whether heuristics are “right” or “wrong”, it is whether they are appropriate for the decision being made.

Example questions a heuristic may be useful for:

- Was my parent’s estate worth $100,000 or closer to $1-million?

- Is this home likely below or above typical market ranges in the area?

Automated Valuation Models (AVMs)

Automated valuation models (AVMs), such as Zillow’s Zestimate, use algorithms and large datasets to estimate home values.

They are built to provide fast, directional estimates based on patterns in recent sales, public records, and user-reported data. In ordinary, low-stakes situations, they can offer a rough sense of where a property might fall within a market range.

The problem is not that AVMs are “bad.” The problem is that they are often used outside the conditions they were designed for.

Zillow itself publishes error-rate statistics that acknowledge this limitation. Those statistics are typically presented as median error rates and are often highlighted for on-market homes, where recent listing data helps anchor the algorithm.

What is less obvious to many users is that off-market accuracy is meaningfully worse — and probate, inherited, and estate properties are almost always off-market.

They often cite a median error-rate around 7% for off-market homes. Meaning, more than 50% of the homes have a Zestimate that is off by 7%. Your Zestimate could be off by 20 percent or more for all you know.

There is no opportunity for an AVM to inspect the home, verify condition, or understand functional or economic obsolescence.

For this reason, AVMs are best understood as orientation tools.

They can help answer broad questions about market range, but they are not well suited for probate administration, inherited property decisions, tax basis calculations, buyouts, or any situation where a valuation must support a specific legal, financial, or fiduciary purpose.

In estate transitions, the issue is not whether an AVM produces a number, it is whether that number can reasonably support the decision being made.

Sales Comparison Approach

The sales comparison approach estimates value by analyzing recent, similar properties and adjusting for differences in:

- Size and layout

- Condition and updates

- Location and lot characteristics

- Market timing

This method is the backbone of most residential valuations because it reflects actual market behavior, not averages or formulas.

Its reliability depends on:

- The quality of comparable sales

- The appropriateness of adjustments

- The judgment of the person performing the analysis

When applied correctly, this approach can support many estate-related purposes, including probate administration, buyouts, and pricing decisions.

The same sales comparison approach may be used by a licensed appraiser or a real estate professional preparing a market analysis, or an advisor helping an estate understand options.

The underlying logic is consistent, but the level of formality, documentation, and independence varies depending on the context.

When a valuation must withstand external review, such as for court filings or tax reporting—the method is applied within a more structured and documented framework.

When the goal is decision-making, such as pricing a sale, evaluating a buyout, or comparing options—the same approach may be used more flexibly to inform strategy rather than establish a final, binding conclusion of value.

Uncommon Valuation Methods

Most inherited and probate homes are valued using market-based comparisons. However, there are situations where a standard residential approach does not fully capture how a property would be valued in the real world.

These less common valuation methods typically arise when the property has characteristics that fall outside a typical single-family residence, such as:

- Income-producing or partially rented property

- Multi-unit or mixed-use property

- Horse properties, farms, or acreage with functional utility

- Homes with limited comparable sales

- Properties tied to a business or operational use

In these situations, alternative valuation approaches may be used — often as supplemental analysis, rather than a complete replacement for market comparisons.

Cost-Based Valuation

The cost approach estimates value by considering the underlying land value, the cost to replace or reproduce improvements, and depreciation for age, condition, and obsolescence.

This method is most useful when:

- The home is newer or recently constructed

- Comparable sales are scarce or unreliable

- The property includes unique construction features

In estate settings, cost-based valuation is typically used to support or cross-check other methods rather than stand alone as the final opinion of value.

Income-Based Valuation

When a property generates income—such as a rental home, duplex, or commercial building—value may be linked to cash flow rather than recent sales.

Income-based valuation may involve:

- Net operating income

- Capitalization rates

- Discounted cash flow analysis

These methods are appropriate when buyers in the market would reasonably evaluate the property based on income potential rather than personal use.

Gray areas often arise when a property sits between owner-occupied and income-producing use. In those cases, judgment is required to determine which approach best reflects how the market would actually value the property.

Who Can Value Property?

Once the valuation method is understood, the next question is often who should perform it.

Choosing the right professional is less about titles and more about matching the level of rigor to the purpose of the valuation.

