So, you have inherited a property and you want to sell that inherited property. In this guide, we’re discussing the ins and outs of selling an inherited house.

We will explore methods for selling your home, such as using an agent or skipping the realtor process.

We will look at specific questions you need to ask yourself when inheriting a house, some of the common mistakes people make, and look at different implications based on if there is a loan on the property.

- 5 Steps To Selling Inherited Property

- Sell Inherited Property For Cash As-Is

- Why Sell An Inherited Property to Cash Home Buyers

- Common Mistakes When Selling Inherited Property

- Sell An Inherited House With Siblings

- Sell Inherited House That Is Paid Off

- Sell Inherited Property With A Mortgage

- Sell Inherited Home With a Reverse Mortgage

- Sell Inherited Property In Michigan

5 Steps To Selling Any Inherited Property

Selling an inherited property, at its core, is similar to selling any real estate property. The real difference is in the details. Before we dive into those details, let’s look at the process for selling an inherited house.

Get An Evaluation

The first step in selling an inherited property is getting a valuation of the property. You need to know how much it is worth. This step is important for several reasons when selling an inherited home.

First, there is the tax implication and trying to determine step-up cost basis if you inherited the property in an eligible way. Second, there is the need to determine the fair market value of an inherited property if you inherited the property with siblings, for example.

If you’re selling the property, then you can most likely get help from a real estate agent. Your local real estate agent can do a comparable market analysis and come up with a price.

However, one common pitfall is picking just any real estate agent. Not all real estate agents are properly trained in doing a home value analysis. Unfortunately, most realtors only know how to pull comparables and offer a wide range for the valuation.

For example, you may have an inherited property worth $275,000. Your realtor may only give you an estimated value with a range, such as $265,000 to $285,000.

For a normal property, this is usually okay. When you’re selling an inherited property, you need a specific number. The IRS will not accept a range. They need a hard number to set your cost-basis.

Second, you mitigate risk and liability when you have a specific number. As a result, look for a real estate agent with experience in home valuation or simply ask them to provide a specific number.

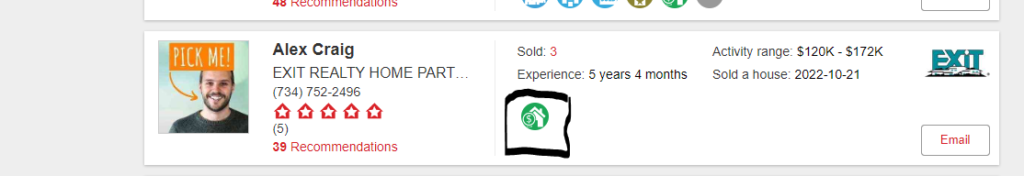

One way to check your real estate agent is trained is to look for the pricing strategy advisor certification through the National Association of Realtors. You can often find this when looking up Realtors or a specific agent on realtor.com. They will have a green logo with a dollar sign and a house.

Hire A Realtor

The next step or one that is done simultaneously when trying to get your home’s value is to hire a real estate agent. In reality, you may call up three different real estate agents to provide a home valuation and interview them to decide on the real estate agent you want to sell your inherited property.

For several reasons, it is a good idea to work with a real estate agent knowledgeable, experienced, and familiar with the estate process and selling inherited homes. That means they need experience working in probate, with trusts, quit claim deeds, as examples.

The common mistake people make is hiring any real estate agent. What I will see is people who inherited a home hire the real estate agent they used to purchase their home.

Since there are many similarities, any real estate agent can theoretically sell an inherited property. But, as an overused analogy, think about your doctor. If you had a heart condition, would you rather visit the general doctor or the cardiologist?

Specialists are better than generalists. They are going to reduce headaches, look out and avoid problems, and earn you more during the sale.

Unfortunately, not every region or market has a specialist in estates and dealing with inherited homes. In the Lansing and Detroit markets, the Dolinski Group has become the specialists when it comes to inherited properties and being probate real estate agents.

List & Market The Home

At this stage, your goal is to get the property on the market. During this phase, your real estate agent will take property photos, write a listing description and do what they need to get the property into the multiple listing service or MLS.

As the property owner, you have a responsibility to get the home ready and in listing and showing condition. This means putting the property in the best condition possible to get the home sold quickly and for maximum amount of money while maximizing return on investment.

During this stage, you may find yourself decluttering the property, calling an estate company, calling a junk removal company, cleaning, making basic repairs, or doing other repairs that will have a significant return on investment.

In most cases, I would say about 90 percent from experience, large repairs are not worth doing to an inherited property. You often do not make your money back. Meaning, you end up spending more money and net less at the end of the day.

Sometimes, for example, it is worth pulling carpet to reveal hardwood floors or repainting a room. But, major remodels are never worth it.

Good lighting, no clutter, and a clean condition is often all you need. Here is often what the Dolinski Group is aiming for when listing an inherited property.

