Are you thinking about tapping into the equity or need to sell a parent’s home to pay for assisted living?

You’re not alone. The cost of assisted living and long-term care exceeds several thousand dollars a month, and much of the financial burden is being put on those who need care or their family members.

In fact, family out-of-pocket expenses can be as much as 40 percent of total care costs. One in six people will spend over $100,000 out-of-pocket on long-term care, according to NASI.

If you’re considering selling a home to pay for assisted living, you’ve come to the right place. We’re going to talk about how to sell a home to pay for assisted living and discuss some alternative options to pay for long-term care.

What’s The Average Cost Of Long-Term Care?

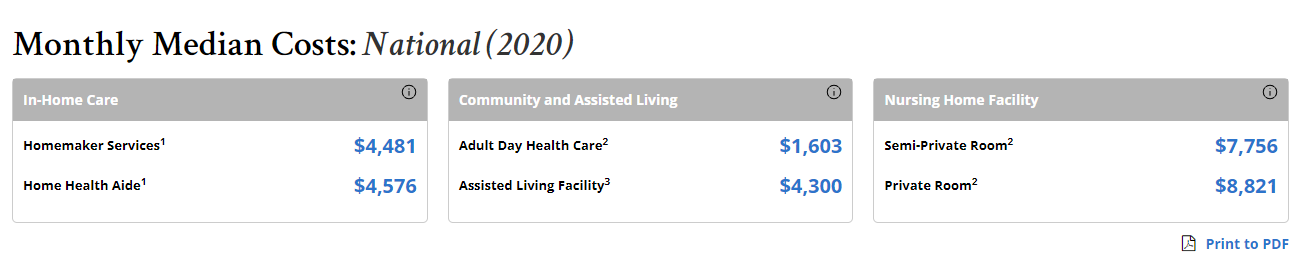

In 2020, the national average for long-term care in an assisted living facility ran about $4,300 per month. That’s just the national average, though.

For the Metro Detroit area (Michigan), the average cost for assisted living was $5,100. And if you needed in-home care? You can practically double that figure.

While Government programs, like Medicaid, certainly help offset some of the costs, there is no doubt that long-term care places a large financial burden on those who need care, family members, and those caring for loved ones.

Since a home is often a person’s largest asset and contains a fair amount of their net worth, many people are thinking about selling the home to pay for assisted living or alternative long-term care options.

Pros and Cons Of Selling The Home

The most obvious reason to sell the home is to use the cash proceeds to pay for the cost of assisted living.

Before we dive into the nuts and bolts of selling a home to pay for assisted living, I want to explore the pros and cons so that you can be informed and empowered to make a decision that is right for you.

Medicaid Won’t Always Pay For Assisted Living

Medicaid is a bit funny when it comes to paying for long-term care. For some reason, they have decided that they will only kick in as long as you have no more than $2,000 worth of assets.

Assuming you have some decent equity in the home, selling the home will most likely bring a homeowner above the allowed-asset limit.

However, your home is only considered an asset if you sell it or no longer live in it. So, for example, if you live in a home, it’s possible for medicaid to kick in and pay for long-term care options, like in-home care, as long as your countable assets are less than $2,000.

All of this means that if you sell a home, you will likely be required to use the home sale proceeds to pay for long-term care before medicaid will pitch in.

It’s a fine balance between reducing overall care costs while having subsidized payments from medicaid. While you may get medicaid if you choose in-home care, the overall care costs will go up and that might mean you have high out-of-pocket costs.

On the other hand, moving to an assisted living facility could possibly reduce overall costs and lower your out-of-pocket expense on a monthly basis, even if you don’t qualify for medicaid.

Shelter Your Assets

Of course, there are a few ways around all of this. It’s possible to sell your home and still qualify for medicaid by sheltering your assets. You can sell your home and use the protected proceeds to pay for things that medicaid won’t cover — family members to provide care, extra home care, etc.

As a real estate agency, this sort of topic is beyond our scope of knowledge and service.

If that’s something you’re looking to do, we recommend that you contact an estate attorney or an elder law attorney. They would be much better positioned to help you shelter your assets and still qualify for medicaid.

