Homes For Sale In Downriver MI

Working with a local downriver real estate agent to find your first or next dream home. We use systems to make the process smooth and data to avoid overpaying for a home.

Downriver Michigan is a group of 18 cities located in southern Wayne County where you can buy a home. It is defined as Taylor or Romulus’s city limit in the west and the Detroit River in the east. Lincoln Park, Melvindale and Ecorse defines the northern limit and the southern Wayne County border defines the southern limit.

The region has its own unique culture, industry, and community. Downriver’s name is rejected by some and embraced by others. Traveling outside of Downriver you will not hear many other Michiganders use the name.

Its name comes from its relation to the Detroit river. You can “access” the region by traveling down the Detroit river. Hence, Downriver.

Notable cities inside Downriver include Southgate, Taylor, Allen Park, Wyandotte, and more.

If you’re looking for downriver homes for sale, you will look for homes in Riverview, Wyandotte, Brownstown, Woodhaven, and other cities.

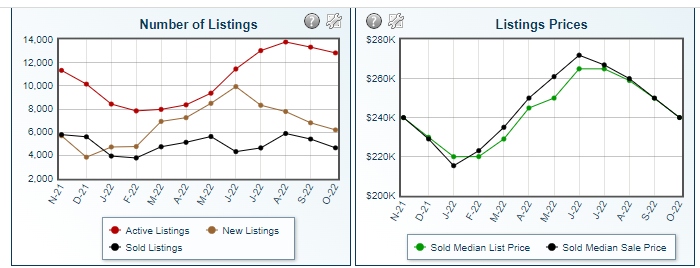

Downriver Real Estate Market

In mid-to-late 2022, interest rates began to rise, cooling off the real estate market in Downriver and Metro Detroit. Data suggests that we are not in a concerning real estate market, but we are seeing home sales start to take longer, price growth slow, and buyers have more leverage. The real estate market of today is much more favorable to home buyers than it was just one year ago where prices jumped 20 percent in a single year and home buyers could not find a home.

Absorption rate, often a measure of how the real estate market is doing, is slowly increasing. In a balanced market, the absorption rate is around 4 to 6 months. Currently, the real estate market in Detroit sits around 2.5 months. It is still a seller’s market, but the data suggests the market is improving for home buyers.

Downriver Economy

In Downriver, heavy industry, like manufacturing, is a big source of jobs. Over the last few years, there has been a slight transition to more white-collar jobs. For example, many employers, like Ford Motor Company, are major employers in the area. However, companies like Quicken Loans and Rocket Mortgage — based in Detroit — provide commuting jobs and work-from-home jobs for many residents in the Downriver area.

Many of the manufacturing plants are found in southern parts of Downriver or along the Detroit River. In Wyandotte, you can find companies like BASF. In Flat Rock, you will find Ford Motor Company plants. In addition to manufacturing, you can find some working farms in southern parts of Downriver.

Best Places to Live In Downriver Michigan

Trenton MI

Trenton is a desirable city — often because of its school district. However, sometimes residents complain about the city’s rules and regulations. For example, the city of Trenton requires a full interior and exterior inspection when selling your home.

Just like Wyandotte, Trenton has its own Downtown area, which features Elizabeth Park. When it comes to real estate, Trenton is divided into two sections. The neighborhoods east of Fort Street were developed earlier. Many of the homes resemble those in Wyandotte. Neighborhoods west of Fort Street were developed in the mid-1900’s.

Depending on what kind of home you’re looking for will depend on the neighborhood in Trenton you pick. There are various types of homes for sale.

Demographically, the city’s residents have a median age of 46 and income of $53,000. The median home value in Trenton is $200,000.

Southgate MI

The city of Southgate features many bungalow style homes for sale along with ranches. In the early 2000’s there were some newer developments in the northside and southside of Southgate. Certain neighborhoods between Trenton Road and Fort Street feature two-story older style homes for sale.

The city has a median age of 39 and an income of $61,000, which is slightly higher than the Michigan average. The median home value in Southgate is $180,000.

Lincoln Park MI

Lincoln Park sometimes gets a bad reputation. However, Lincoln Park has some of the lowest home values, which means it is most affordable for home buyers who have been priced out of the market or first-time home buyers. You will find a decent number of homes for sale in Lincoln Park.

