This guide contains everything you need to succeed at Quickbooks for real estate agents and brokers.

How to choose the best Quickbooks version for you, how to get set up, some best practices, and how to use your financial reports and metrics to make better business decisions that allow you to grow and scale your real estate business.

Real estate accounting is a necessary evil. It can feel like a drag. For most real estate agents, Quickbooks is neglected because it’s unenjoyable. Many would prefer to go out and show a home and take a listing.

Accounting for real estate agents is what vegetables are to toddlers. You might pick at them. Your parents (i.e. your accountant) will bribe you to eat them (i.e. get it done).

You might take a bite (i.e. make one entry), but you’re going to do everything you can to avoid them. You’re going to eat everything else off your plate before you touch those vegetables (Read: you’re going to get every task off your plate before you even look at your Quickbooks).

I know there is a lot of resistance to real estate accounting. But, it’s not just you, really. Many business owners feel this way.

When I worked as a bookkeeper and accountant early in my career and prior to getting into real estate, I could see how much of a drag accounting was for people.

In this post, I will show you how I set up my Quickbooks, how I break down my income and expenses, how I use my numbers to grow, and how you can do all of the same.

If you want to jump right into setting up your Quickbooks for real estate agents, then jump to “Setting up Quicbooks”

[If you’re looking for information about using quickbooks as a real estate investor, check out our separate short guide to quickbooks for investors.]

My Case For Real Estate Bookkeeping

Despite real estate bookkeeping and accounting feeling like a necessary evil, it needs to be placed on a higher-priority list. It’s not as important as taking listings or showing homes, but it’s far more important than most treat it.

And here’s my simple principle for why: The way you earn and keep money requires different strategies from how you make money.

When it comes to making money, lead generation and conversion is the focus.

When it comes to keeping and earning money, we need to manage our expenses, hold our marketing accountable, and learn how cash moves in and out of our business to avoid cyclical cash flow and going into debt.

For many, Quickbooks is updated once a year only to file taxes. By then, it’s far too late to gain any kind of insight from your data.

I want to make a case for real estate bookkeeping and accounting. You will need to build an accounting system that you can complete and execute on at least a monthly basis.

Better financial control will allow you to scale your real estate company and improve profits — whether you’re an individual real estate agent or a real estate broker.

As one of my friends, a Certified Financial Analyst (CFA), always said, “Anybody can start a company, but not everybody can scale it.”

Oh, how true those words are. Ponder on it for a minute.

Starting a real estate business is easy compared to scaling it. To start, you just have to file some paperwork, get the necessary licenses, and create a website.

But, to scale a company…

That takes financial discipline. It requires profitability. A strong understanding of cash flow as you grow.

You need to understand how to fund cash flow differences if you’re profitable but cash flow negative.

Take this stuff seriously. I know it’s not the most enjoyable topic for most.

Learn how to manage your real estate agent finances with quickbooks online. In our real estate agent cash crash course, we show you:

- How to slay the tax monster and avoid a surprise tax bill.

- How to properly record your gross commission income checks. Hint: most agents and bookkeepers are doing it wrong.

- The relationship between the success of your real estate career and your personal finances.

- How to pay yourself correctly so you never leave your business starving for cash or dipping into your personal finances.

Why Use Quickbooks For Real Estate Agents?

A quick Google search for “real estate accounting software” will turn up several solutions. You will see the familiar companies, like Quickbooks. But, there are also alternative accounting software solutions that real estate agents can use.

For example, Freshbook is an alternative accounting platform for real estate agents and brokers. There is also Xero for real estate agents and brokers.

This article is about Quickbooks for real estate agents because that’s what I recommend to real estate agents. Quickbooks is simpler, easier to use, and comes equipped with the tools real estate agents need to run their business.

For example, all plans of Quickbooks Online include the mile tracking feature. Agents can track mileage automatically using GPS tracking on their phone. All you have to do is drive and your phone will do the rest. That’s way better than keeping a log book in your car and recording all of the instances you drove.