Licensed Real Estate Appraisers

A licensed real estate appraiser provides the most authoritative and defensible opinion of value. Appraisals are performed under formal standards, with required documentation, independence, and clear reconciliation of data.

Appraisals are commonly required or strongly preferred when:

- The value will be relied on by the IRS

- A probate court or legal proceeding is involved

- The valuation may be reviewed, audited, or challenge

- A clear, third-party opinion is needed to reduce disputes

The primary disadvantage of an appraisal is cost.

Appraisals involve a fee and may take more time than other valuation options. For that reason, they are best reserved for situations where defensibility matters more than speed or convenience.

Real Estate Agents

Real estate agents frequently use the sales comparison approach to estimate value, particularly when the goal is to understand market positioning, pricing strategy, or available options.

Agent-prepared valuations can be appropriate when:

- The estate is evaluating whether or when to sell

- Heirs are exploring buyout scenarios

- The value is being used for planning or decision-making rather than formal reporting

Not all agent valuations are equal. Some agents pursue advanced pricing education, such as Pricing Strategy Advisor (PSA) certification, which emphasizes appraisal-style logic, adjustment discipline, and market analysis.

This additional training can improve reliability, but the key factor remains valuation competence, not the credential itself.

Agent valuations are generally less formal than appraisals and may not be sufficient where external review is expected.

Attorneys and Tax Professionals

Attorneys and CPAs typically do not assign property value themselves, but they play an important role in advising what level of valuation is sufficient for a given situation.

They can help clarify:

- Whether an appraisal is required or recommended

- How a value will be used for tax basis or reporting

- When a market-based valuation may be acceptable

- How valuation choices affect risk and exposure

Consulting with legal or tax professionals is especially important when valuation decisions may have long-term tax or fiduciary implications.

Property Inspectors

Property inspectors do not determine value, but they can provide critical input regarding condition, deferred maintenance, and repair needs.

Inspection findings often inform:

- Adjustment decisions in a valuation

- As-is versus repaired value scenarios

- Investor versus retail pricing considerations

In estate contexts, inspections help ensure that valuation assumptions align with the property’s actual condition.

How Executors Should Determine Value: A Decision Framework

Let’s wrap all of this information into something you can apply. We originally developed this framework to help attorneys guide their clients after we found our results from studying Michigan SEV values.

The question is not simply “What is the house worth?”

The real question is “What level of valuation is appropriate for the decision we’re making?”

That decision can be approached through three lenses: risk, exposure, and justification.

Step 1: Identify the Risk of the Decision

Start by clarifying what could go wrong if the value is off.

Some valuation decisions carry minimal risk. Others affect taxes, ownership interests, or fiduciary obligations. The greater the consequence of being wrong, the more careful the valuation process needs to be.

Ask:

- Would an inaccurate value create tax consequences?

- Could it affect how assets are distributed?

- Might it trigger disputes among heirs?

- Could it be questioned later by a court or tax authority?

Low-risk decisions may tolerate broader estimates, like heuristics and automated value models. High-risk decisions require tighter precision.

Step 2: Understand Your Exposure as Executor

Next, consider who relies on the number and whether you are personally accountable for it.

Exposure increases when:

- You are signing court filings

- You are approving distributions or buyouts

- You are establishing tax basis

- You are acting on behalf of multiple beneficiaries with differing interests

In these situations, the valuation is no longer informal. It becomes part of the estate record, and your role shifts from organizer to fiduciary.

Step 3: Determine the Level of Justification Required

Justification answers a simple question: If someone asked how this value was determined, could it be reasonably explained and supported?

Some situations require only internal clarity. Others require documentation that can withstand outside review.

For example:

- A planning estimate may only need internal logic

- A buyout requires fairness and transparency

- A probate filing may require standardized support

- A tax basis determination may require formal documentation

The more justification required, the more formal the valuation method, and the professional preparing it, should be.

Step 4: Evaluate Multiple Valuation Paths

Estate decisions rarely hinge on a single number. Executors often benefit from looking at multiple valuation paths, such as:

- Value if sold immediately vs. after repairs

- Retail market value vs. investor pricing

- Value today vs. value at a past date

- Holding value vs. liquidation value

This is especially important when liquidity pressure, repair costs, or market timing influence outcomes.

Seeing these paths side by side helps clarify tradeoffs instead of forcing a premature decision.