Demographically, the median age is lower and closely resembles the demographic of young families.

Wyandotte MI

Wyandotte Michigan is a quaint little town with a Downtown which includes restaurants, shops, and parks on the Detroit River. Many of the homes have charm as they were built in the 1920’s to 1940’s. The homes of Wyandotte model the homes in Detroit’s city limits. You can find Victorian homes and craftsman style homes in Wyandotte.

The median home value in Wyandotte is $159,000. Median age is 43 years and median income is $51,000 per year.

Grosse Ile MI

Grosse Ile Michigan is considered to be part of Downriver, but is actually an island in the Detroit River. Residents must take a bridge to access Grosse Ile and experience the unique culture of the island.

When compared to other regions of Downriver, Grosse Ile has higher home values. The media home price is $335,000. Median age is 52 years and median income is $93,000. This data aligns with regions in northwestern Wayne County, like Northville, Livonia, and Canton.

Homes For Sale In Downriver: Your Options

#1: Build Or Purchase a New Home

The first method for buying a home in Downriver is to purchase or build a new home. Most of Downriver is developed or has been developed in the early 1900’s to mid-1900’s.

However, in neighborhoods like Trenton, Woodhaven, and Brownstown, you can build new homes ro find homes built after the 2000’s. When looking for newer homes for sale, you will need to search the southern part of Downriver.

Home values tend to be around $300,000 to $450,000 for newer homes in Downriver.

Pros: Buying a new home means less maintenance compared to an existing home that needs more work. Plus, if you’re in the beginning stage of buying a new home, then you can customize it.

Cons: Tend to be more expensive in the area. They are often larger homes. They rarely build 1,000 square foot homes in the area. Most are 2,000+ and you may not wish to have much square footage.

If you’re looking to build or looking for a newer home for sale, then you can buy a home in Downriver by contacting the Dolinski Group Real Estate.

#2: Fixer Uppers, Probate or Foreclosure

If you’re looking for a lower-priced home for sale and do not mind putting in the work, then search for fixer uppers, probate homes, or foreclosures for sale in Downriver.

Given the current market, there are not a ton of foreclosures. At least not like it was in 2008 through 2012. Every once in a while you can find a good foreclosure for sale. Most “fixer upper” homes are going to be homes that go through probate or pass through an estate.

These homes for sale are often outdated. They may have some good bones, but aesthetically they need a face lift.

Pros: You can get homes for the lowest price possible.

Cons: They need work. You could end up buying a lemon if you fail to do your due diligence and properly inspect the property.

#3 Existing Homes For Sale

A majority of homes for sale in Downriver are existing homes. These are near ready to move in homes and likely in neighborhoods built up around the early to mid-1900’s.

In cities like Southgate, you will find a lot of bungalow style homes for sale. In Riverview and Trenton, you will find tract style homes with distinct subdivisions and neighborhoods. As you move south of Downriver, you can find homes with a little bit more land and acreage to the home.

Pros: Probably the safest option. While it may need some maintenance or repairs when compared to a new home, it does not require the wait time a new home build could or the extensive repairs required with a fixer upper.

Cons: These homes often experience the most demand. Competing with other buyers could drive home prices up or cause you to lose out on a home.

Your Real Estate Options

You have a few different options for buying a home. Let’s look at some of those options and the associated pros and cons.

#1: Hire a Flat-fee or Discount Realtor

Instead of paying the full commission rate, there are real estate brokers and agents that charge discounted rates or flat fees for their services.

Often it works like this: a listing real estate agent offers 2.5 percent to 3 percent to a cooperating real estate agent (typically the buyer’s agent). The discounted broker, for example, only charges 1 percent. The difference between what the list agent offers and what the broker charges the buyer is given to the buyer as a credit.

Putting some numbers to this, say you are looking to buy a $300,000 house. The listing agent is offering the buyer’s agent $9,000 in commission. Your buyer’s agent only charges 1 percent, or $3,000. As a result, you get $6,000 as a credit to be used for closing or down payment.

Typically, these options are less than full-service. Meaning, you get less service than with a traditional real estate agent. Exactly what each company offers differs.

Often with these companies, buyers can expect to do more of the legwork during the transaction. If you’re familiar with the buying process, this can be a great option. However, if this is the first time you’re buying a home, you want to consider going the traditional route.