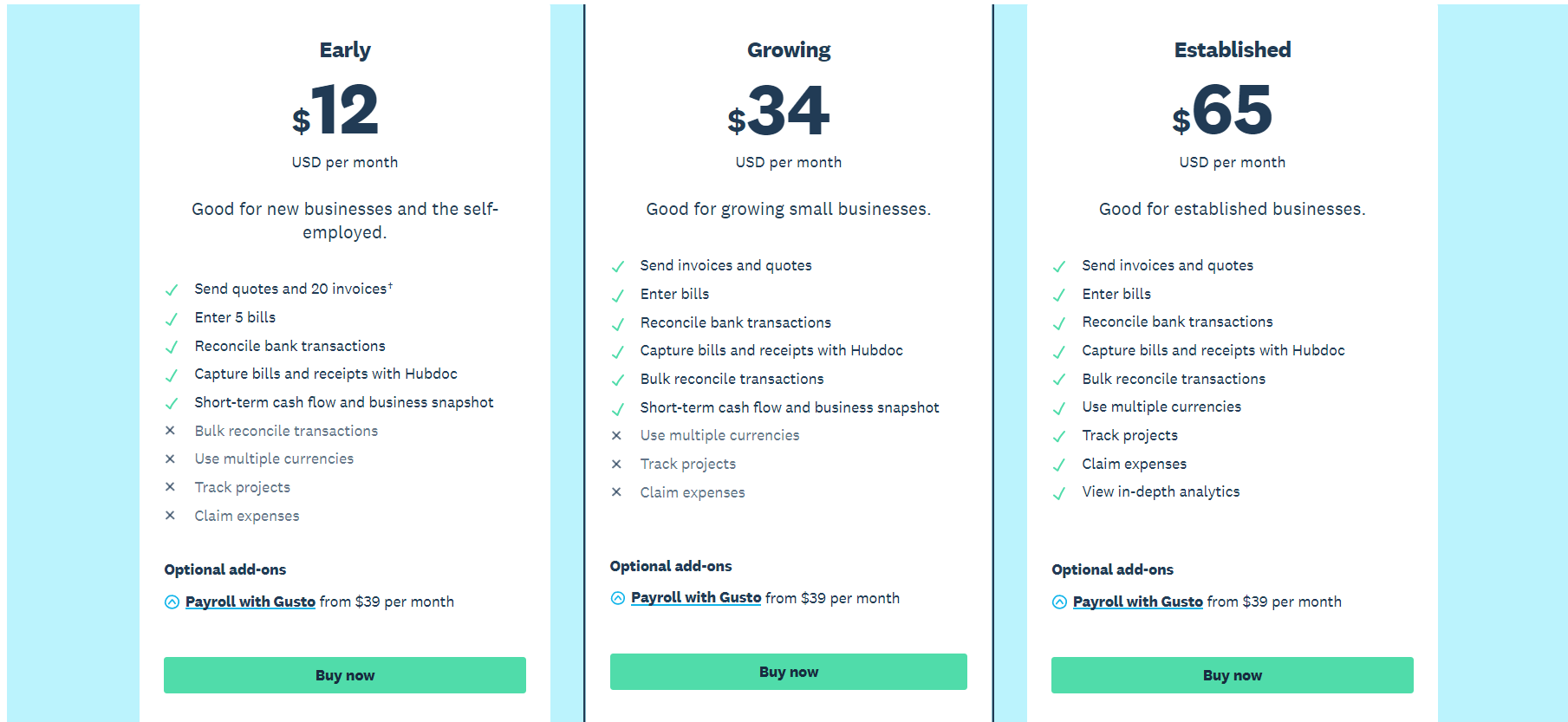

If you wanted the same mileage tracking feature with Xero, you would have to sign up for their highest tiered plan, the Established Plan. At the time of this writing, that would be $65 per month.

However, you could get started with Quickbooks Online and have mileage tracking at a much lower cost. Even though Xero has a low plan at $12/month. It’s far too restrictive for what a real estate agent or broker needs.

More Support With Quickbooks

Since Quickbooks is an industry leader and the most popular, a real estate agent will be able to find far more support — through forums, blog articles, YouTube videos, and Live help — than they could with alternative real estate accounting software solutions.

So, if you’re unfamiliar at all with accounting and accounting software, you should use Quickbooks. Even if you are familiar with it, I still recommend Quickbooks for real estate agents.

Let’s say you’re a real estate brokerage. I would recommend Quickbooks because far more real estate bookkeepers and accountants are trained in Quickbooks and Quickbooks Online.

If you’re looking to outsource your bookkeeping and accounting, you’re going to have an easier time finding qualified candidates at reasonable prices that are right for you at your stage of business.

A bookkeeper or accountant well-versed in Xero can be considered a specialty. The supply is low and often these candidates are higher-level accountants, like CPAs. As such, finding a bookkeeper or accountant with Xero will come at a premium price.

You’re also less likely to find a candidate that is qualified in the real estate industry.

The reality is that people who are trained in Xero are overqualified for what a majority of real estate agents and brokers need.

Growing Automation

Quickbooks is getting smarter and smarter. With the recent launch of AI, I’m certain that Quickbooks will continue to help real estate agents automate many of their bookkeeping tasks.

For example, Quickbooks has already been using smart technology to help auto-categorize expenses for you. It uses machine learning to understand how you categorize expenses.

Second, you can set up automated rules. In this way, expenses are automatically assigned to categories based on information you provide Quickbooks.

As an example, you know that your NAR dues come out every single month from the same account, for the same amount. Here you could create a rule to assign your NAR dues to a “Dues and Education” category.

Alternative solutions like a spreadsheet, while seemingly more cost-effective, require manual entry. It’s possible you will spend more time in an Excel spreadsheet than you would with Quickbooks.

Quickbooks Online or Desktop?

For most real estate agents and brokers, Quickbooks Online is the way to go. There are some instances where Quickbooks Desktop is a better option.

For me, I use Quickbooks Desktop. I use it for several reasons, but there are tradeoffs. I accept those tradeoffs, though.