Step 5: Account for Real-World Constraints

Estate valuation does not happen in a vacuum. Common constraints include:

- Limited cash to fund repairs

- Disagreement among heirs

- Court-imposed timelines

- Market conditions that favor speed or patience

A valuation that ignores these realities may be technically sound but practically unhelpful. A good valuation framework acknowledges both.

Step 6: Document the Reasoning, Not Just the Number

Finally, remember that the value itself is only part of the record. The reasoning behind it is often just as important.

Documenting:

- Why a particular method was chosen

- Why alternatives were not used

- How assumptions were made

- How competing interests were balanced

This protects executors, reduces disputes, and provides clarity for everyone involved.

Tools like structured valuation worksheets or tracking systems can help organize this thinking and keep decisions consistent over time, especially when estates unfold over months or years.

Rule Of Thumb

As risk, exposure, and justification increase, the valuation method and the professional performing it should increase in rigor and independence.

In practice, that usually looks like this:

- Low risk / internal planning: When the value is being used for orientation, early planning, or internal discussion, high-level estimates or heuristic references may be sufficient. These values help frame decisions but are not relied upon by outside parties.

- Moderate risk / decision-making: When the value informs pricing strategy, timing decisions, or equity discussions, a market-based analysis using the sales comparison approach is typically appropriate. This is often performed by a real estate professional with strong pricing competence and an understanding of condition, market timing, and buyer behavior.

- High risk / external reliance: When the value will be relied upon by a court, the IRS, or other parties outside the family—or when the executor has significant fiduciary exposure—a formal appraisal is generally the appropriate level of rigor. In these cases, independence, documentation, and defensibility matter more than speed or cost.

Throughout the process, attorneys and tax professionals play an important advisory role in determining what level of valuation is sufficient for the specific legal or tax purpose involved, even if they are not assigning the value themselves.

The goal is not to over-engineer every decision, but to match the valuation approach and professional to the consequences attached to the number.

Using AI or ChatGPT In Home Valuation

With the rise of AI tools, many people now ask whether platforms like ChatGPT can be used to value a home.

The short answer is: AI can assist with valuation thinking, but it does not replace a valuation method or a valuation professional.

By itself, AI behaves much like an automated valuation model (AVM). When asked for a home’s value without context, it tends to rely on generalized market knowledge, public data patterns, or estimates similar to what you would see from consumer-facing tools.

In that mode, it functions as a directional reference, not a decision-grade valuation.

Where AI can become more useful is when it is treated as an analytical aid rather than a source of truth.

For example, AI can:

- Help organize heuristic inputs or assumptions

- Summarize market trends you provide

- Compare datasets you upload

- Assist in scenario analysis or thought exercises

Our own internal testing revealed, when historical market data is supplied, such as comparable sales from different years, AI can help identify patterns or infer internal heuristics.

However, the output is still dependent on the quality, completeness, and relevance of the data provided. The model does not independently verify condition, confirm comparability, or apply professional judgment.

Most importantly, at this time, AI cannot:

- Inspect a property

- Adjust for condition or deferred maintenance

- Reconstruct a defensible date-of-death market

Document assumptions in a way that satisfies courts or tax authorities

Because of these limitations, AI-generated values should be viewed as supportive analysis, not standalone conclusions, especially in probate, inherited property, or fiduciary contexts.

In other words, AI can help think through valuation questions, but it does not change the underlying rule:

The more risk, exposure, and consequence attached to the decision, the more important it is to rely on established valuation methods and qualified professionals.

Used thoughtfully, AI can complement that process. Used alone, it simply becomes another form of estimation.

Where AI May Eventually Add Real Value

It’s reasonable to imagine a future where AI becomes genuinely helpful in real estate valuation; not by replacing valuation methods, but by supporting how those methods are applied.

In a more mature data environment, where MLS records include clearer, more consistent information about condition, updates, concessions, and timing, AI could assist with parts of the sales comparison approach itself.

For example, instead of asking AI to “value a home,” an executor or professional might:

- Describe the subject property in detail or take a picture

- Specify condition, level of updates, and constraints

- Ask AI to help identify which comparable sales are most relevant

- Use AI to surface adjustment considerations or flag outliers

In that scenario, AI is not acting as an AVM. It is operating within an established valuation method, helping with comp selection, organization, and consistency — much like an analytical assistant.