Pros: You can save on commission and get some of that money to be used to cover closing costs or as part of your down payment.

Cons: You can expect to put in some of your own time and effort. Failure to understand what you’re doing could lead to potential legal problems.

#2: Buy A Home Alone

Nothing says you have to use a real estate agent to buy a home. In fact, you could handle the purchase of a home all by yourself and potentially save up to three percent in commission.

For example, since most homeowners list their home with a real estate agent, you can contact each individual agent to set up a showing.

However, there are several cons with this method and it isn’t recommended. You will be required to do all of the legwork or put your trust in a real estate agent that has no obligation to you.

Every year, home buyers purchase a home without the help of a buyer’s agent and rely on the listing agent. While this can be done, consider the fact that the listing agent has no obligation to you.

The list agent works for the seller and their obligation is to get the best result for the seller. That means the list agent is unlikely to advise on price or offer much help through the process.

Pros: You can save a significant amount on commissions.

Cons: You open yourself up to liability and negotiate without someone having your best interest in mind. Often, buyers will overpay for a home in an effort to save a little bit of money. You will be required to do all of the legwork when it comes to closing if you expect to save on the commission. If the listing agent has to do all of the work, they are unlikely to offer any of the savings to you.

#3: Contact a Downriver Real Estate Agent

The most common method for buying a home is to work with a local, trusted traditional real estate agent. If you’re a first-time home buyer, this is especially the best method for buying a home in Downriver.

Pros: One of the biggest benefits working with a real estate agent is their guidance. An agent will explain the process and help you with paperwork. This brings a sense of peace, especially if you’re a first-time home seller. Because of their connections and resources, they can help you sell your home faster and for more than if you tried to do it on your own.

Cons: For starters, the commission and transaction fees can really add up. Even though an agent helps, you still need to fix up the home, get it ready for photos, have individual buyers walk through your home, do showings in the evenings and on the weekends.

If you’re looking for more great tips on how to find a Downriver real estate agent, take a look at our article on finding a downriver real estate agent.

Why Work With Our Downriver Agents?

The Dolinski Group is a trusted, experienced home buyer in Detroit. In addition, we’re a team of real estate agents that have helped hundreds of home buyers and home sellers in Detroit.

- Data-Driven: We use data to accurately value and price a home. For sellers, that means getting maximum value for your home without the costly mistake of overpricing it.

- Training: We have gone above the industry requirements in training by achieving our pricing strategy advisor certification.

- Honesty Approach: We would rather be honest than delusional, just to win you as a client. At times, that meant turning down clients that wanted to price their homes too high.

Frequently Asked Questions

How Do I Get Started Buying a Downriver Home For Sale?

It’s a good idea to get started by contacting a real estate agent or a lender. By contacting a real estate agent first, they can refer you to a local lender. There you can get pre-approved so you know how much home you can afford.

You can also contact a lender first if you prefer. We have a great resource for homebuyers in Downriver that you can view.

How Long Does It Take To Buy A Home?

That depends. Generally, 90 to 120 days. Typically, you can start looking at home once pre-approved and can find your ideal home within 30 days. After that, it takes 45 to 60 days to close on a home once your offer is accepted.

However, your timeline can vary based on your needs, the type of home you’re looking for, and the supply of homes on the market.

What is MSHDA?

Most cities in Downriver allow home buyers to purchase their home with the MSHDA down payment assistance program. The down payment assistance program allows home buyers to use up to $10,000 in down payment assistance for qualifying zip codes. Most homes for sale in Downriver are eligible for the $10,000 down payment assistance program.

If you want more information about this loan program, be sure to check out our complete MSHDA down payment assistance guide.

Buy A Home For Sale In Downriver: 4 Simple Steps

Dolinski Group Real Estate has one of the easiest processes for buying a home in Downriver.

- View Homes – The first step is to contact us and let us show you available homes on the market.

- Write An Offer – We understand that buying a home is a big decision. We will help you write an offer you’re comfortable with and gives you the best chance at winning the home.

- Complete the Loan – Once your offer is accepted, it is time to complete the loan process so you can get the keys to your new home.

- Close and Get Keys – After the deal is closed, you get the keys and move in.

Contact Dolinski Group Real Estate if you have any questions about how to buy a home for sale in Downriver.