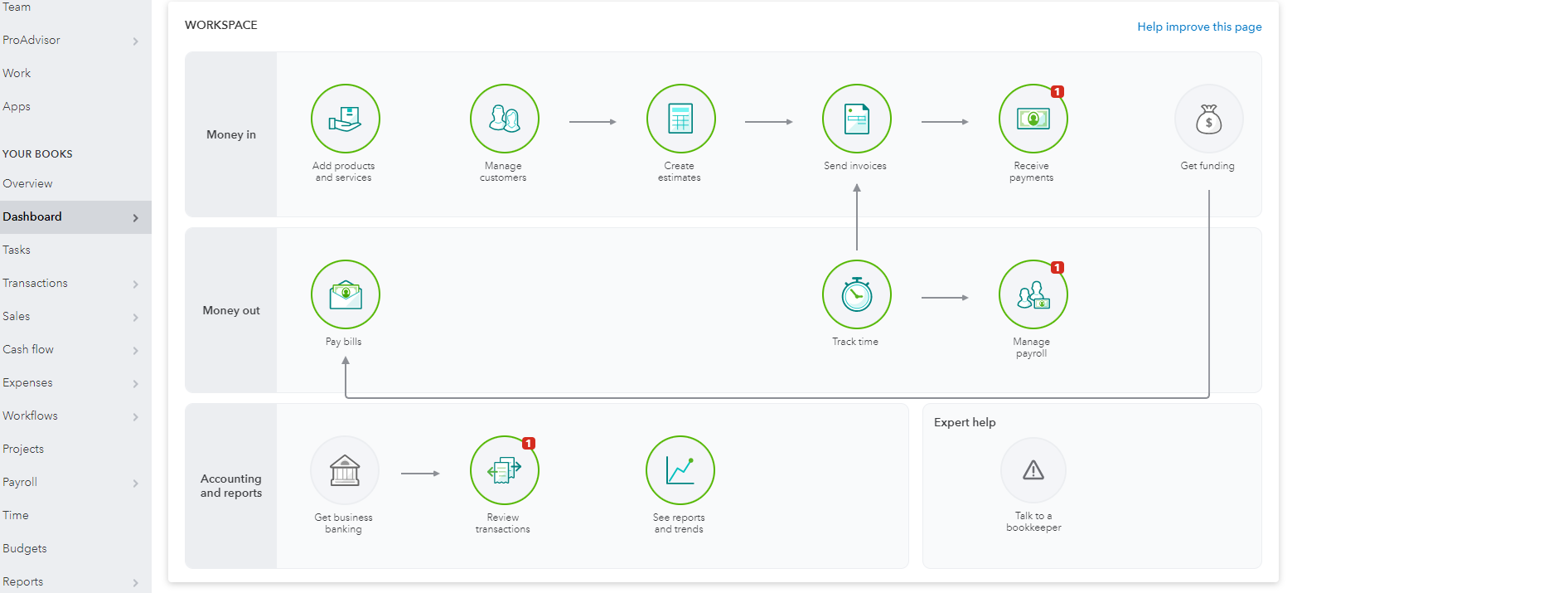

The biggest advantage Quickbooks Online has is the ability to connect your bank accounts, smart-learning to categorize and record expenses, cloud-based solution, and mileage tracking.

Quickbooks Online has the power to automatically import, categorize and approve certain expenses. This can seriously shorten the time required to enter accounting data.

Example: Every month I pay my dues to the board of Realtors and my MLS access fee. It’s the same price every month. This transaction is automatically loaded into my expense feed for approval. If this is the first time entering the expense, I need to categorize it. After a few times, Quickbooks Online smart learning will automatically categorize the expense for me. Saving me a few clicks of a button.

But, I can go one step further. I can create a rule inside Quickbooks Online to automatically approve and record the expense. Now, all of my fees from the association can automatically be recorded without me having to do anything.

Talk about a massive time saver and the kind of solution real estate agents need so that they don’t have to spend all day in their Quickbooks file.

As mentioned earlier, Quickbooks Online includes mileage tracking. This feature isn’t offered with Quickbooks Desktop.

The mileage tracking feature allows you to add trips manually or have your phone’s GPS record them automatically. The only way to do it on Desktop is to enter everything manually.

The biggest drawback to Desktop is that it’s tied to a computer. With online, you can do it anywhere — from your office, your home, or on-the-go.

Why Am I On Quickbooks Desktop?

I’m on Quickbooks Desktop for two reasons. First, I run a company and my wife runs a company. With Quickbooks Online (QBO), we would have to pay for two separate subscriptions.

There is a discount for adding companies, but it would come out to a higher monthly cost than if I purchased the desktop solution and upgraded every year.

Second, and most importantly, the desktop version has far greater functionality, accounting and reporting that allows me to run my different revenue sources in one file.

Since I have education and work experience in the accounting and finance industry, I prefer more data and functionality than what QBO can provide me.

For example, the desktop version allows me to keep track of, record, and accurately report on my commission income, my flipping income, residual income, and affiliate income.

A tool that I often use on the desktop version is the financial forecast and projection tool. I will frequently model out a financial projection for a specific revenue model in Google Sheets and transfer that into my Quickbooks to measure myself against.

For example, what if I decided to niche down and target the divorced real estate market? How do I think that would change my business revenue, expenses and profit?

I can evaluate if a potential idea may be worth pursuing. Any real estate agent can do this, but it’s far more than they need to do and has a steep learning curve.

The learning curve with desktop is too steep for most real estate agents and they don’t need the tools I use. For that reason, I recommend Quickbooks Online for real estate agents.

Brokers, you may want to consider Quickbooks desktop if you have larger needs and have the resources.

Update: Since writing this article, Quickbooks has switched their desktop platform to a subscription model, too. In the past, I have favored desktop for the cost savings and one-time installation fee.

However, I have since switched my books over to Quickbooks online and no longer recommend Desktop.

Quickbooks Desktop For Brokers

If you’re a large brokerage and you believe you want the kind of insights that come from financial forecasting and planning, then you may want to look at Quickbooks Desktop.

As a broker, you might wonder:

- What happens if we open up a new office across town? Will we recruit more agents and how much will it cost us to operate the office?

- What if we acquire one of our smaller competitors and merge the offices?

- If we invested into Zillow’s broker lead generation program, how would that affect our ability to recruit and retain agents? Will it drive more revenue and profits to the company?

But the tool doesn’t do all of the work for you. To answer these questions, you will need someone that can enter the data and build out a reliable projection.

As the adage goes, garbage in, garbage out. So, you’re going to need a financial analyst or chief financial officer. A bookkeeper isn’t going to have these skills and accountants are usually too busy doing taxes.

If you have this kind of person on staff, then full steam ahead. Otherwise, Quickbooks Desktop has too many features that will go unused. You will be better off sticking to QBO.

Quickbooks Online Plans

Quickbooks Online offers five different plans for real estate agents and brokers. In order from least expensive to most expensive:

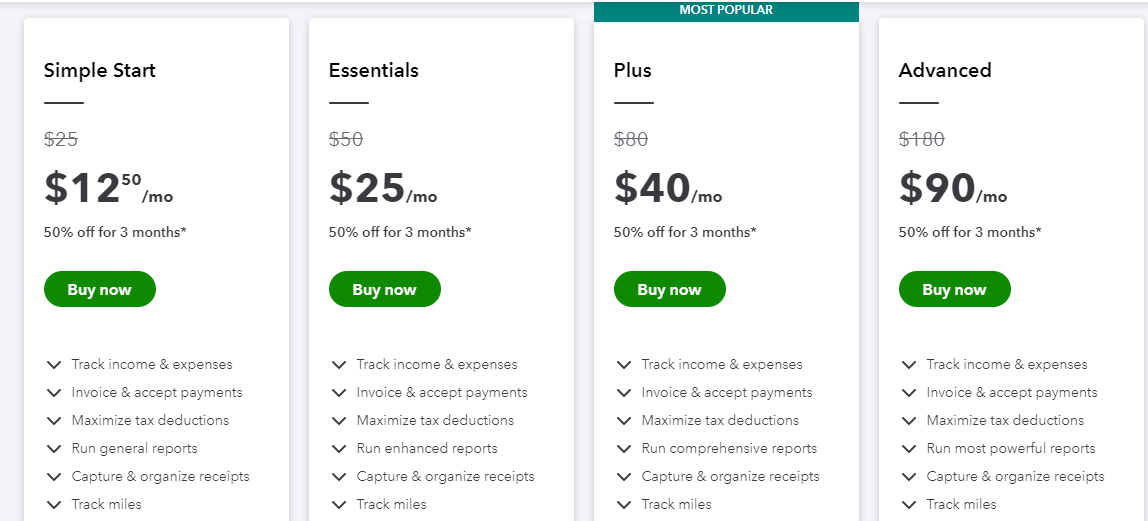

- Self-Employed: This plan starts at $15 a month and has all of the features a solo real estate agent needs. It offers mileage tracking, income and expense tracking, and reporting. For the average individual agent, this is enough. Especially, if you’re just starting out.

- Simple Start: This plan, starting at $25 a month, includes everything the self-employed plan includes, plus it allows you to manage 1099 contractors. If you’re a small brokerage or real estate team, the self-employed version isn’t possible. You will need to upgrade to this plan, at a minimum. The more 1099 contractors you have, like most brokerages, the larger the need for this plan. Some individual real estate agents may need to upgrade to this plan, too. For example, the agent that pays a self-employed real estate photographer more than $600 in a year is required to file a 1099. You can keep track of this on your own or do it in Quickbooks.

- Essentials: This plan, starting at $50 a month, includes everything in Simple Start, plus allows you to add up to 3 users and manage and pay bills. Few real estate agents need this. A real estate team may wish to use this plan for the bill management and adding extra users. A lot of brokerages will opt for this plan so they can manage an advanced payables account and add extra users. The plan also includes time tracking, which you may wish to use for payroll purposes.

- Plus: This plan, starting at $80 a month, includes everything in the Essentials plan, plus the ability to have up to five users and track project profitability. Really, there is no need for this plan unless you have a need for five users. Project profitability and inventory tracking isn’t a feature that real estate brokers or agents need.

- Advanced: Starting at $180 per month, this plan is the most comprehensive. It includes everything in the Plus plan, plus a higher level of support from Intuit, greater business reporting and analytics, and the ability to manage employee expenses. This plan can be costly, but is most similar to many of the functions a user would have with some of the desktop versions.

Keep in mind that none of these plans include Quickbooks Payroll. If you have employees and need to process payroll, there is a separate subscription fee to do that.

Setting Up Quickbooks For Real Estate Agents

Okay, I’m going to walk you through some decisions you have to make when setting up your Quickbooks. If you’re looking for a generic set-up, I recommend using Quickbooks’ guides for getting started.

You can find specific, technical how-to advice about their software with these Quickbooks Get Started guides.

I’m going to cover whether you should use a cash-based accounting method or go accrual, the types of chart of accounts you should have, and what accounts should be an expense versus a cost of goods sold.

Cash or Accrual Method?

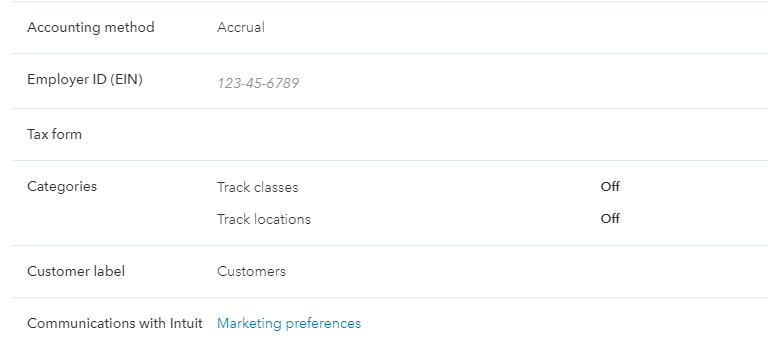

As a real estate agent or broker, you have a choice between two different accounting methods: cash-based or an accrual method.

Without getting into too much detail, I will briefly explain the difference. The main difference between the two methods is when income and expenses are “realized”. That’s a fancy way of saying recorded into Quickbooks.

A cash accounting method for a real estate agent is the simplest of the two options. Cash-based accounting realizes income and expenses as cash changes hands. You can think about it like a bank account or credit card.

When you pay for something, the expense is recorded. When you get your commission check, income is recorded.

This is the method I recommend for all real estate agents. There is very little reason to be on an accrual method.

In contrast to a cash-based method, accrual accounting will realize an expense and income before cash changes hands. For example, a real estate agent might get a bill from a marketing agency, but not be required to pay it for 60 days.

This isn’t uncommon. Most agents will file it in a folder and pay the bill as it becomes due and then record it (cash method). In an accrual system, you will enter the bill into Quickbooks when it is received. The expense will be dated on the date of the bill rather than when the bill is actually paid for.

Seems pretty confusing, doesn’t it? So, why do people even recommend it?

An accrual-based method gives a company better insights into the cash position of a company. It gives insights into their balance sheet.

With cash-based accounting, income and expenses go unrecorded until the time cash changes hands. This means if you’re looking at a profit and loss statement, it under-reports your income and expenses.

Giving you a false representation of the financial picture of your real estate business.

Cash Accounting Is Just Fine

Here’s the reality. Most real estate agents don’t need to bother with accrual accounting.

In fact, most agents keep two separate accounting books.

The one that is in Quickbooks Online. And the one that is in their head.

While a cash-based method can underreport expenses and income on the profit and loss statement, I find most real estate agents make the adjustments in their heads.

