Pricing is so fundamental to being a real estate agent, that every single agent should learn how to do a CMA, or a Comparable Market Analysis.

Unfortunately, I’ve seen a lot of real estate agents just pull comparables, without making adjustments, and then give their buyers and sellers a wide range of pricing for a home.

It makes me sad to see this.

As a Realtor, we have an obligation to uphold the standard of our industry and work toward the best interest of our clients. To me, that means understanding how to price and value homes with greater accuracy.

That starts with understanding how to do a CMA, and ideally, getting your Pricing Strategy Advisor certification.

In this post, I’m going to share with you the exact steps for doing a CMA so that you can provide better pricing and home valuations for your clients.

What Is A CMA?

A CMA, or Comparable Market Analysis, is a tool used by real estate agents to determine an estimated fair market value for a specific property by comparing it to similar homes that recently sold in the area.

It’s similar to an appraisal, but not exactly the same.

Only an appraisal can be completed by a licensed appraiser. An appraisal often costs hundreds of dollars and can be used for securing a loan, refinancing a home, or distributing assets in a divorce.

The purpose of a CMA is to help homeowners price their home for sale and to help home buyers determine a fair offer price.

However, the process we’re covering in this article is similar to the process licensed appraisers use. This helps us create better price estimates.

When Do You Do A CMA?

Okay, let me dispel a myth here. The CMA isn’t only for listing a home. A comparable market analysis should be used to price homes for sellers AND home buyers.

The listing side is fairly obvious. Create a CMA prior to listing the home, and ideally, before the listing appointment so you can discuss the list price.

On the buy-side, real estate agents should perform a comparable market analysis so they can determine a fair offer price. You should NEVER assume that a real estate agent priced the home accurately.

First, a list agent could have been pressured to list a home at a higher price. Or, maybe they don’t know how to do a CMA so they just guessed a list price.

Blindly offering the list price will create issues throughout the home buying process. Your clients will overpay for a home or be in a terrible situation when the appraisal comes in way lower than the offer price.

So, every agent should do a CMA before they write up an offer. Explain the estimated fair market value to your clients and guide them through their decision for an offer price.

The Case For Doing A CMA

I have two perfect stories on why every real estate agent should do a CMA for their buyers and sellers.

When I was in the first two years of my real estate career, I was working with a first-time home buyer where I was glad I performed a CMA prior to writing an offer.

The home was listed for $109,000. After doing my CMA, I determined a more accurate value was $95,000.

That was a HUGE difference. Of course, we would have offered this CMA value, but there were multiple offers on the home. So, I knew we would have to come at list price or higher to get our offer accepted.

The clients decided they wanted to offer $110,000. I properly informed my first-time home buyer clients that it is unlikely to appraise, but if it did, they were okay with the price.

Lo’ and behold, the appraisal came in at $97,000.

Most clients are shocked at this outcome and then scramble trying to figure out what to do because their real estate agent didn’t do a CMA.

My clients knew this was the likely outcome and were willing to walk away if the seller didn’t adjust the offer price to the list price.

But I can tell you from the conversations with the list agent, the client and agent were very upset by this. Angry, really. Blamed me for it all and made the rest of the transaction very hostile.

My buyers won because they knew it was going to happen. The seller was angry because the agent didn’t do a proper CMA.

It could have been avoided. Don’t fall victim to these situations. Do a CMA.

Another Case For The CMA

So, aside from pricing surprises, a CMA also helps clients sell their homes in the best timeframe. That’s a win-win for your clients and you. A properly priced home will sell within market timeframes, which means you get paid faster.

In my third year of real estate, I had a referral call me up to list their parent’s home that they had inherited.

Sweet. I was excited for it. I learned that I was going to be interviewing with other real estate agents.

No worries. I prepared my listing presentation and completed a thorough CMA. The property I was valuing was a two-bedroom home in a predominantly three-bedroom neighborhood.

Finding comparables wasn’t easy and I knew most real estate agents would overvalue the property and find it hard to come up with a price.

I wish I could say I won the listing. I didn’t.

When I later went back to ask the client why they went with another agent, the client said the agent was going to list it higher and lived in the neighborhood so they felt more confident about her pricing.