Reduced Monthly Expenses

From property taxes, to mortgage payments, to lawn mowing, to snow removal, to utilities, to everything else, maintaining a home isn’t cheap. Selling a home will reduce overall monthly costs.

Plus, selling a home will free up family members from having to maintain the home. A family member being a caregiver can become a real problem when they are the only ones shouldering the burden. It creates a lot of sibling conflict and can quickly lead to family estrangements.

In a worst case scenario, nobody takes care of the property and maintenance is deferred. At that point, repair lists start to add up and the value of the home starts to decrease, creating a phantom cost.

You don’t see the cost until it’s time to sell and you’re told you can only get 80, 70, or even 50 percent of the home’s value.It’s possible for the equity in a home to be eroded over time due to deferred maintenance and large repair lists.

Ideally, a home is kept in good condition until it’s sold. But, we understand it happens.

If you don’t believe you or someone will be able to properly care and maintain the home, it makes sense to go ahead and sell the home.

How To Sell Your Home To Pay For Assisted Living

Selling the home to pay for assisted living can be completed in a four part process. While it’s only a four part process, make no mistake about it, selling a home is a major undertaking. Especially if you’ve found yourself in this situation unexpectedly.

Step 1: Get Authority To Sell

The first step to getting the home sold is to establish proper authority and legality to sell the home. Average homeowners don’t have to worry about this since authority and legality is rarely an issue.

However, when dealing with aging parents, someone with dementia, or other capacity limits, it can call into question the validity of any contract.

And therefore, will call into question a purchase agreement between a buyer and a seller.

Each case is going to have to be evaluated on an individual basis. For that reason, it’s recommended that you seek legal counsel.

But here are some things that you need to think about and ask yourself:

- Am I or my parent of sound mind?

- Do I need the court’s permission to sell my parent’s house?

- Can what I’m doing be misconstrued as undue influence on my parent?

- If I have a power of attorney (POA), conservatorship, or guardianship, do I have legal authority to sell the home on behalf of my parent?

In contract law, for a contract to be enforceable, a person must be of sound mind. This could potentially disallow someone with dementia from selling a home. Or, it may not.

Be prepared to keep records and have justifiable proof of authority and validity of a contract. Lenders and title companies will require it prior to closing on a home.

For example, I once worked with a client whose father had dementia. He moved into an assisted living community. Even though my client had POA, the title company required that they speak to the father to verify sound mind and ensure the father wasn’t being unduly influenced or scammed by the son.

Step 2. Find The Equity Value

Prior to listing the home or making a decision, it’s a good idea to find the equity value of the home. You can do this by getting an accurate assessment of the home’s value and subtracting any mortgages and loans on the property.

This includes any HELOCs or reverse mortgages that are on the property.

With an idea of the equity position, you know how much cash you may have for providing long-term care in an assisted living facility.

For the most accurate value of a home, request an analysis from a real estate agent with a pricing strategy advisor (PSA) certification.

PSA real estate agents have additional training and knowledge that allows them to be better at home valuations than the average real estate agent.

You don’t want to find yourself in trouble because a real estate agent made a mistake and undervalued or overvalued your home.

Seriously, I can’t emphasize this enough. Don’t just contact any real estate agent. Look for one uniquely qualified in home valuations.

Step 3. Determine How To Sell

Wait… isn’t this article about how to sell a home to pay for assisted living?

Yep. But, there are two ways you can sell your home. First, you can go the traditional route and list your home with a real estate agent. Or, you can sell the home to a cash buyer.

Each option has their benefits and disadvantages. Let’s cover a few of these.

Under the traditional method, you’re going to get maximum value for your home. You’re going to sell it for the highest price possible.

However, it’s going to take longer to sell when compared to selling it to a cash buyer. On top of that, you may need to complete some repairs and go through the long, arduous process of getting the home listed for sale.

Cash buyers are a great option for selling the home quickly, eliminating the traditional real estate process, and optimizing for convenience.