For example, they will take a look at the P&L. Add additional revenue from commission checks they expect to receive. They will add expenses from bills they know they received or pay on a monthly basis.

Essentially, they are making these adjustments in their head and producing an “accrual-like” profit and loss statement.

For these agents, an accrual-based accounting method doesn’t offer any benefit over cash-based accounting. If anything, it adds complexity.

Of course, this only holds true for real estate agents who are managing their books and keep some financial control. Meaning, they are entering everything into Quickbooks on a regular basis.

You can’t convert outdated profit and loss statements into accrual-like statements. These agents still need to use a cash based accounting method.

They’re just not going to be able to get insights and paint an accurate picture of the financial condition of their company.

You can make these adjustments under the “company preferences” tab inside Quickbooks online.

Real Estate Chart Of Accounts

When you first get started, Quickbooks will give you a large list of accounts. Some will be relevant to your business and others will be irrelevant.

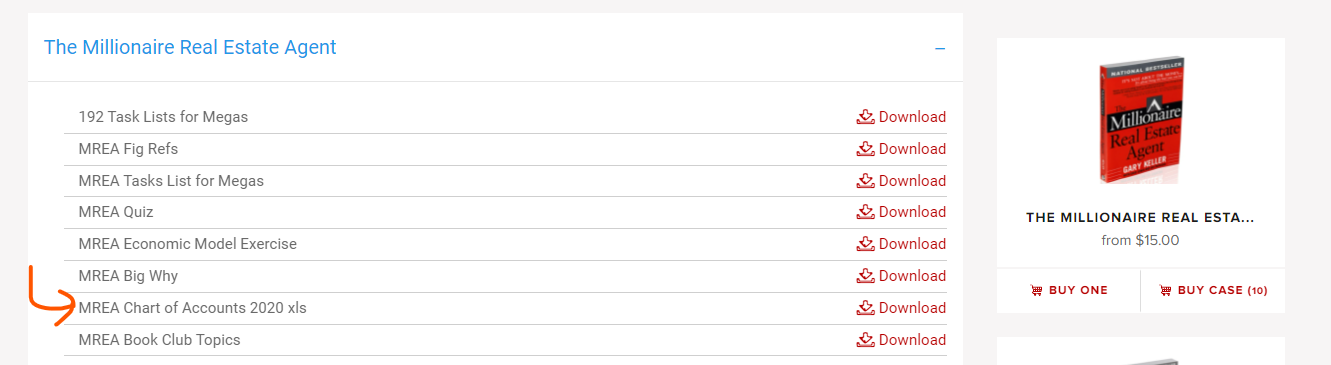

I recommend that you model your real estate chart of accounts based on the information in the Millionaire Real Estate Agent by Gary Keller. A quick search for MREA chart of accounts will give you a full list of accounts. Alternatively, you can download MREA chart of accounts on the KellerInk website.

Simply click “Millionaire Real Estate Agent” and download the MREA chart of accounts file.

I have used the MREA Chart of Accounts with slight modification over the years to work better for me. You will likely do the same. However, if you’re just getting started, these charts of accounts will lay the strongest foundation.

Income Categories

At a minimum, I recommend breaking out your listing income and residential sales income. I.e. the income from working with buyers and the income from working with sellers.

You can go and create subcategories for these if you would like. For example, you might have “new construction” income, relocation income, and resale income. To me, this is overkill. Few agents create enough revenue and income in these categories to separate them.

Instead, if you want to do something like this, consider using class tracking. This will help you see income from your niche markets.

Here’s how I have my income accounts as related to being a real estate agent.

- Commission Sale Income – income from working with buyers to help them close homes.

- Listing Income – income for listing homes for sellers.

- Fix/Flip Income – income from my real estate investment activities. Specifically, fix and flips or wholesale deals.

- Referral Income – income received from referring out leads to other agents, either buyers or sellers, that end up closing.

Note: I recommend avoiding any uncategorized income accounts. No matter how small the account.

When I used to be with Coldwell Banker, a small amount of money was paid out to the agent if their buyer or seller purchased a home warranty.

Most would throw this income in the wrong account or leave it uncategorized. For these types of transactions, I recommend creating an account name that can encompass this income.

Examples include:

- Affiliate Income

- Ancillary Service Income

Expense Accounts

These accounts can be quite extensive. Your goal is to create enough accounts to give yourself the financial detail you need, but not too many that categorizing expenses becomes overwhelming. Here are the accounts I use.

- Lead Generation – a simple account for anything related to getting clients. From Zillow leads, to content marketing, to email newsletters, and more.

- Communication & Technology – this includes all of my communication tools, like email and phone. It also includes any technology to run my business, like my website hosting and CRM.

- Education & Dues – here are expenses associated with being a member of the association of Realtor, as well as any training. This includes continuing education or certifications I may earn through NAR.

- Professional Fees – tax professionals, accountants, and lawyers go here. You could also choose to throw your coaching expenses in here or place it in education and dues.

- Supplies & Office Expenses – this is kind of a catch-all account for anything else leftover in the business. If it can’t be put in one of the accounts above it often goes here. It includes desk fees, brokerage fees, office equipment, and more.

- Payroll – this account is for any real estate agent salaries you have. Examples may include an office assistant.

- Rehab Holding – Since I use the same account for my investing, I put holding expenses here. Please note: this is only for holding expenses, like property taxes and utility bills. It’s not for construction and repairs. That should go into the cost of goods sold.

Cost Of Goods Sold Accounts

These accounts are expenses that are directly tied to generating the income that you earned. Under Generally Accepted Accounting Principles (GAAP), these types of expenses must be categorized differently from your ordinary expenses.

Here are some of the Cost of Goods Sold accounts I use:

- Listing COS – these are costs related to paying agent commissions on listings. As a solo real estate agent, I kept this account to understand the scalability of my business model. In other words, if I paid out agent commissions for listings, could I be profitable? I recommend you do the same.

- Buyer COS – these are costs related to paying out buyer agent commissions.