In my analysis, I put the home’s value around $105,000. The other agent listed the home for $125,000.

Almost a 20 percent difference!

The Bad Outcome

And the result of the home that was overpriced? The home sat on the market for over a year — when homes were selling in 60 days — and ended up selling for $109,000.

I’d argue these clients were worse off. If they sold it a year prior at $105,000, they would have saved several thousands in property taxes and holding expenses.

Second, while they sold the home for $109,000, home prices went up 10 percent over that year. Meaning, a closer market value was $115,000.

In this case, these clients ended up holding the home a year longer and selling the home below market value.

Of course, I blame myself for not being better at sales to win the listing. Unfortunately, these clients probably don’t realize the money they lost and the cost they actually paid for this agent’s poor results.

Doing a CMA helps me avoid clients that want to overprice their home, and as a result, sit on the market for too long.

Who do clients blame when a home doesn’t sell? The agent.

A home that won’t sell because it’s priced wrong is going to reflect poorly on your service. It’s not the kind of service that leads to referrals or gets real estate client reviews.

CMA Definitions

Before diving into the nuts and bolts of how to do a CMA, I think it helps to define some key terms to make sure that we are all on the same page.

- Subject Property: This is the name for the property that we are valuing. It is the home whose price we are trying to find.

- Comparable Property: These are the properties, often just called comparables, that share similar characteristics — square feet, age, location, etc. — to our subject property. All adjustments made are made to the comparable property.

- Adjustments: These are the financial changes made to a comparable property to account for differences between the subject property and comparables. For example, two homes with different square feet will see a positive or negative financial adjustment to the comparable property.

- Reconcile: Once you’ve made adjustments and performed a CMA, you need to ensure that the value makes sense. To reconcile is to align the price estimate with the most likely value and the data you gathered. We’ll cover this a bit further later on.

Step One: Gather Data About Your Subject Property

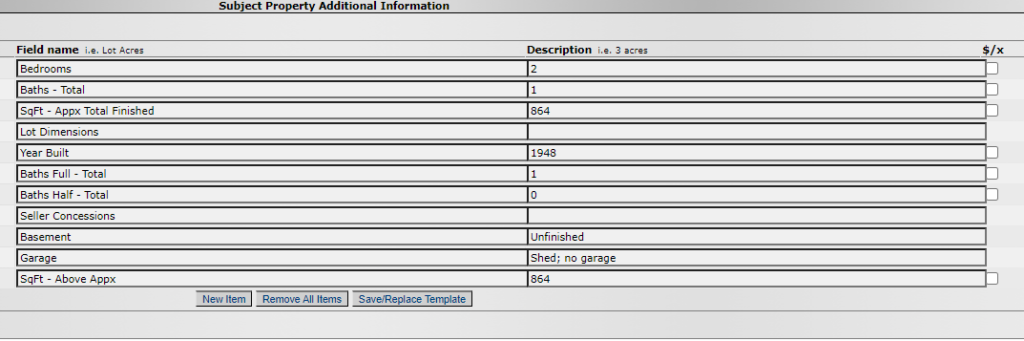

Before you can do anything, you need to gather data about your subject property. At a minimum, you will need to know the square footage, year it was built, condition of the home, garage amenities, and other relevant data that is important in your market.

For example, here in Michigan, that’s going to be the type and condition of the basement. Michigan basements have different values than a full-finished basement. In states like Arkansas, a basement might not be very common, and therefore, isn’t going to be something you need in your CMA.

There are multiple sources you can use in your research. The best source is the house itself.

The House As A Data Source

If you’re preparing a CMA for home buyers, then generally you can get your information when you tour the home with your clients.

You can also find a lot of information in the MLS, but it’s always good to verify the information or make notes for yourself while you’re touring the home.

Pictures and MLS data sheets don’t always reveal all of the information you need for your CMA.

If you’re looking to list a home, you’re often going to need to see the home before you complete a CMA. That’s because public data has some inaccuracies in it. Especially if the home hasn’t been sold in the last decade.

Let’s look at some other sources of data.

Zillow or The MLS

A great place to get your data is from Zillow or the MLS. In our market, our MLS will bring up past listings from 10 years back or more. That’s great because I can often pull data like square footage and garage space, which don’t often change, and create a decently accurate CMA without seeing the home.

