Updated December, 2025

When a loved one passes away, dealing with the home is often one of the hardest things to face.

For many families, it’s not the first task they address. What to do with the home is a task they put off while they grieve, sort through paperwork, or simply try to catch their breath.

Eventually, though, the question surfaces: what happens to the house? And more specifically, whether anything can—or should—be done before probate begins.

Those distinctions matter, because the rules are very different depending on which situation applies.

In this article, we will explore different answers based on the context of the word “before” probate.

At a high level, here’s how it works:

- If a home is part of a probate estate, it generally cannot be sold before probate begins and authority is granted.

- Once probate is opened and proper authority is granted, the home may be sold during probate.

- And if the home passes outside of probate, it may be sold without waiting for probate at all.

This article is meant to clarify what “before probate” actually means, explain why authority matters, and help you understand which of these situations may apply to you so you can move forward without creating unnecessary risk or complications.

A Quick Clarification (Important)

Our role is to help families understand how real estate decisions fit into the estate settlement process, and to highlight common scenarios we see when homes are sold before, during, or after probate.

Can You Sell a House Before Probate Begins?

Generally, no.

If a home is part of a probate estate, it cannot be sold before probate begins because no one has legal authority to act on behalf of the estate yet.

Until the court formally opens probate and appoints a personal representative (executor), no one—not heirs, family members, or even the person named in the will—has authority to sell the property.

Before probate begins, your role is typically limited to:

- Securing the property

- Maintaining it

- Preventing damage or loss

You usually cannot:

- List the home

- Sign a purchase agreement

- Transfer title

- Empty the house before probate

This is one of the most common (and costly) misunderstandings families encounter.

If you want further explanation about probate, check out our Michigan probate resource hub along with our guide to executor duties

Can You Sell a House During Probate?

If what you really mean by “before probate” is before probate ends, then the answer is usually yes.

Once probate is opened and a personal representative is appointed, the estate has legal authority to sell the home, subject to Michigan probate rules, court supervision, and whether a valid Will has explicit instructions.

Selling during probate is common and often used to:

- Pay estate debts

- Cover ongoing expenses

- Prevent foreclosure

- Simplify estate settlement

If you want a full explanation of how this works, see our detailed guide on selling a home during probate in Michigan.

Now, whether you should sell during or after probate is a decision you must evaluate. We wrote an entire guide and offer some guidelines on how to decide when to sell a probate property.

Homes That Do Not Go Through Probate

There are situations where a home can be sold without waiting for probate, but this only applies when the home passes outside of probate entirely.

Common examples include:

- Homes held in a trust

- Lady Bird deeds (enhanced life estate deeds)

- Joint ownership with rights of survivorship

In these situations, ownership transfers automatically at death. Because the property is no longer owned by an estate, the new owner may be able to sell the home without opening probate.

From a real estate standpoint, these scenarios are best understood as inherited home sales, not probate sales.

The key distinction is timing, not outcome.

In both cases, the end result is the same: the home is owned by heirs rather than an estate.

The difference is whether the home is sold while it is still part of the probate estate or after it has already become an inherited property.

Understanding this distinction helps explain why some homes can be sold without probate involvement, while others must wait until legal authority is established.

Probate vs. Estate Settlement (Why This Gets Confusing)

Part of the confusion comes from how people use the word probate and the probate legal-jargon that is thrown around all the time.

Estate settlement is the broader process of settling the affairs of a loved one — from the home, to personal belongings. Probate is just one phase of estate settlement.

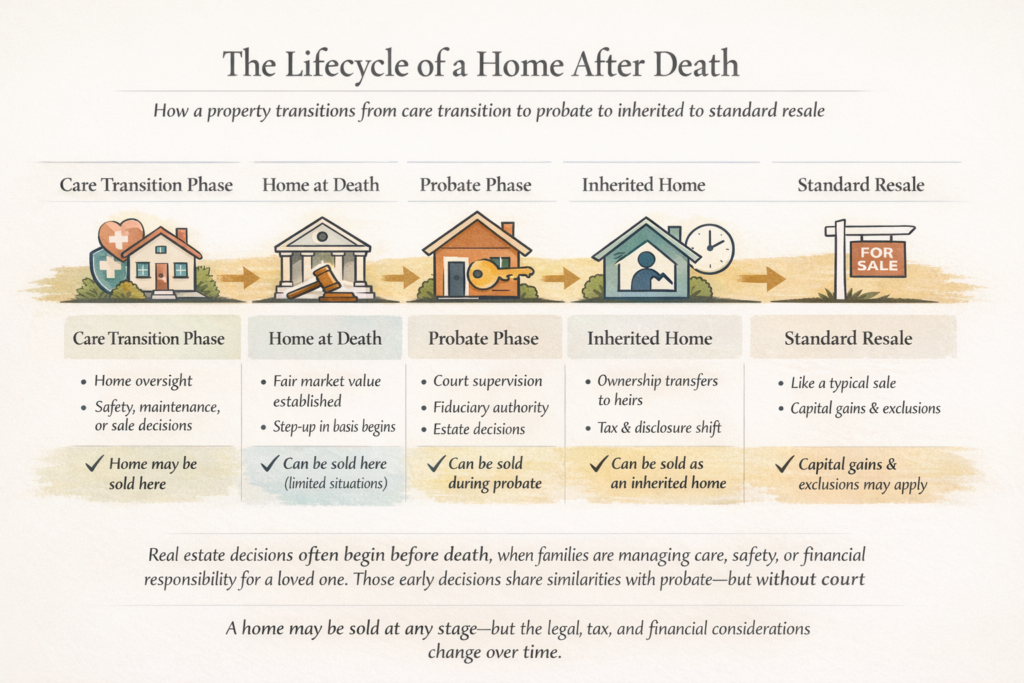

Real estate decisions can arise:

- Before death (during care transitions)

- During probate

- After probate, when the home becomes an inherited property

Understanding where the home sits in the estate timeline is often more important than the word “probate” itself.

Here is a visual representation of where we help families through the estate transition process.

The Bottom Line

So, can you sell a house before probate in Michigan?

- If the home is part of a probate estate: No, it cannot be sold before probate begins

- If probate has started and authority is granted: Yes, it can often be sold during probate according to laws, court, and the Will.

- If the home passes outside of probate: Yes, it may be sold without waiting for probate at all depending on how the property was inherited or bypassed probate.

When in doubt, a probate attorney can confirm whether a home is subject to probate and when authority exists to sell.

When it comes time to actually sell the property—whether during probate or after inheritance—our role is to help families navigate the real estate side of the estate transition with clarity, structure, and care.