Often, cash buyers buy home as-is, so you can skip the need for repairs. Plus, you avoid paying any real estate agent fees.

The biggest drawback is that you’re going to sell the home for a lot less. However, depending on your circumstances it is possible to net more money.

Maintenance costs and real estate fees can really add up on a home. For some, it is better financially to sell the home as-is for cash. Even if you net less, you can get the proceeds faster.

How Long Does It Take To Sell A Home To Move Into Assisted Living?

Not long. The real estate market is hot right now. Of course, the exact time it takes will depend on the method for selling your home, the condition of the home, your list price, and the real estate agent you hire.

In this market, homes sell in days and weeks instead of months.

Five to ten years ago, the major advantage of selling to a cash buyer is they could close much faster than an average buyer with a mortgage.

Just a few years ago it took three to six months for a home to sell and close. Meaning, you didn’t get the sale proceeds for four to six months.

Today, you can get an offer in a week and close in 45 to 60 days. Either way, the timeline is shortening between cash offers and traditional selling methods.

Step 4. Determine When To Sell

You have two options for selling the home when it comes to paying for assisted living. You can either list and sell the home before moving or after moving to assisted living.

Benefits To Sell Before You Move

The primary benefit to selling before you move into assisted living is that it’s cheaper. If you move and own a home, there will still be a mortgage to pay, maintenance to take care of, utilities to pay, and so much more.

This can be a real drain on any cash or financial reserves. If the home takes longer to sell than anticipated, that can put a financial strain on yourself or the caregivers.

Benefits To Sell After You Move

Selling the home after you move makes the home easier to stage and complete repairs. It’s much easier, for example, to paint walls when all of the furniture is out of a home. Of course, this a moot point if most of your repairs are outside, like exterior house painting.

Second, homes that are decluttered and staged sell for more and faster. It literally pays to remove stuff from a home and no longer live in it.

Alternatives To Selling The Home For Assisted Living

If you prefer to stay in the home, there are alternative ways to pay for medical costs without selling the home. Again, everything comes with its own pros and cons. I only recommend these two methods if you plan to live in the home.

Home Equity Line Of Credit

If you have substantial equity in your home, you may be able to get a Home Equity Line of Credit, or HELOC. This is a method for pulling some of the equity out of your home. The primary advantage of doing this is that a homeowner can remain in the home and not count the home as an asset for the purposes of medicaid.

Typically a HELOC will have a time period at which the home needs to be paid back. Otherwise, it’s converted into a traditional loan.

Qualifying for a HELOC will likely require some proof of income and it can increase your monthly expenses since you will need to make monthly payments.

For that reason, we don’t typically recommend using a HELOC.

Reverse Mortgage The Property

Another option that has been gaining a lot of popularity over the years is the reverse mortgage. A reverse mortgage is a way to tap into a home’s equity and doesn’t require income or monthly installment payments.

When receiving the money from a reverse mortgage, it can be received in a lump sum or monthly installments.

A reverse mortgage can be a great option for some and a poor financial decision for others. Be sure to understand the ins and outs of a reverse mortgage before picking this option.

With a reverse mortgage, debt will be created and liens against the property. A family’s inheritance is being spent and inheriting a home with a reverse mortgage can be a complicated process.

Find The Right Real Estate Agent

There’s no doubt about it. Selling a home to pay for assisted living is a unique process. For that reason, it’s important to work with a real estate agent that understands your situation and has experience with these situations.

An attorney can be a great place to start for recommendations or look for real estate agents who are sharing content on related topics.

Even if you were happy with a real estate agent you used in the past, I recommend using them only if they have experience in these kinds of subject areas. Otherwise, you may find a steep cost — in terms of delays, hiccups, and headaches — to work with that agent.

The process can be complex. It’s a good idea to work with an experienced agent.

At the Dolinski Group, we are proud to offer clients our experience and dual service model. We help our clients sell their homes with our traditional real estate services, as well as, our cash offer program.

Most real estate companies out there only offer one or the other. They will either list your home or make you a cash offer. Few companies, like ours, offer both.

To get started on selling your home, get in touch with us.