Negotiate Offers

Once the home is listed, hopefully you receive some offers and can start the negotiations. When negotiating on offers made to an inherited property, it is important to understand the concept of leverage.

Leverage is the power you have to move the other party to your position. So, for example, say the offer for your inherited property is $225,000, but you want to sell the property for $235,000.

If you have the right amount of leverage, you can move the buyer over to your side and closer to your asking price. The number one factor in giving buyers or sellers leverage is the current real estate market condition.

In times where there is a shortage of houses, low interest rates, and a lot of buyers, people selling an inherited home have a lot of leverage. Therefore, homes will sell for asking price or above.

On the other hand, when interest rates rise and buyers exit the market, the leverage is mostly with the buyer. In this case, you may have to move towards the buyers position to get the property sold.

A great real estate agent can help you navigate the different offers so you understand the risks and leverage of each offer.

Accept An Offer And Close

Lastly, you need to accept and agree to an offer that is best for you and possibly the other parties involved. The keyword is “best” and what that looks like is different for every single person.

The most common mistake during this stage is assuming that the highest sales price always means the best. However, you have to consider other terms that can reduce your net profits from the sale of your inherited property or terms that increase risk.

Some example terms to look at are closing date, request for seller’s concessions, the type of loan a buyer is using, and the earnest money deposit the buyer is putting down.

Long close dates and seller’s concessions will lower your net proceeds as you will need to pay money to hold on to the house or pay for some of the buyer’s closing costs. When it comes to lending type and earnest money amount, this helps assign a risk value to the offer.

In other words, it helps an experienced real estate agent determine the probability the transaction will close. It can be expensive in time and money to have a deal fall apart. While it cannot be avoided with certainty, the right real estate agent can increase your odds and mitigate the risks.

Sell Inherited Property For Cash As-Is

Up to this point, the guide has explored how to sell inherited property through a traditional real estate agent. However, you have another option when it comes to selling an inherited house.

You can sell the property as-is for cash to a real estate investor or company that buys houses. The Dolinski Group is one such company. We buy houses for cash in Metro Detroit and Lansing Michigan. You can learn more about our program and how it works by visiting those pages.

This is often a great option for simple properties where beneficiaries to the inherited home are looking to dispose of the property quickly. It’s also for someone that understands the value a cash home buying company provides, such as fast closing timelines, no need for repairs, fewer closing costs, reduced home buyer risks, and convenience.

Let’s look at some of the benefits to selling your inherited property for cash.

Why Sell An Inherited Property to Cash Home Buyers

Selling your inherited property to a cash home buyer is a perfect option for some. For example, the client who inherited a property, but lives out of state often does not have the resources to sell an inherited property through traditional avenues. Often these people just need a quick closing without the headache of trying to prepare a property and get it sold when they are states away.

Here are some specific reasons you may want to sell your inherited property for cash. Take a read of our seven reasons to sell your house for cash.

Estates Can Be Complex and Time Consuming

Depending on how the property is inherited, you may be in for a long time-consuming and expensive process. For example, a property that needs to go through probate without a will is often a year-long process.

Anything you can do to speed up the process, such as selling the home to a cash investor, is often preferred by people looking to close an estate quickly.

Expensive Repairs And Junk Removal

Many inherited houses are in disrepair or outdated. Often this is because the original owner was too old or too ill to manage the property. Another reason is insufficient funds to update the house.

As a result, you may have carpet in the house that was installed nearly 20 years ago. Or cabinets that have not been in style in over 50 years.

Worse, there could be major issues like a leaking roof. Many repairs are expensive, time-consuming, and have a low return on investment.

If you are trying to sell the property from out of state, your task is that much more challenging as you try to manage handymen and contractors to complete the repairs.

With a home buying company, you can skip all of the repairs. You don’t even need to clean out the property. A company like the Dolinski Group will purchase the property as-is with all of the items in the house.

This can be a real simple process for someone looking to sell an inherited property quickly and conveniently.

Quick Access To Cash

The biggest benefit to selling any inherited property for cash is the quick access to the proceeds. Many cash investors can complete a closing in as little as two weeks.

Without the need for lender approval, the only bottle neck in the process is the title company. How fast you can close is a matter of how fast the title company can complete a title search and process the necessary documents to deliver a free and clear title.

In most cases, this can be done in as little as three weeks.

Common Mistakes When Selling Inherited Property

In my years of experience, I have seen seven common mistakes that people make when selling an inherited property. Let’s cover some of the most common mistakes briefly, but we wrote a more in-depth analysis on the seven common mistakes people make when selling an inherited property.

The first common mistake is mismanaging the timeline. Waiting too long to start the process of selling an inherited property is going to cost you in terms of holding expenses. For example, you or the estate may be responsible for paying property taxes, maintenance expenses, and insurance.