- Commissions To Office – To use this account, you must record the full commission amount from the sale of a home. Then, you will record your broker’s cut. This is important because you can hold accountable the company where you are licensed. You can ask yourself, given the amount I paid to my brokerage, do I feel I got the service I paid for? If not, you might want to look for another brokerage.

- Rehab COGS – Again, since I do some fix and flips, I use this account for recording transactions associated with fixing up the properties. Note: this account should only happen at the time of the sale of the property. That’s to limit the tax effects. If you are unsure about this, ask your accountant.

Assets & Liabilities

Most of you won’t need a ton of accounts in this category. Typically, a bank account and credit card will be all you need. For me, I have only these two accounts.

- Credit Card – here I track all of my business expenses and pay it off every month. I like to earn my 2% cash back.

- Bank Account – Here is where I keep the cash in my business.

If you’re running your business out of your personal account, I recommend that you stop and go set up a business bank account. Mixing funds with your personal accounts complicates the accounting process and can open up some legal issues.

When in doubt about your accounts, consult with a Certified Public Accountant, or CPA.

Expense or Cost of Goods Sold?

There’s a reason people hate accounting. It’s the confusing definitions and processes. They just don’t make sense for the way most of our brains think about money.

One big area of contention is when to classify something as an expense or cost of goods sold.

Some transactions are obvious.

For example, it makes sense to record commissions paid out to real estate agents as a cost of goods sold. But, what about listing photography?

Technically speaking, the expense only occurred as a result of trying to sell the home. Should it be placed in your COGS or under an expense account?

For me, I place it into my listing cost of goods sold account, but you and your accountant might feel differently.

There isn’t a right or wrong answer to this, but I do want to bring up an idea. It’s the idea of what I refer to as a contribution margin. This term was borrowed from Greg Crabtree who wrote the book, “Simple Numbers. Straight Talk. Big Profits.”

Not Gross Profit In Real Estate. Contribution Margin.

Greg Crabtree introduces the concept of contribution margin as the gross profit minus the direct labor. It’s his belief, and mine too, that when we compare contribution margins, we can compare companies to one another.

Otherwise, we’re chasing a fool’s errand.

Example: Aaron runs a real estate brokerage with 50 agents. The company does about $30 million in transaction volume and $900,000 in gross commission income. Every agent is on a 70/30 split, so the company will pay out 70 percent, or $630,000 in commissions. The brokerage is left with $270,000.

Most people would argue that the brokerage is a nearly $1-million company. Greg Crabtree and I would argue that it’s only a $270,000 company because most of the revenue is pass-through.

A real estate brokerage isn’t really in the business of completing real estate transactions. They’re in the business of providing training and support to real estate agents in the form of technology, systems, and lead generation.

If you built a real estate team that runs similar to a brokerage, then the same applies. You might write $10-million in production under your name and keep 50 percent of gross commission income after paying your cap and commissions to the agents on your team.

Don’t fool yourself into thinking you have a $300,000 business. You don’t. It’s only a $150,000 real estate business.

When using contribution margin, we can start to accurately compare real estate teams versus brokerages versus individual real estate agents. We can also start to set realistic profit and operating expense margins.

Why Use Contribution Margin?

Pretty much all businesses, regardless of industry, should achieve a 15 percent profit margin.

You might be thinking, no way! Grocery stores operate on margins of 2 percent!

And you’re right. But this comes down to the difference between basing profit margins off of revenue versus contribution margins.

It’s recommended that once your gross profit, as a percentage of revenue, drops below 40 percent, you should consider basing your profit metrics off gross margin instead of revenue.

So, a business broker that pays out 70 percent to a real estate agent, needs to be basing their profit targets off of gross profit and not the gross commission income.

Example: Aaron, who runs a brokerage with 50 agents, does $30 million in transaction volume, $900,000 in gross commission income, and keeps $270,000 after paying out agents. This brokerage should target a 15 percent profit margin on 270,000 rather than $900,000.

To be considered successful, the company will need to generate a profit of $40,500, or 4.5 percent of revenue.

If you’re comparing the profit margin as a percent of revenue of a real estate brokerage, a team, or an individual agent, you are likely to make false assumptions.

On the surface, running a real estate brokerage doesn’t seem very appealing or profitable. But, when you use contribution margins, you start to see these businesses in a different light.

This helps if you’re considering making a switch from a solo agent to a real estate team or thinking about becoming a brokerage.