You can also check sources like Zillow if your MLS doesn’t keep accurate records of past transactions.

Understand that if the home hasn’t been sold in recent years, there could have been changes made to the home, like an additional bathroom or an upgrade from a half bath to a full bath.

If you’re trying to create a CMA without verifying the data, you will create CMAs with some inaccuracies.

Tax Records

Lastly, you can look at the tax records for some public information. These records often include the age of the home, the square footage, and bedroom and bathroom count. In my market, this is helpful to get this basic information and is a way to verify the accuracy of the data in the MLS.

Mistakes happen so it’s a good idea to check the data in the MLS for accuracy. There have been cases where data was entered into the MLS incorrectly and by accident.

This is the reason errors and omissions insurance exists. But, if we can avoid lawsuits and problems, then we should try to do that.

Step Two: Find Comparables

Everyone will have their own method for finding comparable properties, but there are general rules we need to follow when selecting our comparable properties.

First, we’re going to filter out properties by type, location, how recently the home sold and square footage. Just doing this will filter out 80 to 90 percent of the properties and leave us with only a handful.

Here are the following rules for each filter criteria.

Filter By Type

The whole goal of a CMA is to determine a fair price by comparing apples to apples. It’s hard to determine the price of an apple if we’re talking about the price of an orange.

For that reason, we want to pick comparable homes that are the same type of build. Meaning, if our subject property is a ranch-style home, then ideally, we would select ranch-style comparables. A two-story yields two-story comparables.

So on and so forth.

Sometimes, we find issues with split-level homes, like bi-level, tri-level, or quad-levels. Unless the home was built in a neighborhood where split-level homes are common, it can be hard to find comparables to the same type.

In this case, it’s generally a judgment call, but I like to pick ranch-style homes and make adjustments for type and basement.

Location Filtering

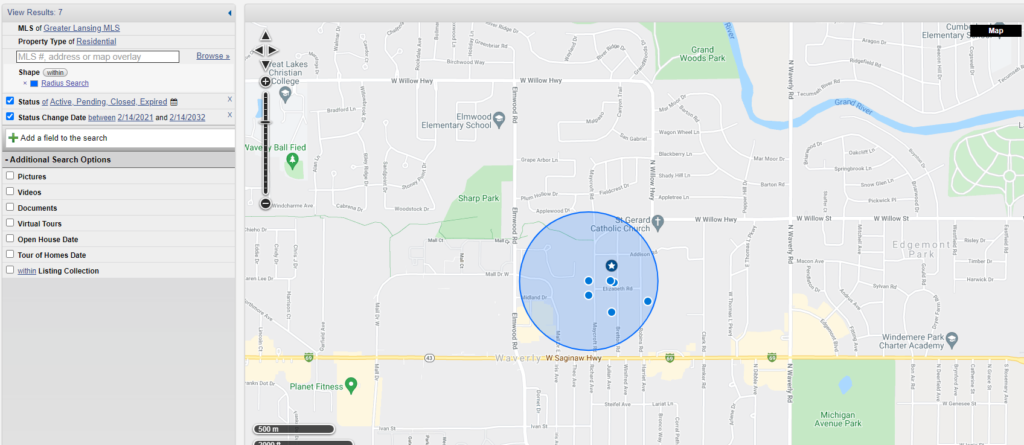

You want your comparable properties to be as close to your subject property as possible. In urban areas, this is within 0.5 miles, the same school district, and city.

Don’t make the mistake of picking a home that is in a nearby neighborhood but a different city or school district.

In suburban areas and small towns, your radius can go to about one mile, but again, keep it in the same school district and city.

Rural areas are always hard. In general, your radius should be about five miles, while still keeping comparables in the same township and school district.

If you can’t find any comparables in your area, you may have to expand your search — either the location radius or through your other search filters.

Recency Of Transaction

The general rule is that all comparables should have been sold within the last six months of the current date. However, this really only applies to a balanced market. A balanced market is often attributed with an absorption rate of around four to six months.

