The most important millionaire real estate agent model, or MREA, is the budget model. Your budget model is your key to profitability and making your real estate career or business worth it.

In this guide, we’re exploring Gary Keller’s budget model as outlined in his book “TheMillionaire Real Estate Agent” and we’re expanding on it.

The book flew over an important topic when it comes to money and finances for real estate agents. We’ll dive deeper into the budget model and make a deeper connection between the budget model and the three other models.

What Is The MREA Budget Model?

Budgets aren’t the sexiest thing. Even the word can trudge up mixed feelings. Real estate agents are often free-spirited individuals and the idea of following a strict plan for spending… no thanks.

For that reason, we prefer to call the budget model, the money model. At the end of the day, the MREA budget model leads to more money and time. It leads to a richer life and career.

The MREA budget model lays out expected costs and profit for various stages of your real estate career. For example, it gives you a benchmark for how much you should spend on marketing, salaries, and how much you should earn.

Its purpose is to show every real estate agent where they should focus their attention to reap the best rewards.

The Case For Budget Model Priority

In Keller’s book, there is an overwhelming sense that the most important model in real estate is the lead generation model.

This is evident in areas of the book where he writes that real estate agents are like sharks when it comes to lead generation. Just as sharks always need to move forward in water to breathe, real estate agents must always generate leads.

The sentiment makes sense. Without leads, you have no clients and no income.

That’s fair.

But… in today’s world, with the proliferation of internet-based tools and apps, like Zillow or Facebook, acquiring leads is simple.

The market is FULL of third-party companies willing to sell you leads for a price. Some of them will charge you upfront, monthly fees. Others charge a referral-based fee after closing on a home.

For example, a marketing company may charge you $99 per month to manage your Facebook ads. These Facebook ads generate leads and it’s up to you to convert and close the leads.

Or, you can find a third-party company that will give you a lead and at close you must pay them 30 percent of the gross commission income.

It’s not difficult to generate leads. Simply sign-up for a program and pay some money.

It IS difficult to generate leads PROFITABLY.

The keyword is profitability. It is hard to generate leads that make being a real estate agent worth it.

In other words, it’s about finding lead generation strategies that are cost-effective and allow you to reach your real estate goals — whether that’s building a real estate team or making a living as a real estate agent.

Lead Generation Needs A Budget

The lead generation model needs the budget model. Lead generation absent a budget model is a slippery slope and leads to an agent being overworked for very little money. You will see great production numbers, but poor take home pay.

Consulting with real estate agents we’ve seen it too often where a real estate agent has amazing production, but their lead costs are out of control. They’re getting a 2x ROI or are sometimes breaking even.

That means these agents are doing all of this production, but they aren’t taking any more of it home or being able to reinvest back into their business.

To be successful, real estate agents MUST analyze and assess their marketing channels from a profitability and return on investment standpoint.

Lead generation analysis with a focus on return on investment is really critical for anyone who has a team or plans to build a team. It’s this analysis that allows a real estate agent team to scale and grow.

You Can’t Grow A Team Without It

Until you learn to generate leads profitably and analyze the profitability of the lead channels, you can’t scale your real estate team.

If you’re a real estate agent using marketing channels that bring in very little money, you do not have enough money left over to grow.

What happens far too often is real estate teams are paying too much for leads and they’re losing money without even realizing it.

Here’s a common example we’ve found when analyzing the profitability and financial numbers of a real estate team.

The team leader sources leads from Zillow for a total cost of $4,250 per month. For simplicity, let’s say all of these leads are given to a member on their team.

The average payout to their team members is 50 percent of the gross commission income.

Any given month, the team generates roughly $9,000 in gross commission income. So, the team leader gives $4,500 to the team member and they keep $4,500. The broker takes their split of 10 percent, or $450.

In this case, the team leader is getting $4,050 each month from their team member before accounting for their marketing costs. Once we take into account the cost of Zillow, the team leader is losing $200 each month by having a team.

If we grow and add more members, then a team will grow unprofitably. Each member added can result in $200 loss per month.

All of this doesn’t even account for the effort, headache, and problems that come with managing a team. In examples like these, a real estate team leader is better off keeping their team small or working solo until they find profitable lead channels.

Is Your Lead Generation Profitable?

So, what kind of returns does a real estate agent need in order to make a marketing channel worth it?

Ideally, 10 times the return. If a real estate agent spends $100 in marketing, they should expect to get $1,000 back in gross commission income (the money before the broker takes their cut).

There are two key principles to keep in mind:

- The overall return on investment for all marketing activities should be 10x

- Individual marketing channels should be assessed for a 10x return and evaluated if below that metric

Your budget model helps you find which lead generation strategies are worth pursuing. It also points out the lead generation strategies we can improve.

Just because a lead generation strategy might have a low rate of return, doesn’t mean we cut it if we can improve it.

Let’s look at how to find these numbers and how to pull reports if you’re using a tool like Quickbooks.