Using Your Profit And Loss For Decision Making

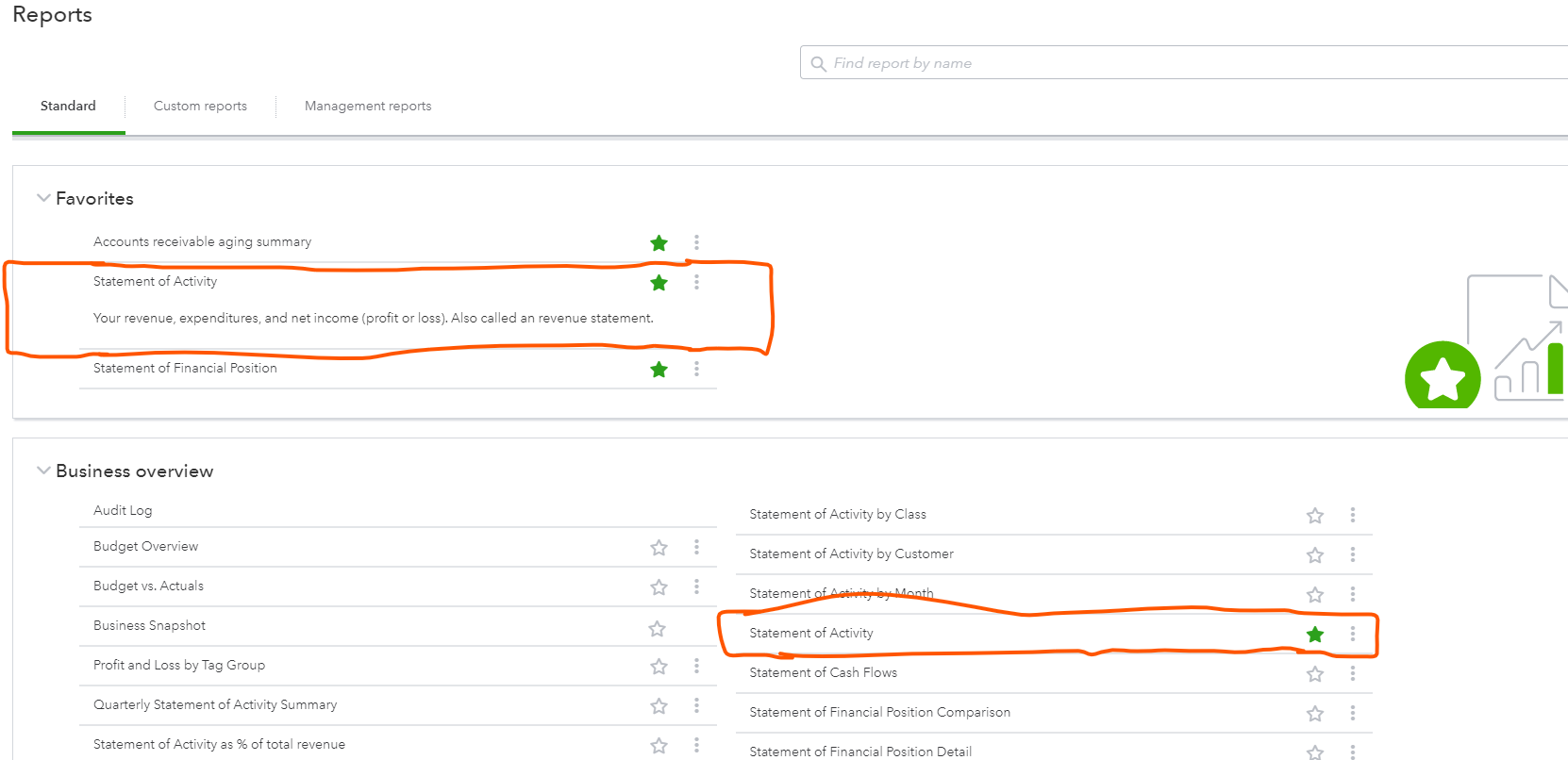

You can access and customize your reports in the “reports” tab of Quickbooks. For the Quickbooks Online version, you will find your profit and loss statement is titled “Statement of Activity”.

You can star the report so that it will show up in your “Favorites” section. This helpful for faster access in the future.

Once you have your profit and loss statement, you can make financial decisions about your real estate business.

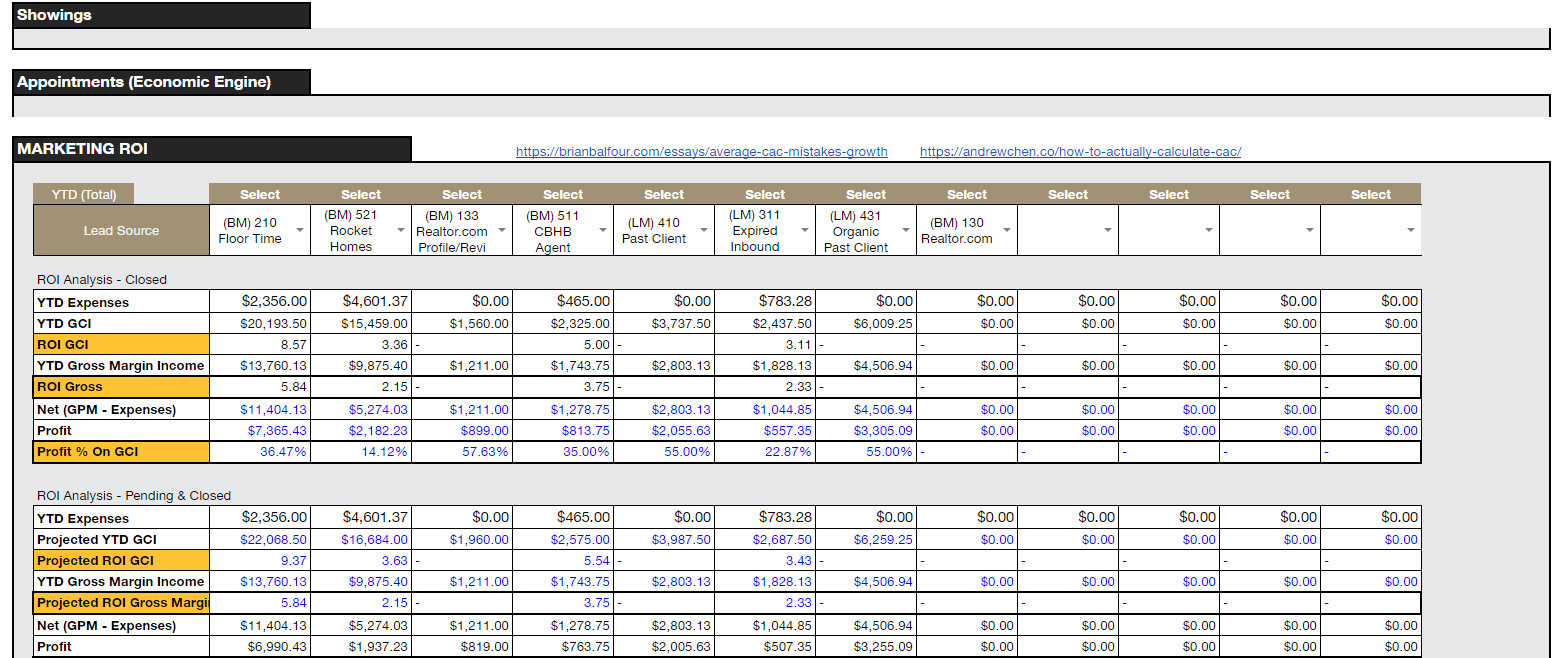

You can see where you need to cut back expenses or try to increase income. I’m always amazed at the people that realize Zillow is a losing strategy for them after they look at their profit and loss statement. Especially real estate agents that run teams.