In the case of 2020-2022, where homes are selling at a quick rate and home prices are changing rapidly, comparables need to be more recent. If there is a three percent increase in home values in the last six months, then an agent should pick comparables that sold in the last 90 days, or three months.

If you select comparables outside of these timeframes, you need to make adjustments to the comparables to account for changes in home values.

Square Footage Filter

Lastly, set up a square footage filter. When looking for comparables, the comparable properties should be within 10 percent of the subject property’s square footage.

So, if your subject property is 2,000 square feet, then your comparables should be between 1,800 and 2,200 square feet.

It’s important to use above-grade square footage, even if a subject property has a finished basement. From an appraisal perspective, above-grade and below-grade square footage are valued differently.

Above-grade square footage has a much higher value, then below-grade.

Other Criteria

Once you’ve filtered for the above criteria, you should only have a handful of homes. At this point, you’re going to select your comparables so that they align the most with your subject property.

We want to get it as close to perfect as possible, but that’s not always the case. You should be looking at comparable properties that are most similar in age, bathroom count, bedroom count, condition, garage, acreages, and more.

It’s unlikely you will find perfectly comparable properties. Sometimes you do get lucky, but just pick three to five homes that are closest to the subject property.

If there are any differences to the comparable properties, we will make adjustments.

Potential Problems and Mistakes

Finding comparables is part art and part science. At times, when your search criteria doesn’t bring up enough results, you may need to violate the general rules of thumb and expand your search.

This is part science and everyone has a different approach. Here is the order I use for widening my search.

- Square feet – expand up or down and make adjustments later

- Sold Date – if I have to extend my sold date, I will make adjustments in pricing as needed. I will go by 3 month adjustments. So, if I’m looking for homes sold within 90 days, I will make it six months, then nine months, then 12 months until I get enough comps.

- Location – I try to expand the search radius as little as possible while staying within the same city and school district.

You might find a different method that works for you or that is recommended in your real estate market.

Do Not Pick Listings As Comparables

Please, please hear me. Do NOT pick active or pending listings as comparables. It’s a HUGE mistake. Seriously.

Active and pending listings do not give you an accurate estimation of price. Assume that all currently listed homes aren’t priced properly until proven otherwise.

A home is only proven to be priced properly when it closes and sells for that price.

I shared an example of two listings where the agent overpriced the home by 10 to 20 percent of the home’s real value.

If somebody used those homes as a comparable, they would have overvalued their subject property. A home that is overpriced sits on the market longer, drives less traffic, and tends to sell less than market value.

This is really problematic in today’s real estate market where home values are rising and a home will get an offer price even if it is overpriced.

To properly adjust for the market conditions, pick past homes sold and then make adjustments based on the current rate of growth for home values.

I have found several agents who use currently listed properties as the lazy way of doing a CMA. But, they are making a fatal assumption when they do this. They’re assuming all homes listed are priced accurately to the fair market value.

That’s just not the case.

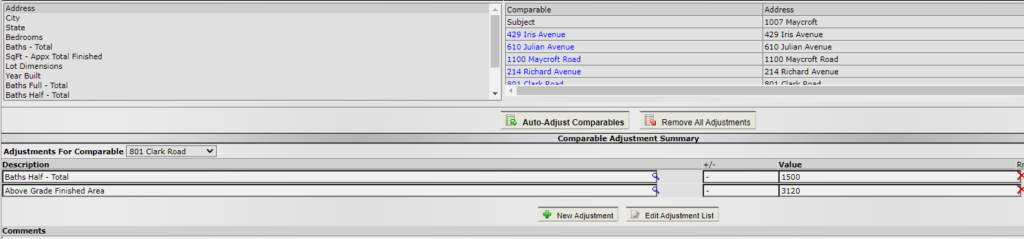

Step Three: Make Adjustments To Comparables

There’s a good chance your comparables differ, in some way, than your subject property. That’s not a problem. All we have to do is make accounting adjustments for those differences.

Here are the major rules when making adjustments during a CMA. First, always adjust ONLY the comparable property. Never adjust the subject property.

When a comparable home lacks something, positive financial adjustments are made. When a comparable home has something a subject property lacks, negative financial adjustments are made.