Calculate Manually

To find your overall return on investment for your marketing efforts, add up your total marketing dollars spent and divide it by your overall gross commission income.

So, let’s say you spent $300 on print advertising, $50 at open houses, and $3,000 in referral-based income. Your total marketing budget is $3,350.

Out of those marketing efforts, you generated a commission income of $15,000. Doing the math ($15,000 / $3,350), you get a 4.47x rate of return.

We can use the same methods to evaluate different marketing channels. Let’s say you sign up for a referral-based platform that charges 30 percent after the sale of a property.

So, when you get a $10,000 gross commission check, $3,000 will go to the referral company. Your rate of return is 3.33x.

Fixed percentage lead channels have lower risk for real estate agents, but there is also no ability to improve your return on investment for the marketing channel unless you can renegotiate terms.

Contrast that to a lead generation strategy where you get a lead for a fixed amount. Say you sign up for a program that generates leads for $60.

Your ability to convert those leads is the single biggest determinant to your return on investment.

If your conversion rate is five percent of those leads and the average commission is $6,000, your rate of return is 5x. On the other hand, if you improve conversion rates and convert at 10 percent, then you reach the 10x rate of return target.

Pull These Reports In Quickbooks

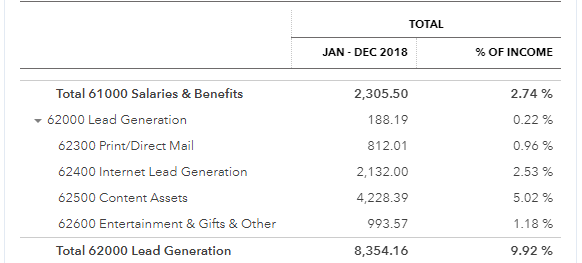

One of the benefits of using Quickbooks is your ability to pull reports quickly. Inside of Quickbooks, go to your reporting tab and select the “profit and loss statement as % of total income”.

Then, adjust your report for the specific period you’re looking for — monthly, quarterly, or yearly. Select “Run Report”.

You should get a report that looks something like this:

You’re looking for the “% of income” column to be around ten percent. This equals a 10x return and is consistent with targets in the MREA budget model laid out by Gary Keller.

Depending on your MREA chart of accounts, you can get really specific or keep it more general. For example, in the report pulled, this was when we first started our real estate company, so we left it broad.

If you’re not already using Quickbooks, we highly encourage every single real estate agent to start. It’s well worth the cost.

MREA Budget Model Feeds Economic Model

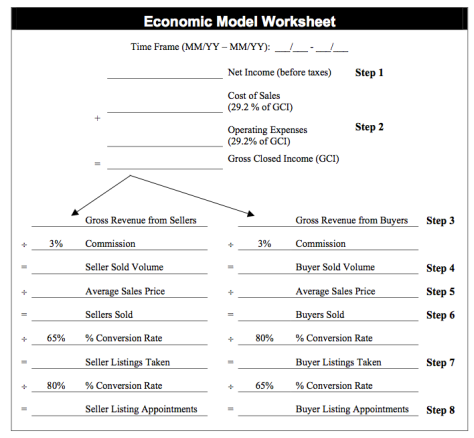

At the heart of any real estate business plan is the economic model. The MREA budget model feeds the economic model, too.

Without a budget model, your economic model and business plan is simply wishful thinking. If you view the economic model worksheet of the MREA, it starts with the budget model.

In the economic model, we recommend stopping at the gross commission income and adding in your lead generation information.

By doing this, you come from a wishful plan to an actionable plan. For example, let’s say my lead generation had a 9x rate of return.

So, if I want to generate an additional $100,000 in gross commission income, I have three options:

- I can spend an additional $11,100 on lead generation using the same strategies

- Or, I can try to improve conversion rates and boost the rate of return on a specific lead generation strategy

- A mixture of the two

Here I have actionable plans and goals. For example, I can set goals like “improve conversion rate of Zillow leads” or “grow my database by 350 people”.

Now you have greater clarity for what to work on and how to reach your goals. Your business plan doesn’t have to be an exercise you go through and then never look at again until the end of the year.

Getting Started & Getting Help

To get set up, you will want to have an accounting platform and build a chart of accounts according to “The Millionaire Real Estate Agent”.

If the idea of setting up your accounts, categorizing and tracking expenses, and running reports is too much, then look for help. A good accountant, bookkeeper or a financial consultant can hold you accountable.

Specifically, look for a bookkeeper that is familiar with the MREA chart of accounts and budget model.

Take our real estate agent cash crash course to learn how to set up your real estate finances using Quickbooks online.

Quick Agent: Cash Crash Course

Learn how to manage your real estate agent finances with quickbooks online. In our real estate agent cash crash course, we show you:

- How to slay the tax monster and avoid a surprise tax bill

- How to properly record your gross commission income checks. Hint: most agents and bookkeepers are doing it wrong

- The relationship between the success of your real estate career and your personal finances

- How to pay yourself correctly so you never leave your business starving for cash or dipping into your personal finances