By the time they pay Zillow, the real estate agent, and the brokerage, they lost money. They would have been better off keeping the money than trying to drive production volume up.

Too many of us focus on vanity metrics, like number of homes sold and production volume. This often comes at a financial and profitable cost. Your P&L will help you understand if it’s financially worth pursuing those vanity metrics.

Having these numbers, you can make decisions and increase the odds of scaling profitably.

The Shortfall of Real Estate Accounting

Your profit and loss statement is necessary, but it has a few shortcomings. First, a profit and loss can be considered a trailing indicator. The data comes after the fact. It comes after activities, or lack thereof.

A profit and loss statement is in the past. You can’t change past performance. Only future performance.

You need a way to gauge where you are, where you’re going, and if you’re headed in the right direction. Your profit and loss can only tell if you got there.

For that reason, your goal should be to create an activity-based scorecard that is directly tied to your business’s profit and loss statement. Take the actions that lead to revenue and profits and give them an economic value.

Example: you build a real estate business that is heavy on phone calls and outreach. You tracked your phone calls and revenue. You see that you made 1,000 phone calls in the year and made $85,000 in gross commission income. Economically, each phone call is worth $85 to you.

Now, you can set your revenue goals and you know if you’re going to be able to achieve them.

You decide you want to earn $100,000 in gross commission next year. Based on the value of each phone call, you need to make 1,177 phone calls in the year. Break that down weekly and you need to make 22.6 phone calls.

Track this inside a simple spreadsheet. If you miss these phone calls, you know that your profit and loss statement is going to be worse. If you make these phone calls or more, you know that your profit and loss statement will be better than you hoped.

Your Real Estate Scorecard

You should be able to look at a scorecard from week to week and know how your business performed or is performing.

Tie your action data from your P&L to see if you can find the actions that create the results you want. Then, focus on moving those KPIs forward.

I do this inside my own company for all revenue sources. For example, I know that for every qualified lead generated through my website organically results in a sale 90 percent of the time.

My goal is then to pursue activities that will increase my lead generation in a cost-effective way.

You will never be done finding these action-oriented metrics. Markets shift and change. Numbers will change as the market changes.

However, armed with financial data from your Quickbooks for real estate agents, you can update these numbers and adjust.

No more waiting around until the end of the year and being surprised by your financial results.

Your profit and loss shouldn’t be a surprise. You should have a strong idea what it’s going to look like based on the activities you’re doing from week to week.

Can I Have A Real Estate Bookkeeper Do Quickbooks?

Absolutely.

If you hate bookkeeping and accounting, I recommend that you hire a bookkeeper or accountant familiar with real estate.

Even though you will hire someone, it may still be up to you to set them up properly. You will have to share how you want expenses categorized and the kind of reporting you need.

It can be a good idea to send them this article so they can understand what you’re trying to accomplish and the financial insights you wish to have.

Find a bookkeeper or accountant that will update your books on a monthly basis — at a minimum. If you have a bunch of transactions, you may need weekly or bi-weekly reporting.

Monthly is sufficient for most real estate agents.

Your goal is to get timely data so you can make proper decisions. Don’t wait until the end of the year to make adjustments to your business.

If you’re looking to outsource, here are some places you can look:

- Quickbooks Bookkeeping – an obvious solution if you use Quickbooks online.

- UpWork – you can find a virtual assistant to do this. Their skills may be limited in accounting.

- Bench.co – they can help you get caught up if you’re behind and handle monthly bookkeeping.

I don’t have any personal experience with any of these companies. I just did a brief Google research and tried to share the companies I thought might be a good fit for a real estate agent.

Expect to pay about $200 to $350 a month if you want someone to do this for you. The cost can be much higher or lower. It will vary based on your business needs, systems, and the type of company you choose to outsource this to.

Do Real Estate Agents Need Quickbooks?

Real estate agents do not need Quickbooks. It’s just one solution for tracking your expenses and income as an agent. There are alternatives available.

For example, you could use an alternative accounting software solution like Xero or Freshbooks. You could also explore using a simple agent expense tracking spreadsheet.

Some of the benefits to using Quickbooks as opposed to alternative solutions is the fact that it can be an all-in-one kind of platform for real estate agents — from tracking expenses, to tracking miles, and more.

Plus, Quickbook’s smart technology and AI saves real estate agents substantial time when it comes to bookkeeping. You should be out generating and converting leads. Not entering financial data.

Final Thoughts Quickbooks For Real Estate Agents

While any accounting system has a learning curve for any real estate agent, Quickbooks Online is probably the shortest. With its ease of use and integrated features, Quickbooks is likely to be the best real estate accounting software for real estate agents and brokers.

Running your business with updated financial data and tying it into activities will help you run your business on a weekly basis. You can stop being reactive and start being proactive. You will know weekly the adjustments that you need to make.

I tried to make this article as comprehensive as possible and I understand that some of the topics are a little bit more advanced. If you have an interest in further studying topics like contribution margin, I recommend your check out Greg Crabtree’s book: Simple Number. Straight Talk. Big Profits (affiliate link).

To learn about the idea of a scorecard, I recommend checking out the book Traction by Gino Wickman(affiliate link). I learned this idea from the Entrepreneurial Operating System, or EOS, he developed.

This is a book that has changed the way I see my real estate business. It’s well worth the read if you’re looking to grow your business and avoid the mistakes many businesses make.

Learn how to manage your real estate agent finances with quickbooks online. In our real estate agent cash crash course, we show you:

- How to slay the tax monster and avoid a surprise tax bill.

- How to properly record your gross commission income checks. Hint: most agents and bookkeepers are doing it wrong.

- The relationship between the success of your real estate career and your personal finances.

- How to pay yourself correctly so you never leave your business starving for cash or dipping into your personal finances.