Example: Comparable property A is 1,800 square feet. The subject property is 2,000 square feet. A positive adjustment will be made to the comparable property. Assume the adjustment price is $30 per square foot. In this case, the comparable property will have a $6,000 adjustment to its sales price.

But how do you know the adjustment values to make? Well, it’s pretty complicated and a task better left to appraisers.

So, I recommend you do two things. First, do some basic research around the web for potential adjustment values. Second, start creating your own database of adjustments.

That’s what I do every time I get an appraisal. I will look at my home buyer’s appraisal and record potential value adjustments.

In my area, I have learned that:

- An individual garage space is worth $4,500. A property that has a two-car garage rather than a one-car garage will have a $4,500 adjustment.

- Finished basements have a value of $10 to $15 per square foot depending on quality and condition.

- Above-grade square footage has a value of $30 to $40 per square foot.

Your local real estate market is going to determine the price adjustment values. I live in the midwest. These values are different from the values in Los Angeles or New York City.

Step Four: Check and Reconcile

Once you’ve made adjustments, your most basic CMA software will spit out an average price with a range of values. Your next step is to reconcile the results with the data you gathered.

In other words, does this price recommendation and range make sense? What is the most likely value for the home?

To reconcile your CMA, is to select from alternative conclusions and pick the results that most accurately reflects market value.

Let’s say you selected three comparables where two of them, call them A and B, have significant differences between the subject property. Property C is nearly identical to the subject property. After making adjustments to property A and B, you found their values to be $275,000. Property C has a value of $285,000.

If you take all three properties and average them out, you would get an average fair market value of $278,333.

As part of reconciling, you would see that the subject property is closer to Property C, and therefore, it’s more likely that the price is closer to Property C and so the fair market value should be adjusted up from the average.

Reconciliation is all about picking the result that makes the most amount of sense and reflects true market conditions. There is a lot of discretion on the part of the real estate agent when reconciling.

Check The Zestimate

I can hear you grumbling, and I have my own issues with the Zillow Zestimate. Understand that your clients are going to Zillow and looking at their Zestimate.

Don’t use the Zestimate to fully reconcile your CMA, but you need to be prepared during a listing presentation and when you present your estimated value for a client’s home.

If you’re lower than their Zestimate, you’re going to have to explain yourself and walk them through your CMA. You’re going to have to help explain this entire article to them and how CMAs are created.

Even if your estimated price is higher, you may need to explain yourself. Some homeowners might be skeptical if you’re pricing the home way above a Zestimate. They might think you’re pricing it that way to just win the listing.

Tools For Doing A CMA

There are a lot of tools out there to help you complete a CMA. Most often, you probably already have access to a tool without even realizing it.

You may have access to CMA software through your MLS system or association. For example, in my market, I can access tools like RPR and ToolKit CMA. Both of these tools allow me to build fancy CMAs.

I can also create simple CMAs inside my MLS system. I prefer to use the MLS so I don’t have to input or modify data.

Be sure to check out which options you have as part of your brokerage or local association.

How To Get Better At CMAs

There are two ways to get better at doing CMAs. The first is to practice. If you’re just starting out as a real estate agent or you’re new to doing a CMA, I suggest taking some time to practice on recently sold listings.

Grab a listing that sold within the last week. Then, find comparables for it and make adjustments. Did you get a CMA value that is close to the final sold price?

If not, why not? Are your adjustments off? Did you pick bad comparables? Dissect why you might not have been as close to the sold price.

The second way to get better is by getting certified through the National Association of Realtors for your Pricing Strategy Advisor certification.

I achieved mine and recommend every agent to get certified. Through this certification, you will learn many of the techniques we talked about here in greater depth. You will find hours of videos rather than a single blog post.

Final Words On How To Do A CMA

Go out there and practice. Develop the skills and knowledge on how to do a CMA. Your clients will thank you and it just makes smart business sense as a real estate agent. The process is part art and part science. It involves gathering data on your subject property, picking the right comparables, making adjustments, and then reconciling your results.

There are a ton of tools and software solutions to help make this easy for you. A CMA can often be done in as little as 20 to 30 minutes. It will save you hours of frustration when an appraisal comes into low or you list an overpriced home.

Check out earning your PSA certification through the National Association of Realtors.