Or worse, is when you inherit a home with a reverse mortgage and the mortgage is not paid upon death under the due on death clause. This can cause the home to go into foreclosure and be auctioned off. I have seen this happen and it is sad.

Second set of common mistakes happen when improperly following the legal aspects of inheriting a property. Depending on how the property was inherited and with whom the property was inherited with, there are certain rules that need to be followed.

You can create a host of legal issues if you sell without the proper authority, fail to file proper paperwork, or fail to get a proper home valuation.

Next, let’s move onto specific circumstances for how a house is inherited. We will briefly cover each one.

Sell An Inherited House With Siblings

If you’re like most, then chances are you inherited a house with siblings or other family members. There are generally two questions that need to be addressed if you are inheriting a house with a sibling.

Here are the two most common questions that need asked:

- Do all siblings need to be in agreement about an inherited property?

- What are our options if all parties do not agree?

In the first question, the answer is usually yes. This assumes the estate has been settled and each of the siblings are left with an equal share in the property.

For example, three siblings inherit a property from their parents that is worth $300,000. Each sibling is entitled to one-third of the property, and therefore, $100,000. Keep in mind if the property is leveraged with a mortgage, then each sibling is entitled to one-third of the equity in the property.

Siblings do not have to be in agreement when there exists a legal document, such as a Will, stating what is to be done about the property. For example, let’s say your sibling was named the personal representative of the estate and the Will explicitly states that the property is to be sold and the proceeds divided.

In this case, your opinion or that of the siblings is irrelevant. As long as the Will is deemed valid, then the terms of the Will must be executed to the best of the personal representative’s abilities.

As for the second question, when all parties do not agree, you can:

- Buy out your siblings share of the house fairly

- File a suit of partition and force the sale.

It’s up to siblings to reach agreement. When agreement cannot be reached, parties will need to buy each other by using other estate proceeds, personal cash, or a mortgage.

If a party doesn’t have the funds to buy out other parties, then a suit of partition may need to be filed to force the sale of the property. This is usually a last option as it can easily cost ten to twenty thousand dollars.

Sell Inherited House That Is Paid Off

When you inherit a property that is paid off, you have far more options for what you can do. The biggest constraint for many beneficiaries is the mortgage.

For many, the house usually needs to be paid off in order to satisfy the mortgage on the property. According to some studies, the average mortgage debt when someone dies is roughly $50,000. The median inheritance is roughly $69,000.

Meaning, there is very little equity in an estate to pay off the mortgage and keep the house. This often means that the money needs to come from somewhere else if someone wishes to keep the property.

If you’re interested in learning more, you can look at our guide to selling a house that is paid off.

Sell Inherited Property With A Mortgage

This is the most common situation beneficiaries find themselves in. Often, a mortgage needs to be paid off and to do so, the home is sold.

When selling an inherited property with a mortgage, there are a few obstacles to look out for.

First, most mortgages have a due on sale clause. Luckily, there are several legal protections in place that allow most beneficiaries to inherit a property and assume the mortgage payments.

It is important to understand the estate or the beneficiaries must continue to make mortgage payments even if they plan to sell the inherited property. Failure to make the payments could result in foreclosure.

Sell Inherited Home With a Reverse Mortgage

If there was a reverse mortgage on the property, the loan amount becomes due 120 days after the death of the borrower. Unlike traditional mortgages, there are not as many protections against a due on death clause.

The loan needs to be paid back and often within the timeline. Failure to sell the property could result in a reverse mortgage foreclosure.

Generally, lenders will work with an estate and the beneficiaries on the timeline if the property is being marketed and listed. For most people, selling within 120 days is not possible given everything that needs to happen to get the home sold — from repairs, to cleaning out, to listing the home, to waiting for it to close.

If you find yourself in this situation, it is important to pay off the mortgage with funds from the estate or communicate with the lender.

Check out our guide on what to do if you inherited a house with a reverse mortgage.

Sell Inherited Property In Michigan

To sell an inherited property in Michigan, you are going to follow the basic steps outlined in this guide. However, it is important to know the probate and estate process in Michigan.

If you’re unfamiliar with it, consult with a probate attorney or an estate attorney in Michigan to understand your legal options. Probate court can take 10 to 15 months and will depend on Michigan’s laws.

When selling an inherited property in Michigan, it is important to know if there was a Will or wasn’t one. Each situation requires different steps and methods.

An owner who left a Will likely mentioned the heirs and what to do with the assets. As a result, the process is relatively simple. The Michigan court has to validate the Will and then the personal representative or executor follows the instructions in the Will.

If no Will was left, the process will follow Michigan law. All property and assets will be distributed according to the law.

In either case, it is advisable to connect with an attorney and an experienced real estate agent.

The Dolinski Group is a team of real estate agents that have experience selling inherited properties in Michigan.