“Why is my Zestimate so low compared to my neighbors,” is a question I hear homeowners ask me when talking about home values.

It’s even more troubling to witness a decrease or drop in your Zestimate, especially when the market is red hot, homes are selling quickly, and inflation is driving home values up through the roof (pun intended).

If you rely on Zillow’s Zestimate tool for your home’s value, you might feel that the Zestimate is so low. You might even have data from a better source, like an appraisal that says your home is worth significantly more.

The Zestimate is a great tool for getting potential values for your home without having to contact a real estate agent or pay the costly fee of an appraiser. There’s no doubt you check your Zestimate and even compare it to your neighbors.

Let’s dive into why your Zestimate is so low. It starts with understanding Zillow’s Zestimate tool.

A Personal Experience With Zestimate

I will dive into the nuts and bolts of the Zestimate, but first, I wanted to share a personal story as a way to introduce you to some of the concepts I’m going to share.

And, to let you know that this is a wide problem. It’s not just you or a handful of homeowners who get inaccurate and low Zestimates.

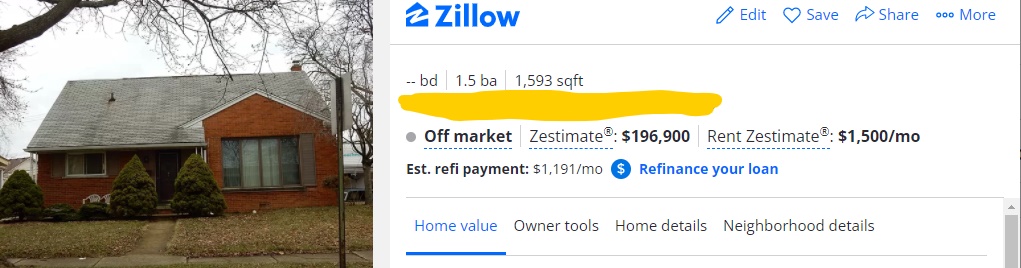

Here’s a home that was purchased in Michigan in 2021. The home was purchased right before the wild inflation. The home bought was an inherited home that just cleared probate. It was outdated and needed fixing up.

This home was purchased the home for 5.5% below market value. After closing, the Zestimate showed the closing price on my home even though I had an appraisal that said my home was worth significantly more.

During the six months this home closed and when the Zestimate was pulled, the Zesitmate has increased about 6%. However, the home’s true value is closer to 25% higher than when it was bought.

This is primarily due to inflation driving home values up and the completed repairs and updates.

So why the big discrepancy? First, Zillow isn’t aware the home appraised for higher than what it sold for. Second, Zillow isn’t aware of the updates to the home that make it worth more.

And that’s the main problem.

Data issues.

Zillow doesn’t have the data.

Notice this random home that doesn’t have bedroom count.

As we continue, keep this fundamental idea in your head: an automated value model algorithm is only as good as the rules and data given to it.

As the old adage goes, “garbage in. Garbage out.”

Zillow’s Data Is Missing Or Wrong

When using an automated value model, like the Zestimate, data accuracy plays a critical role. In accurate data causes all sorts of problems with the Zestimate.

One common cause of data inaccuracy is data decay. Gartner reports that every month around 3 percent of data is decayed globally.

While this applies to all data, it’s reasonable to a degree to interpolate and assume that Zillow’s data is decayed by 3% every single month.

Without additional data points being added, like when a home is listed, the more decay that is going to happen. In other words, it’s reasonable to conclude that the longer a home is owned, the more likely the Zestimate is to be wrong.

For example, it’s common for homeowners to:

- Add bathrooms

- Finish a basement

- Add other amenities

- Bump out their garage

In my personal story, this is a perfect example where Zillow has missing data. Even after six months, the data from when it was listed has already decayed.

For example, they aren’t aware of the improvements I made to the home.

Because of selling at a lower priced point, then fixed up homes, Zillow is pulling homes as comparables that aren’t a good fit to mine.

If you’re looking to improve your Zestimate, take the time to review your home profile and update it as needed. Make sure it accurately reflects the current condition and state of your home.

Poor Choice In Comparables

Every good home valuation method relies on comparing your home to similar homes in the neighborhood that sold within a certain time frame given the real estate market’s conditions.

As a general rule of thumb, real estate agents and appraisers will look for similar homes that sold within the last six months.

Zillow’s Zestimate algorithm holds fast to this rule, regardless of market conditions. Six months is only a general rule and will be shifted based on how the real estate market is doing.

- In a seller’s market, like the one in 2021 and into 2022, comparables should be within 3 months.

- In a buyer’s market, like the years during the Great Recession, comparables may be as far as 12 months out.

Given the inflationary period we are experiencing at the end of 2021, house values are climbing quickly. Zillow’s algorithm, unfortunately, doesn’t reflect this reality when it is pulling comparable homes that sold six months ago.

It’s likely that all homes have a lower estimated Zestimate than actual value.

So, on the basis of time frame, Zillow is picking bad comparables. If your Zestimate includes homes that were sold over 3 months ago, that’s going to be one key reason your Zestimate is so low.

But, it’s not just the time frame. Zillow picks comparables that most qualified real estate agents and appraisers would never use.

From my own internal study, Zillow pulls data based on proximity as a main priority, followed by square footage and then everything else.

It doesn’t take into account the style (ranch vs two-story), improvements, high-end appliances, or other amenities that can increase your home’s value.

There is a good chance, if your Zestimate is low, it’s being compared to homes that aren’t similar to yours.

As a certified pricing strategy advisor real estate agent, I want to pick comparables that are as closely similar to my subject property.

Meaning, identical square footage, location, amenities, and condition.

Unfortunately, the world is less than ideal. Often we have to make tradeoffs. For example, we may select a home that is a little bit further than preferred, but is more identical to the home we are valuing.

The Zestimate algorithm just doesn’t know how to properly prioritize these tradeoffs. It’s something only the human element can add.

All of this leads to poorly selected comparables.

No Adjustments to Comparables

To add insult to injury on your low Zestimate, Zillow doesn’t make any adjustments to the comparables that are picked.

It wouldn’t be as terrible to select different comparables if the algorithms knew how to make proper adjustments for differences between the subject property being valued and the comparable.

For example, let’s say Zillow pulls a comparable home that is 200 square feet less than your home. In my area and at the time of publication (December 2021), an appraiser would make roughly a $30 per square foot adjustment for your average home.

So, if the home that is 200 square feet less than yours sold for $200,000, then we would need to add $6,000 in value to the sold home.

Zillow doesn’t make this adjustment.

As a result, the comparable home will show the sale price and the Zestimate will be pulled closer to the lower sales price.

Here’s the major implication:

If your home has more value-factors (bigger square footage, better condition, more amenities, etc) than the comparables that are pulled, then your Zestimate is likely to be lower than actual value.

Take a look at the comparables selected. Do you have a bigger home? A larger garage? A better interior condition?

All of these will mean that your home is worth more than the Zestimate is indicating.

When valuing a home, we wish to create an apples-to-apples comparison. Unfortunately, the Zestimate tool is more of an apples-to-oranges comparison.