The underlying logic does not change:

- The valuation is still market-based

- The method is still the sales comparison approach

- Human judgment still determines suitability, adjustments, and conclusions

AI simply helps process information more efficiently.

That distinction matters. When AI is used to support professional judgment, it can improve clarity and reduce friction.

When it is used to replace judgment, it becomes just another estimate.

In estate and probate contexts, that difference is critical. The method must remain sound, and the reasoning must remain explainable, regardless of how much technology is involved.

Understanding Date-of-Death Value

When a home is inherited, one of the most common questions is how its value is determined for tax purposes — specifically, the value as of the owner’s date of death.

For federal tax purposes, the IRS generally relies on fair market value at the date of death to establish the property’s stepped-up cost basis.

Fair market value is not a special IRS formula. It is the same concept used throughout real estate valuation: the price a willing buyer and willing seller would reasonably agree to, given the market conditions at that time.

The important distinction is timing. A date-of-death valuation is a retrospective valuation.

Instead of asking what the home is worth today, the question becomes: What would this home have reasonably sold for on that specific date, given the market conditions that existed then?

This means:

- Current market conditions are not relevant

- Online estimates generated today are not reliable for this purpose

- The property’s condition as it existed at that time matters

Comparable sales must be drawn from the surrounding period, not the present

Because there is no public “historical price” for residential real estate, date-of-death value is typically determined using the sales comparison approach, applied retrospectively.

A qualified professional reviews comparable sales that occurred around the date of death and makes adjustments to reflect how the property would have been viewed by the market at that time.

How much formality is required depends on how the value will be used.

In some cases, a well-supported market analysis may be sufficient.

In others — particularly when the value will be relied on by the IRS, used to establish tax basis, or reviewed later — a formal retrospective appraisal may be appropriate.

How Does the IRS Determine Fair Market Value of an Inherited Home?

For IRS purposes, the fair market value of an inherited home is the price at which the property would have changed hands between a willing buyer and a willing seller on the date of death, with neither under compulsion and both having reasonable knowledge of relevant facts.

The IRS does not require a formal appraisal in every case.

Fair market value may be supported by a retrospective appraisal, a well-supported market analysis, or, in some situations, the actual sale price if the property is sold within a reasonable time after death and market conditions have not materially changed.

The IRS details how to determine fair market value of inherited property.

How Do I Value a Home After Death?

After death, a home’s value is determined based on its fair market value (FMV) as of the owner’s date of death, not its current value. This date-of-death value is used for estate administration, tax reporting, and inheritance decisions, including establishing the property’s stepped-up cost basis for capital gains purposes.

Fair market value means the price a willing buyer and willing seller would reasonably agree to at that time, given the market conditions and the home’s condition as it existed then.

The IRS does not require a specific valuation method in every case. A date-of-death value may be supported by:

- A retrospective appraisal prepared by a licensed appraiser

- A well-supported market analysis using comparable sales from around the date of death

Or, in some situations, the actual sale price, if the home is sold within a reasonable period after death and market conditions have not materially changed

Which level of formality is appropriate depends on how the value will be used and the degree of scrutiny it may face.

Conclusion: Valuation Is a Decision, Not a Number

Determining the value of a home during an estate transition is rarely about finding a single, perfect figure. It is about choosing an approach that fits the purpose the value is meant to serve.

Across probate administration, tax planning, inheritance, and eventual sale, the same property may reasonably require different types of valuation at different times. What changes is not the home, but the risk, exposure, and responsibility attached to the decision.

Heuristics and automated estimates can help with orientation. Market-based analysis can support pricing and planning decisions.

Formal appraisals provide defensibility when a value must withstand outside review. None of these methods are inherently right or wrong — they are tools, and their usefulness depends on context.

The same is true of the professionals involved. Appraisers, real estate agents, attorneys, tax advisors, and inspectors each play a role. Effective estate valuation is not about choosing one voice, but about aligning the right expertise with the decision at hand.

When approached this way, valuation becomes less intimidating and more deliberate. Instead of asking “What is the house worth?”, the more useful question becomes:

“What level of valuation is appropriate for the decision we need to make right now?”

Answering that question — and documenting the reasoning behind it — is what turns valuation from a source of stress into a tool for sound estate decision-making.